In the meantime here's something to think about. The ILS and cat bond biz has not been tested during its period of explosive growth, with no landfalling major (cat 3 and above) 'canes in the U.S. since Wilma in October 2005.

From Artemis:

A 1-in-200 year U.S. hurricane loss event could result in insurance and reinsurance losses of as much as $150 billion, which could wipe out as much as 50% of the entire catastrophe bond, alternative capital and ILS market, according to analysts at Deutsche Bank.

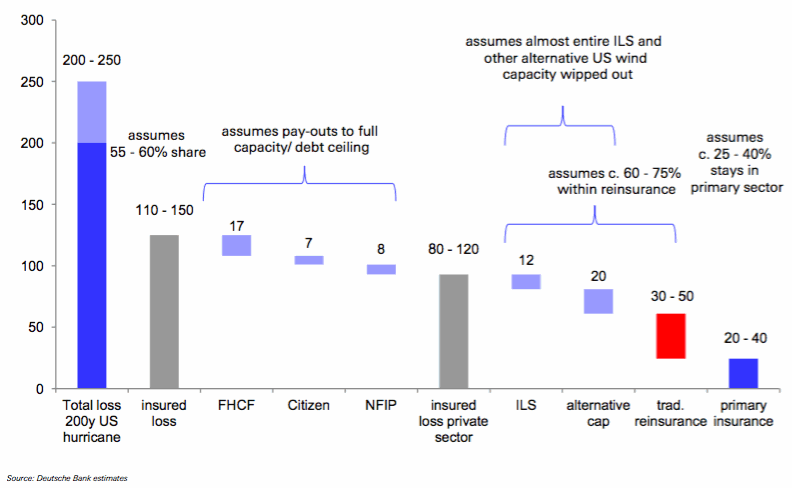

In an extensive new report Deutsche Bank explores the potential impact a 1-in-200-year U.S. hurricane loss event could have on the global insurance, reinsurance, and insurance-linked securities (ILS) market, estimating that such an event would result in an overall economic loss of between $200 billion and $250 billion.

The firm estimates that roughly 55% to 60% of the overall loss would be borne by the insurance, reinsurance and ILS markets, representing between $110 billion and $150 billion, with as much as $80 billion of this total coming from the reinsurance side, both traditional and alternative capital.

At the end of 2015 alternative reinsurance capital volume totaled $72 billion and while the underlying risks for collateralized reinsurance, ILWs and sidecars are unclear, for catastrophe bonds (which makes up approximately 30% of the space) roughly 50% of the outstanding market covers U.S. wind risks, representing $12 billion in capacity.

Assuming a similar risk distribution for other forms of alternative capital, Deutsche Bank estimates that roughly 50% of all ILS capital covers U.S. wind risks, which represents $36 billion of the market, and which could all be eliminated from the marketplace in the event of a 1-in-200-year U.S. hurricane.

The combined loss that would be borne by reinsurers and the ILS market represents 11% to 14% of the entire reinsurance capacity provided, says Deutsche Bank, which translates to a 10% reduction of overall traditional capacity, and the removal of the majority of alternative reinsurance capital that protects U.S. wind risks.

As the above chart highlights, Deutsche Bank estimates that primary insurers would take between $20 billion and $40 billion of the overall loss from a mega hurricane event in the U.S., reinsurance and alternative capital together could see losses of up to $80 billion, with the remaining $30 billion or so falling on public sector entities, the Florida Hurricane Catastrophe Fund (FHCF), Citizens Property Insurance Corporation (CPIC), and the National Flood Insurance Program (NFIP)....MORE