And remember, There was a reason for the choice of the first winner of the Climateer "Our Hero" award back in April 2007:

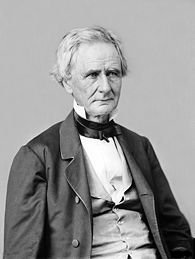

The 26th Secretary of War, the Democrat and Republican (!) Senator from Pennsylvania, Simon Cameron:

Our Hero

"An honest politician is one who,

when he is bought, will stay bought."

Solar manufacturers that are ramping up production now face a looming glut of panels, forcing companies to adjust or face dire consequences.

Trina Solar Ltd, Canadian Solar Inc and JinkoSolar Holding Co are among the suppliers boosting output at factories that will expand global capacity by 18 per cent this year, according to Bloomberg New Energy Finance.

The manufacturers are locked in a race to build bigger and more advanced factories to crank out panels faster and cheaper.

Just as they start rolling off the lines, demand is expected to slow, especially in China where the government rolled back subsidies last month. Prices are slumping, and suppliers expect margins to slip as well. It's a pattern we've seen before, after a global oversupply five years ago drove dozens of companies out of business.

"Oversupply appears to be business as usual in the solar industry," said Jenny Chase, New Energy Finance's lead solar analyst.

The solar industry went through a similar boom-bust cycle after capacity grew faster than demand, triggering a two-year slump starting in late 2011.

The result was a wave of consolidation as prices plunged and panelmakers' losses piled up. Cheap panels also helped spur demand for more solar power, eventually prompting the survivors to expand production.

"These companies are all fighting for market share and their tendency is to build more and more capacity," Pavel Molchanov, an analyst at Raymond James Financial Inc, said in an interview.

"Ultimately that drives down prices and margins for everyone."

Canadian Solar, the second-largest manufacturer, is building a a 350-megawatt facility in Brazil, and JinkoSolar is expanding output from a 450-megawatt factory that went into operation in Malaysia last year.

This comes as demand slows in China, the world's largest market, where the government is reducing subsidies for solar farms commissioned after June 30.

That fuelled a rush of projects in the first half of the year as developers added as much as 22 gigawatts before the subsidy expired, said Hugh Bromley, a New Energy Finance analyst. With the lower subsidy in place, he expects about 6 to 8 gigawatts of new solar projects in the second half.

Trina, the world's largest panel maker, said Tuesday that shipments will fall as much as 6.5 per cent in the third quarter, to between 1.55 and 1.65 gigawatts. At the same time, the company has increased production capacity 7.1 per cent after opening a 500-megawatt factory in Thailand in March. Yingli Green Energy Holding Co said Tuesday that it expects shipments to slip as much as 54 per cent in the current quarter, after 60 per cent of its panels went to China in the second quarter....MOREFor what it's worth Trina is the queen of the Chinese solars and was, along with First Solar, the subject of dozens (hundreds?) of posts over the years. Use the 'search blog' box if interested.