From FT Alphaville:

This is nuts, ‘US30Yr Bond Yield to Evaporate’ edition

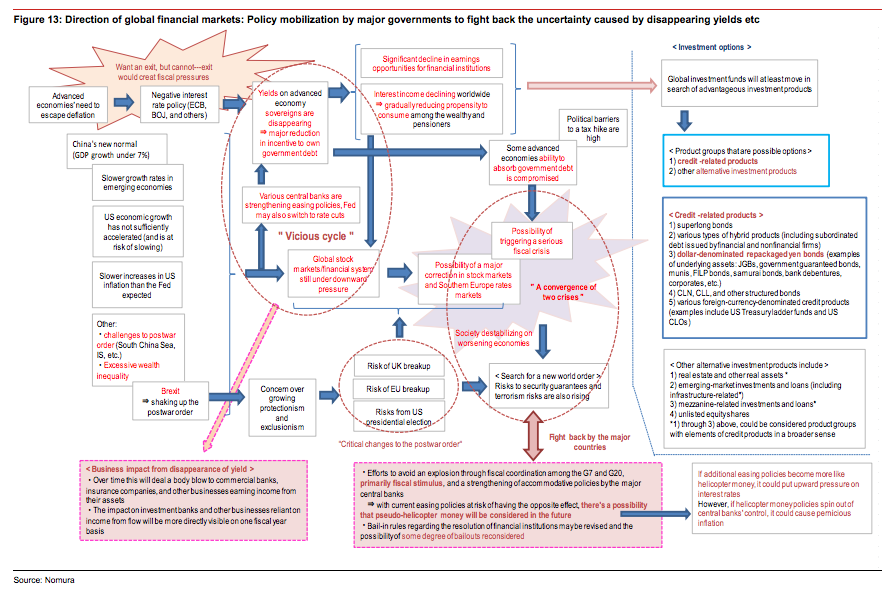

You’ll have already seen Nomura’s chief credit strategist Toshihiro Uomoto attempt to explain the state of the world through chart, here.

But we thought we’d also share his suggestion that the “30yr Treasury yield should near 0% within two years” as the “scarcity of products with a positive yield should continue facilitating the inflow of funds into the credit market.”...MORE

Tightening supply-demand/ Funds also flowing into credit from other asset classes: With the BOJ, ECB, and other major central banks maintaining strongly accommodative monetary policies, yields on sovereign bonds issued by the major countries have been steadily declining. The BOJ’s negative policy rate in particular has reduced the yield on Japan’s government debt, and there is now about ¥900trn of JGBs outstanding with a negative yield. Consequently a large amount of the Japanese money that had been invested in JGBs has instead been flowing into US Treasuries and the sovereign debt of other major countries...