Retail is hard.

Following up on Feb. 3's "Goldman Sachs Says It May Be Forced to Fundamentally Question How Capitalism Is Working".

They have asked the fundamental question, seen the future, and apparently it's going to be all right.*

From Bloomberg:

Get Ready for Labor to Crush Capital in the U.S.

A shift in the balance of power.

Lofty corporate profit margins—and their seeming reluctance to return to longer-term averages—last month had Goldman Sachs Group Inc. thinking about questioning the efficacy of capitalism.

But fresh analysis from Goldman's Elad Pashtan's is sure to instill renewed faith in the Invisible Hand for any colleagues that had begun to have creeping doubts. Corporate profitability is, in fact, poised to fall, he has warned clients.

.

Better yet (at least for the average worker), Pashtan asserted that this decline in profit margins will be driven by employee gains at the expense of Corporate America.

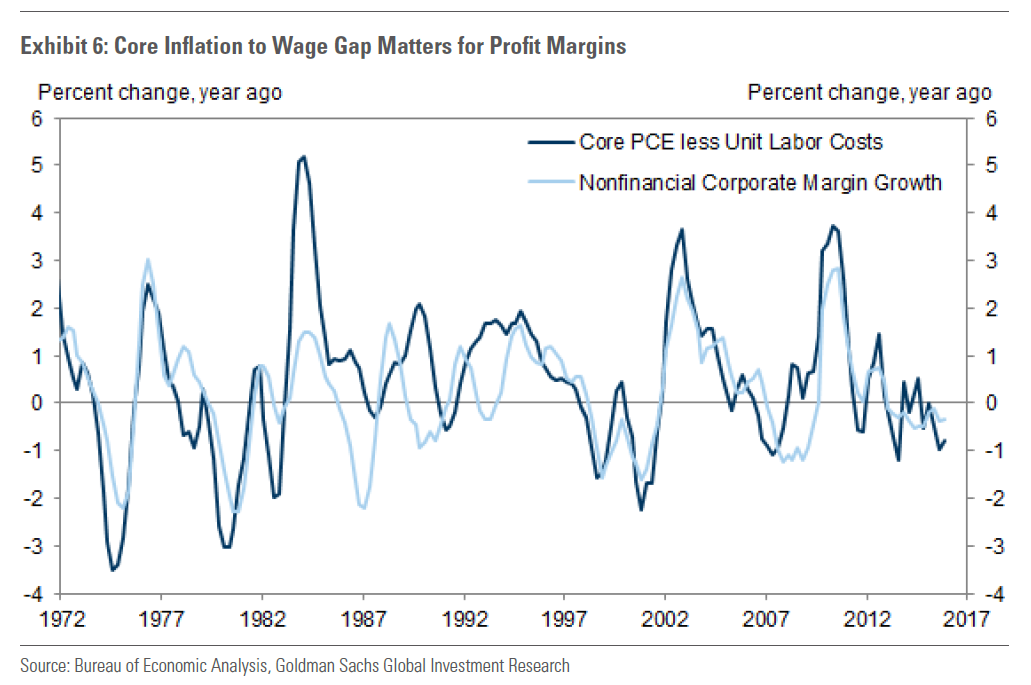

"We may be on the cusp of a more broad-based margin squeeze," he wrote. "Our model of National Income and Product Accounts suggests a moderate decline in 2016-2017 as stronger wage growth is likely to redistribute income away from capital owners and back toward labor."

Profit margins have edged down in recent years, driven primarily by lower oil prices and the rise in the U.S. dollar, which weighed on revenues multinationals generated abroad. Ex-energy, the profit margin for S&P 500-stock index companies is down only a tick since the third quarter of 2014, he noted. Lower energy prices are a boon to many industries in which oil is an input cost, but this appears to have been offset by the adverse effect the greenback's gains have had on top-line performance.

Still, human capital dwarfs energy inputs as a share of gross output, Pashtan observed, and real wage growth is expected to be positive over the next few years because of the lack of slack in the labor market.

"The interdependency of compensation and output suggests a close link between wages and profit margins," he found. "Indeed, as wages accelerate above core inflation—a proxy for output prices—profit margins have correspondingly declined (assuming no changes in labor productivity)."...MORE

*The "seen the future" bit is a riff on Lincoln Steffens' famously wrong statement about Soviet Russia in a letter dated April 3, 1919: “I have seen the future and it works.”.

It didn't.

The Goldman soul-searching is probably all related to the questions raised in 2012's "TAXES, CAPITAL AND JOBS".

See also: "Andrew Smithers on Labor, Capital and Taxes" or any of a couple dozen posts on mean reversion in profit margins.