From the Financial Times:

Here's the Fed Chair's speech at the Economic Club of New York, March 29, 2016:Janet Yellen has reiterated the need for the Federal Reserve to “proceed cautiously” in lifting interest rates given unfavourable market conditions, weaker than expected overseas growth and an uncertain inflation outlook.The Fed chair said recent declines in market expectations for interest-rate increases had helped cushion the US economy from adverse developments overseas, describing the moves as an “automatic stabilizer”.

But she stressed that the Fed had little scope to reverse course and stimulate the economy if the US unexpectedly hits the buffers, underlying the need for a gradual tightening of policy. She homed in on risks still stewing in China and the oil markets as she argued in a New York address for the central bank to move carefully as it considers when to lift rates again.Treasuries rallied as Ms Yellen spoke, with traders at CRT Capital characterising the remarks as a “surprisingly dovish take on the current policy stance and near-term outlook”. The yield on the two-year Treasury, which moves inversely to its price, slipped 6 basis points to 0.81 per cent....MORE

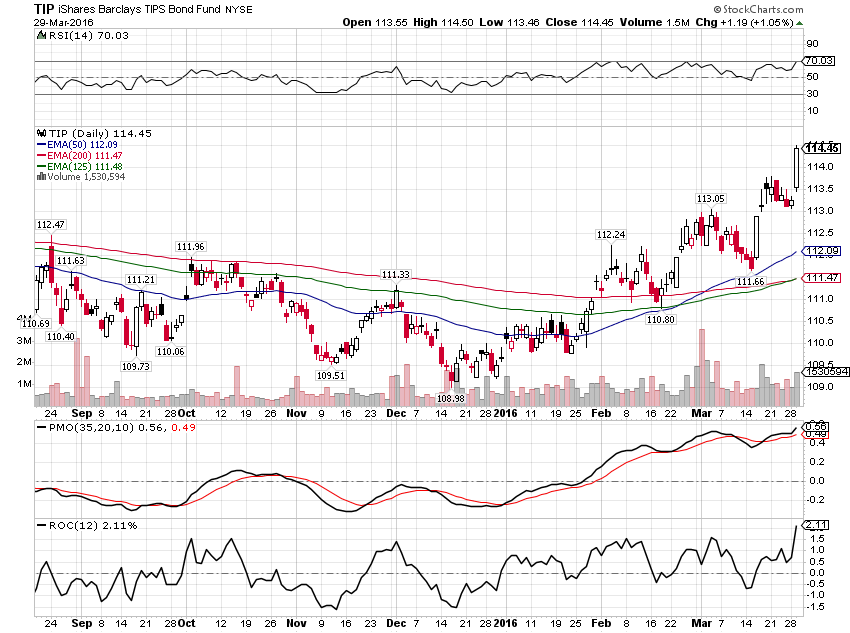

The Outlook, Uncertainty, and Monetary PolicyThe closest approximation of a granted-not-very-exciting "obvious" instrument-for-the-current-environment that we've been able to find, the iShares Barclays TIPS Bond Fund was this evening's 'Chart of the Week' at Alhambra Investment Partners. The ETF is up a bit over 1% on the day and a bit over 3% since our "Saaay, something's going on here" revelation back in February:

Janet Yellen thinks she wants inflation. The market thinks she’s going to get it:

Previously:

Bring On the Stagflation: "Atlanta Fed’s ‘GDP Now’ Plunges; Predicts Just 0.6% Q1 Growth"

"LPL: ‘Modest Stagflation’ Would Benefit TIPS"

"After Fed-Induced Spike, TIPS Auction Proves Weak" (TIP)

Today's Inflation Report Puts the Core Rate At Its Highest Since 2008 (and 2012)

BlackRock: "Why Now May Be the Time for TIPS"

"Is US inflation (finally) rising?"

Inflation: TIPS Breakevens Start to Rise as Economic Data Improves

No Inflation? Look At This (#3 will shock you)

"The Treasury Market Raises Its Inflation Outlook" (buy TIPS)

The Velocity of M1 Money Stock May Have Stopped Declining

A Look At The Consumer Inflation Numbers

You Want Inflation, "Why doesn’t the ECB just buy oil?"