However, the way that impacts economics and finance is really quite fluid.

From FT Alphaville:

Why should changes in population structure affect valuations?

We previously covered some of the problems with the claim that household savings affect valuations by looking closely at what happened in Japan. The short version: corporations more than made up the decline in personal savings rates through a combination of higher profit margins and less investment. Aging and population shrinkage imply less demand for capital as well as less supply, so the net effect on yields is far from obvious.

As it happens, there’s lots of evidence from outside Japan on the weak (or nonexistent) linkage between demographics and asset valuations.

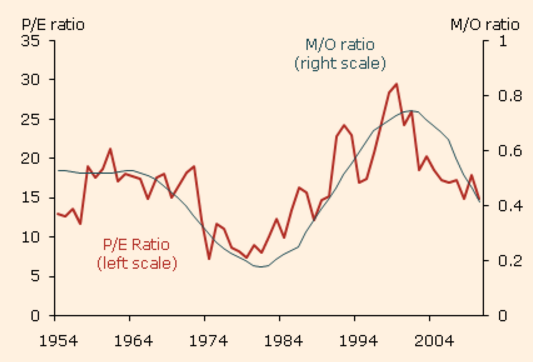

In 2011, economists at the Federal Reserve Bank of San Francisco made waves when they appeared to find a strong relationship between the US population structure and the PE ratio of the S&P 500. The theory was that people aged 40-49 were most likely to be net buyers of stocks, while people aged 60-69 (or 65 and up, whatever) are most likely to be net sellers. So the relative sizes of the two age groups could have some connection to the pricing of corporate equity.

Historically, there was a pretty tight relationship in the US:

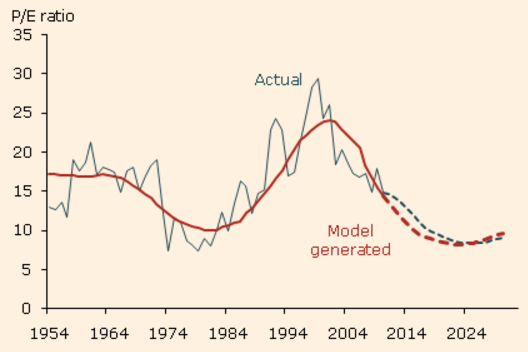

Their punchline was that the demographic projections of the day implied PE ratios would fall by about half, into the single digits, while real stock prices would be flat from 2010 through 2027, assuming constant real earnings growth:

If this actually happened, we personally would be ideally placed to load up on cheap stocks during our prime accumulation years. It’s therefore with some regret we inform you the cross-country evidence suggests the original correlation may have been bogus....MORE