In news more profitable, natural gas is bucking the trend and is trading up 3% on the rolling-off January's and 2.5% for the February's. More on that later today.

From ZeroHedge:

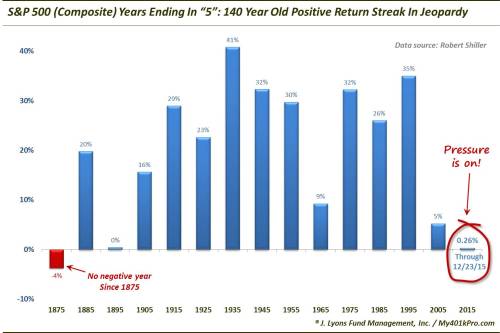

The last trading week of 2015 begins on a historic precipice for stocks: as reported over the weekend, the U.S. stock market has not been lower for any year ending in a “5? since 1875.

That streak however is now in jeopardy, because following Thursday's shortened holiday session which abruptly ended with a mini selloff in the last minutes of trading, the overnight session has seen continued weakness across global assets in everything from Chinese stocks which tumbled the most since November 27 (SHCOMP wipes out down 2.6% as China B Shares plunge 7.9% while USD/CNY climbs 0.16% to 6.4868 after earlier touching 6.4880, matching four year highs) to commodities - after its tremendous surge over the past week, WTI is back down 2.5% and sliding on Gartman's ringing endorsement - including copper and precious metals, to European stocks (Stoxx 600 -0.4%), to US equity futures down 0.3% on what appears to be an overdue dose of Santa Rally buyers' remorse.

Here is where we stand currently:

A closer look at Asian markets shows that shares fall with Chinese stocks declining most with the Shanghai Composite Index’s worst day in a month as fresh signs of slowing growth in China added to concern looming changes to the country’s listing regime and the expiration of a share-sale ban will hurt demand for its stocks. Investors are fretting that the end of a six-month ban on sales by shareholders with stakes of 5 percent or more in Chinese companies will unleash another wave of selling just as reforms to the initial public offering system see a raft of new listings dilute demand for existing equities.

- S&P 500 futures down 0.4% to 2044

- Stoxx 600 down 0.4% to 365

- FTSE 100 closed

- DAX down 0.2% to 10711

- German 10Yr yield down 3bps to 0.61%

- Italian 10Yr yield down 5bps to 1.63%

- MSCI Asia Pacific down less than 0.1% to 131

- Nikkei 225 up 0.6% to 18873

- Hang Seng down 1% to 21920

- Shanghai Composite down 2.6% to 3534

- S&P/ASX 200 closed

- US 10-yr yield up less than 1bp to 2.24%

- Dollar Index up 0.05% to 97.9

- WTI Crude futures down 2.5% to $37.11

- Brent Futures down 2% to $37.13

- Gold spot down 0.4% to $1,072

- Silver spot down 2.2% to $14.06

Compounding those concerns, the head of the nation’s third-largest mobile carrier was swept up in anti-graft crackdown. China Telecom Corp., the nation’s third-largest wireless carrier, dropped 1.3 percent in Hong Kong. China’s Central Commission for Discipline Inspection said in a statement on Sunday that Chang Xiaobing, who headed China Unicom (Hong Kong) Ltd. for more than a decade before becoming chairman and chief executive officer of China Telecom in September, is being probed for severe disciplinary violations.

Japanese stocks outperform; Australian mkt closed for Boxing Day holiday. "Investors don’t like declining industrial profits and they don’t like ongoing corruption investigations in China," said Andrew Clarke, director of trading at Mirabaud Asia. "There are plenty of reasons to lighten their load ahead of the new year and there’s no reason to open any new positions. That’s going to exaggerate the down swing in the market." 7 out of 10 sectors fall with health care, materials outperforming; energy, utilities underperform. Of note, China Nov. Industrial Companies’ Profit Falls 1.4% Y/y while China's November Railway Cargo Shipments plunged 15.6% Y/y to 270m Tons, confirming the severity of China's slowdown....MORE