I will simply copycat professional journalists, in this case FT Alphaville's David Keohane, and watch those page view's rack up.

Step one: Use a political reference the young people won't get, in the headline.*

Check.

Step two: Put feet on desk and try to not tip over.

Che...

From Barron's Focus on Funds:

Oil prices under $40 a barrel has investors like Howard Marks licking their chops.*Mr. Keohane's piece, "This default cycle is for turning" is directly related to what Mr. Marks is up to:

Marks is co-chairman of Oaktree Capital Group (OAK), a firm best-known for banking profits on distressed debt. On Tuesday, Marks told investors that the current environment for sussing out value in troubled companies looks like the best since the collapse of Lehman Brothers. Devin Banerjee at Bloomberg captured Marks’ remarks on energy-sector credit, made Tuesday at a Goldman Sachs-sponsored conference in New York:

“Hedges were in place that have worn off; companies will lose their credit lines. Some of the price declines and some of the weakness makes the prospective buyer very happy.”The Wall Street Journal’s Matt Jarzemsky noted earlier this month that distressed debt strategies from managers including Oaktree, Apollo Global Management (APO) and Brookfield Asset Management (BAM) have done badly this year in the absence of widespread defaults across the oil patch, which many expected sooner.

Are they coming? Barron’s noted back in October that shares of Oaktree could rise as much as 20% as the credit cycle starts to turn....MORE

From Deutsche, there are worse ways to sum up this year in credit…

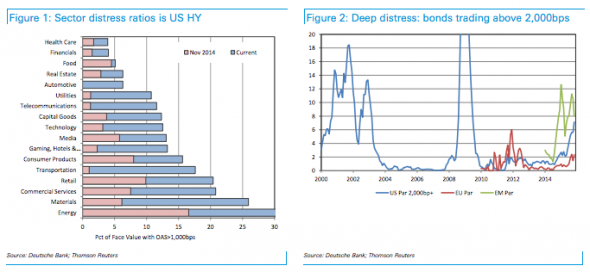

Late stages of every credit cycle, by definition, are built on a theory as to why this time is different.This type of attitude was prevalent going into 2015, when credit markets largely dismissed the oil sector distress, choosing to believe that this was an isolated issue and will stay that way. Historical evidence pointed to the contrary, where no earlier precedents existed of the largest sector being in distress and the rest of the market remaining firm. Today, two out of three sectors in US HY have more than 10% of debt trading at distressed levels.

Or, charted:

That, as they say, shows how distress (bonds trading over 1,000bps) has been spreading across the US HY space. Anyone who thought the stress the oil slide generated would stay nicely tucked away in the energy sector is now standing withtheir bezzle on show to the world as the water drifts ever lower. The early stages of the next default cycle are showing up outside of commodities too, as above. More so, the percentage of bonds in “deep distress” is now at 7 per cent:...

...MUCH MORE