High Yield Debt: How Bad Is It?

From FT Alphaville:

Even if Third Avenue’s recent shuttering

and Stone Lion’s closing of its $400m credit fund — which was run by

former Bear Stearns high-yield bond traders Gregory Hanley and Alan

Mintz according to the FT — are less a signal of worse to come and more just the closing of idiosyncratic (heavily juiced up) funds, it’s still, according to Goldman, going to be the worst non-recession year for HY since 1983.

With our emphasis:

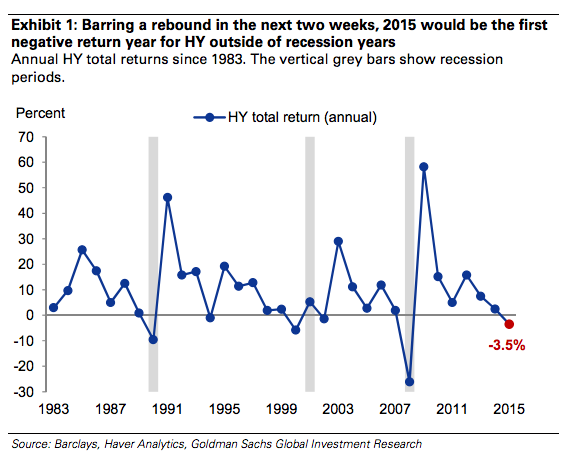

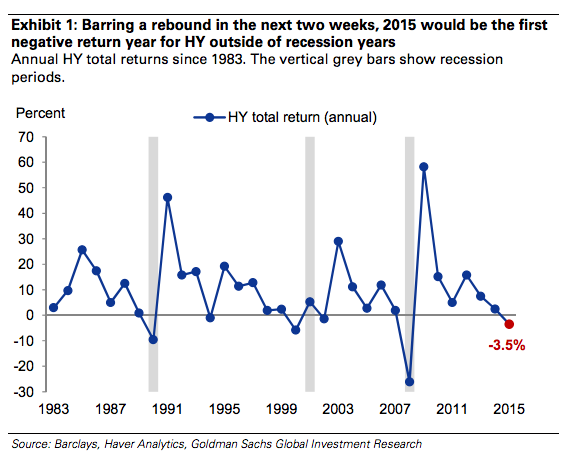

HY returns have sunk to their lowest level on the year as the

pressure from lower oil prices continues to constrain risk appetite. As

we go to press, the HYG ETF is down roughly 5% year-to-date. If the

weakness persists until the end of the year, 2015 could become the worst

non-recession year for HY (see

Exhibit 1). And while last year saw a strong recovery of risk appetite

in the final weeks of the year taking total returns from negative

territory to finish the year up 2.5%, the prospects for a similar

rebound this year seem quite low. Unlike last year, investors

have withstood a longer period of levered losses after idiosyncratic

risk permeated the HY market, and not just in the Energy space.

Sprint—the largest capital structure and one of the most widely held

names—for example, fell to all-time lows on Tuesday, further

underscoring the high degree of dispersion across sectors and issuers in

the market (more on this below). The heavy redemptions, rock-bottom

levels of risk tolerance, and persistent downside risk for oil prices

will likely continue to weigh on HY.

Cheery.

They DO say that the refinancing job facing HY is manageable but also say that’s not the only thing driving default risks:...MORE