I'm glad Bloomberg caught it.

From Bloomberg, Dec. 3:

There's Been a Bezzle-Fueled Boom in Bonds

Easy money and the confidence that comes with it conceals a wide variety of risk.

Economist John Kenneth Galbraith has written many words we should all read, but one in particular is proving especially relevant as cracks in the credit markets continue to spread.

That word is bezzle. It describes the period in which an embezzler has stolen a man's money but the victim does not yet realize he's been swindled. It is, as Galbraith puts it, a time when there is a "net increase in psychic wealth." Charlie Munger, Warren Buffett's longtime investment adviser, later built on the idea with his coining of the word "febezzlement," which (perhaps unnecessarily) formally extends the concept to include completely legal but nevertheless unexpected appropriations of wealth.

Whichever term one chooses, it looks increasingly likely that the world has experienced a massive fe(bezzle) in corporate credit.

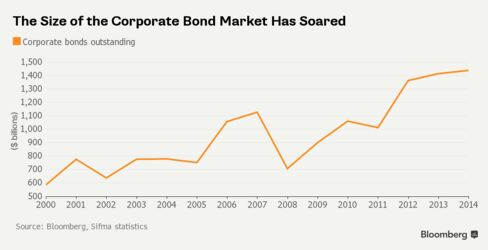

Years of low interest rates since the financial crisis have encouraged investors to pile into the asset class, reaching for the higher yields on offer from such securities as sliced-and-diced packages of commercial real estate loans, leveraged loans, and crucially, corporate bonds. An ever-ready supply of eager lenders and investors has kept borrowing costs low, enabling companies to fund a share buyback and M&A spree that has helped propel the recovery in the stock market, fueling the wealth effect on the overall market.

The bezzle is what has enabled companies to be continuously rewarded for rollup strategies or embarking on ever more-complex corporate structures. It's what's allowed the average level of indebtedness at U.S. companies to rise to its highest level in a decade. It is the thing that has masked potential risks in the credit system, leading to billions of dollars of underwriting fees for banks and a market for new-issue bonds in which prices are only ever expected to *pop* thanks to a perceived massive imbalance of demand and supply.

It is what has allowed a host of emerging market bonds to infiltrate the U.S. credit market, or the riskiness of benchmark bond indexes quietly to increase. As David Keohane of FT Alphaville points out this morning, citing a UBS analysis, the portion of triple-C issuers in the Citi U.S. High-yield Cash Bond Index is currently at 13 percent using an average of ratings from the big three bond graders. Using just the ratings of Moody's, the most conservative of the three rating agencies, the proportion of triple-Cs increases to 20 percent.

The confidence that comes with the bezzle is what has allowed banks and investment houses to enjoy higher fees or returns while simultaneously cutting back on the number of credit analysts they employ. UBS analysts Matthew Mish and Stephen Caprio have previously pointed out that "simply put, the growth of the credit markets [has] not been matched by the addition of research resources (e.g., credit analysts) in many of the silos," citing the example of high-yield money managers with one energy analyst responsible for covering $200 billion in bonds outstanding across 300 separate debt issues....MORE