From RBN Energy:

This Gas Is Made for Burnin’—Where Will Natural Gas Replace Coal in 2015?

This year’s natural gas power burn is shaping up as a record-breaker, mostly because gas consumption needs to rise sharply to offset increased production and the power sector is best able to ramp up its gas use. But what will it take, gas-price-wise, for utilities and independent power producers to increase their 2015 power burn by 2, 3 or even 4 Bcf/d this year? And which parts of the U.S. are likely to see the most dramatic coal-to-gas switching? Today we continue our look at this year’s power burn and its significance to Marcellus and other gas producers.

Huge volumes of natural gas will be produced in the Lower 48 in 2015, probably upwards of 75 Bcf/d, or more than 50% higher than 10 years ago. Once it’s injected into a midstream pipeline all that gas will need to find a home and—at least until the first liquefaction units at Sabine Pass LNG come online late this year or early next—there are only two homes available: storage or immediate use (for space heating, power and steam generation, export to Mexico etc.). One challenge gas producers and marketers must grapple with this year is that, while demand for gas from U.S. industrials is on the rise and Sabine Pass and other LNG export facilities are on the horizon, gas storage facilities may not have room to absorb as much surplus gas as they did last spring, summer and fall. (If they did, they’d be pushing their storage limits.) Power generation is the only gas-consuming sector with the capacity and flexibility to absorb large incremental volumes of gas. Another way to put that is, electric utilities and independent power producers (IPPs) will likely burn a lot of gas in the next nine and a half months (and probably in 2016 too) to keep gas production and consumption (plus storage) in balance.

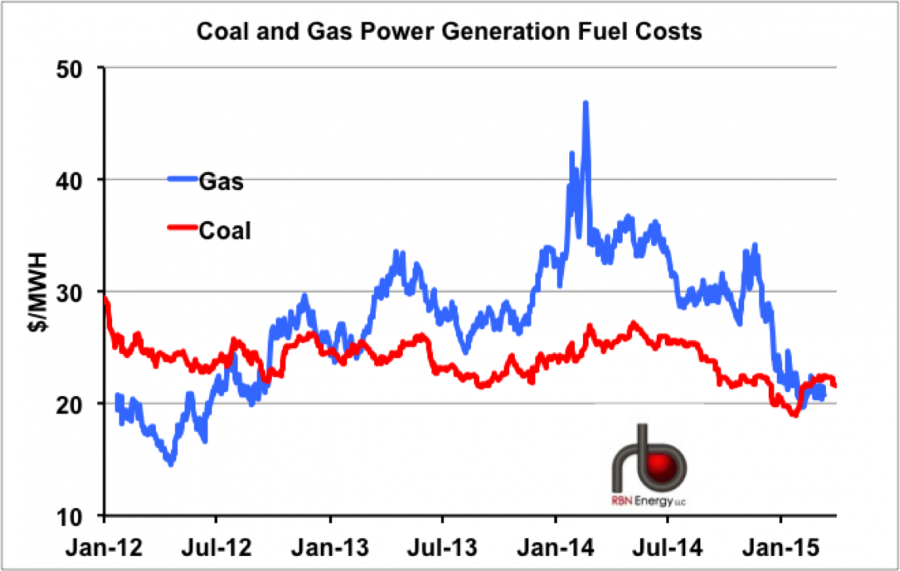

As we said in Episode 1, 2015 may be shaping up to be a repeat of 2012, when a combination of rising natural gas production, unusually full storage, and low gas prices sparked a lot of coal-to-gas switching and a spike in gas consumption by the power sector (up 20% from 2011 to 26 Bcf/d, on average, in 2012). This year and 2012 aren’t mirror images, of course; Henry Hub prices are somewhat higher ($2.68/MMBTU on April 7, 2015, compared with $2.11 on the same date three years ago), and late March/early April gas storage levels are considerably lower (1.4 Tcf now versus 2.5 Tcf in 2012). But Lower 48 gas production levels are up (73 Bcf/d in December 2014 versus 66 Bcf/d three years earlier), And our basic comparison of relative fuel costs for coal- and gas-fired generation shows that the cost of generating power at a gas fired plant is lower than the equivalent cost for generating power at a coal fired plant for the first time since January 2013 (see Figure #1). The blue line in Figure #1 represents the cost of gas at Henry Hub to generate a Megawatt Hour of (MWh) electricity in a typical combined cycle gas turbine plant. The red line is the cost of NYMEX Appalachia coal required to generate a megawatt hour of electricity in a typical coal fired plant. When the gas cost goes below the coal cost (as it did in January of this year), system operators are incented to switch from using coal-fired plants to gas-powered units in those regions where they have a choice. (For a more detailed explanation of the gas versus coal fuel cost analysis see Talkin’ ‘Bout My Generation).

Figure #1

Source: CME NYMEX Data from Morningstar and RBN Energy (Click to Enlarge)

However, as we’ve often said in discussing power burn, fuel economics are a major factor—but not the only factor—in deciding whether to turn off a coal unit and turn on a gas unit (or vice versa). Non-economic, “operational” factors included total system demand (if it’s very high, or if a nuclear unit is down, you may need to run all your coal and gas units), unit location (will taking Coal Unit A offline and firing up Gas Unit B cause transmission congestion?), and gas pipeline capacity also needs to be considered....MORE