From Dr. Housing Bubble:

The Canadian housing bubble makes California real estate look sensible: Crash in energy prices will put pressure on home values up north as Canadians go into maximum leverage.

As the year comes to a close, it is useful to put things into perspective. Sure, California has a love affair with real estate and we go through our traditional booms and busts. $700,000 crap shacks now litter the landscape but there are fewer and fewer lemmings taking the plunge. In Canada there was no correction. In fact, households continue to go into deep debt to purchase real estate. The argument goes that mortgage standards are much tighter in Canada so therefore, they are much more enlightened when it comes to financing homes. People forget that the bulk of the 7,000,000 foreclosures in the US came in the form of standard loans. Garbage loans imploded in more dramatic fashion but people lost their homes because the economy shifted. At that point, it merely meant covering the monthly nut. We were housing dependent and that market contracted aggressively. Canada is housing and oil dependent. And oil just got a big kick to the shins.

In Canadian debt we trust

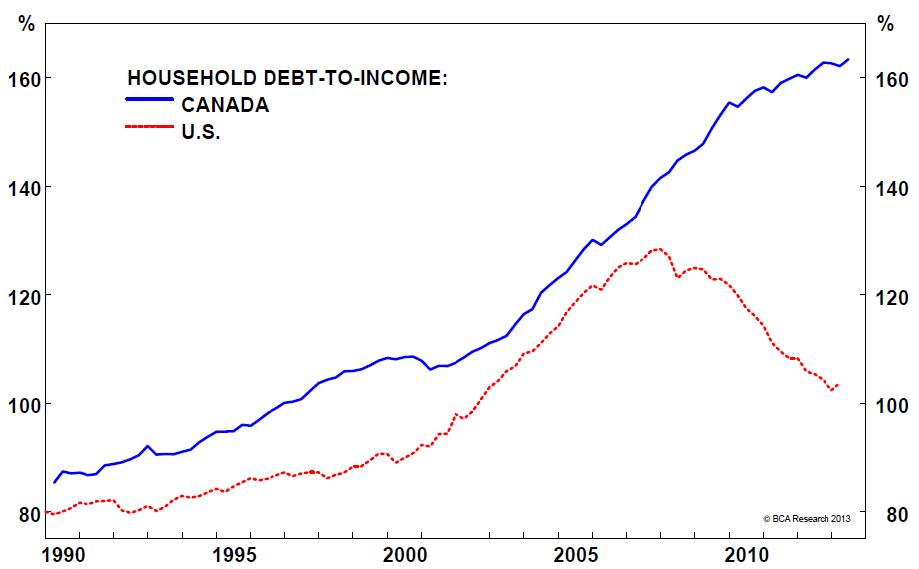

There was an inflexion point for US markets when household debt surpassed household income. People kept saying it was a liquidity crisis initially but it was truly a solvency crisis. People took on too much debt and were walking on a financial tightrope. In the US, this peaked above 120 percent. Canada is well on its way above 160 percent:

Basically Canadians are deeper in debt relative to their income. And a large part of this debt is housing related. A large part of the economy is also tied to oil and as you may know, oil just took a massive cut...MUCH MOREHT: ZeroHedge