Brent $52.21down 90 cents, low $51.23.

Yesterday we

After a quick snapback sometime this week,From FT Alphaville:

We're going lower....

Of crude bottoms and Rins

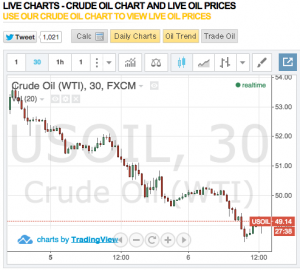

While WTI crude prices fell through $50 per barrel levels on Monday, and still remain there on Tuesday… (chart via LiveCharts):

…Reuters’ John Kemp pointed out that we’re likely reaching the point where upside moves become more probable than downside moves because:

Prices are now too low to provide the cash flow to sustain drilling programmes and nowhere near enough to provide the financial incentive to make equity or debt available.This is important because so-called decline curves for oil wells — particularly for shale wells — are very steep, says Kemp. Output falls to a half or even a third of its initial level by the end of the first 12 months. Consequently:

Thousands of new wells must therefore be drilled each year simply to sustain output at its current level of more than 9 million barrels per day.Now, whilst efficiencies can be made, Kemp says it’s hard to imagine the industry cutting costs and raising efficiency enough to offset fully a 40 per cent or more reduction in the number of rigs operating. That means in the not too distant future the supply glut we keep hearing about could very well become a bona fide shortage. And when that happens… well the market will have to correct.

One thing not mentioned by Kemp, but also worth bearing in mind, is the likely effect of Renewable Identification Numbers (RINs) at this stage.

You might remember RINs from when they blew out two years ago. Back then, the squeeze was caused by a combination of speculation, restrictive thresholds and oversight by industrial and intermediary players.

This time round, RINs could provide the correcting force that fuels a wider price reversal.

The logic goes as follows. When oil prices fall, so do gasoline prices. When gasoline prices fall, demand eventually goes up as well.

Not much is being written about the fact that on a seasonal basis, December gasoline demand is at multi-year highs now. Here’s the data from the EIA....MUCH MORE