From Jon Markman via Yahoo:

"Deflation" and "boom" are not

two words that normally go together. They are almost like "sad

happiness," "lo-cal donut." But in their very unlikely pairing they

appear to do a good job of explaining the unusual economic and market

environment that may lie ahead.

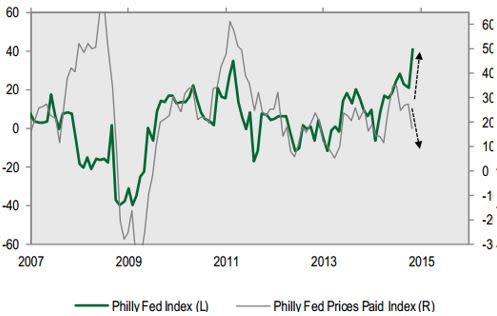

It’s a term discussed this week

by Cornerstone Macro analyst Francois Trahan to describe a rare

condition in which a country’s economic activity rises but inflation

falls. He believes that is the right interpretation of the Philadelphia

Fed data released on Tuesday that showed output in the region up but

prices paid falling, as shown in the chart below.

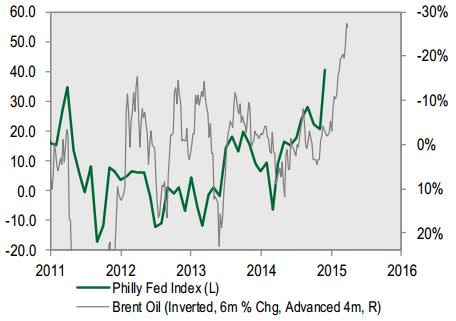

The

improvement of the Philly Fed can be seen in part as a result of the

stimulative effect of falling crude oil prices, and their ripple effect

on the broad economy. The chart below, created by Cornerstone, shows the

Philly Fed Index (green line) charted against the six-month percent

change in the price of Brent Oil, advanced four months (gray) and

inverted.

The

oil price is advanced four months to show the lagged effect that oil

has on economic activity. In other words, when oil falls in price it

takes about four months for the change to have an effect on end users’

decisions....

MORE