The team at Alpha Attribution has done a massive study in which it looked at the stock selection prowess of the entire hedge fund universe to determine who’s really earning that 2-and-20, independent of the broader indices. It’s a really interest idea:

Stock picking starts with honesty. Let’s say you are a hedge fund manager and you held GOOG stock for a quarter. If GOOG goes up 10%, that is great, but if the technology sector goes up 7%, much of that 10% return may have been coming from the sector. You got the sector right, which is worth 7%, but your stock selection ability is only worth 3% (10%-7%). We define stock selection skill is one’s ability to pick a security that outperforms its sector (with some adjustments for beta, etc).

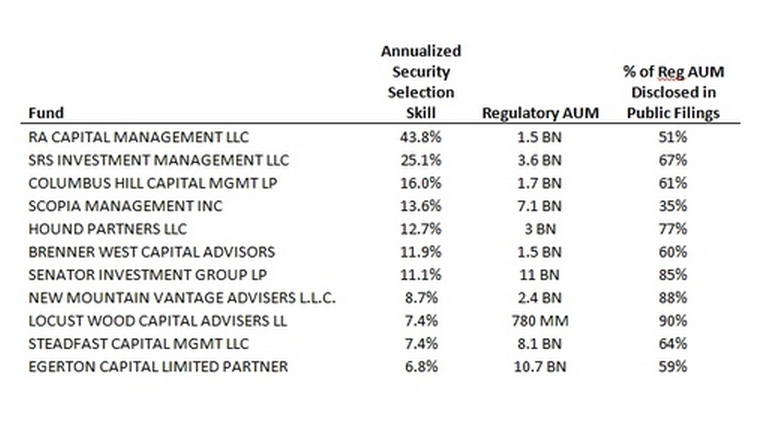

We use this framework to calculate the stock selection skill of every hedge fund manager that publicly discloses their positions. Based on the magnitude and consistency of this skill over the last 3 years, we rank order the entire hedge fund universe and produce a list of 10 hedge funds we think demonstrate high and consistent stock selection skill over the past 3 years.Top Managers Demonstrating Consistent Stock Selection Skill over Last 3 Years

...MORE, including links