I propose hunting peasants for sport.*

From FT Alphaville:

Let there be bubbles!

Citi’s Matt King has jumped on the secular stagnation bandwagon with a really nifty collection of charts that ties the whole story of how we got to this point together.

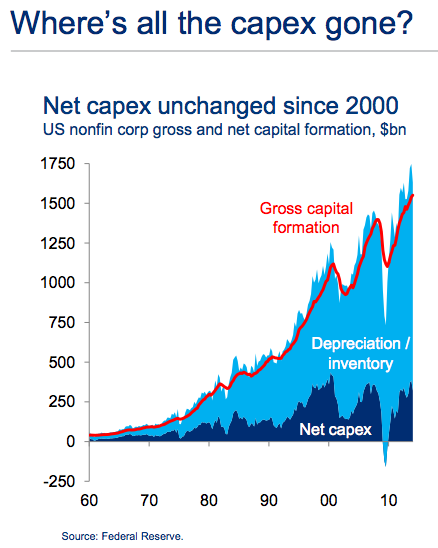

He starts off with the capex issue, noting that despite the cyclical recovery corporates don’t seem to be investing all that much. In fact, according to King, declining capex may be a key aspect of secular decline, which he suggests began in advanced economies and is now spreading to emerging markets as well.

Namely: Anything but capex, because capex ain’t what you need when the name of the game is artificial scarcity.*It's a joke. As was the story of the Russian noble who said to his English host "I've shot two peasants this morning" it was a joke. And I don't really know why I swiped the title of a mediocre Shelley play to refer to Izzy except that Prometheus gave fire to humanity and Izabella unshackled of corporate responsibility would probably be awesome and...

But, as King notes, with companies (for some reason) not keen to expand on the capex side — see our beyond scarcity for why that may be the case — that leaves everyone with a growing dependence on credit:

Growth has instead been propped up by an increasing reliance upon credit acceleration effects. Unfortunately this implies that the recent boost from the end of deleveraging in many economies may prove temporary: either we lapse back into releveraging, or else growth risks fading.Which opens the door to Larry Summers-style thinking that “we need leverage to support the economy and/or faddy bubbles (ideally in non systemic areas like bitcoin) to keep things ticking over”.

In other words, as King notes, you can pump it in, but you can’t control where it goes.

Case in point, you can provide cheap money but you can’t make banks lend if the economic agents don’t think they will be able to pay back the loan, or invest that money productively....MORE

Anyhoo, here are the Richter Scales: