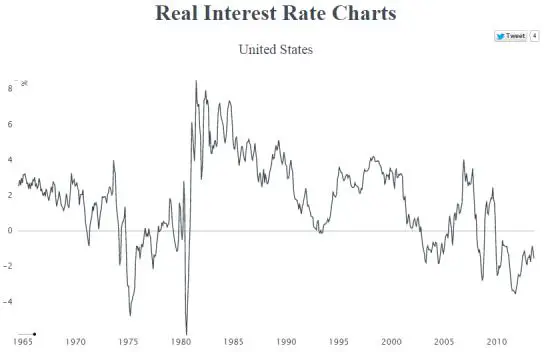

From Dollar Collapse:

The folks at

Gresham’s Law

just published a nifty interactive chart of real (i.e.,

inflation-adjusted) interest rates since the 1960s that explains a lot

about today’s world.

To make sense of this, let’s

start with a a little background: Interest rates are the rental cost of

money, but to figure out the true cost you have to adjust the nominal

(or numerical) interest rate for inflation, which is the rate at which

the currency being borrowed is falling in value.

If the nominal interest rate is

higher than inflation, then the real interest rate is positive. If the

real rate is both positive and high, that’s a signal that money is

expensive and that one is better off being a lender (to reap those high

returns) than a borrower (who has to pay the high true cost of money).

The opposite is true for negative real rates, where the nominal cost of

money is lower than the rate at which the currency is being depreciated.

In this case a borrower actually gets paid to borrow because the true

cost of the loan falls as the currency loses value. So negative real

rates tell market participants to borrow as much as possible.

Given these incentives one might expect the following

....MORE

Here are

the charts, based on OECD data.