From FT Alphaville:

Hedge funds, fortunes and merit

Institutional Investor’s Alpha published its rich list for 2013 this week which, as Matt Levine has described with flair and some made-up maths, is only tangentially related to how well the hedge fund managers in question performed last year:Previously:

If you start with a ton of money, and/or your hedge fund has really good returns, you will make a lot of money. Notions of fair compensation for your labor, or appropriate pay for performance, just don’t enter into it. Money begets money, lots of money begets lots of money, and skill in the begetting is a nice bonus.That post is also his contribution to the burgeoning mountain of Piketty-related comment, and without tossing another pebble onto the pile, it is worth digging a little more into the reasons for those vast fortunes to exist, and why that matters.

The simplest is that some investors are more talented managers of hedge funds than others. Trite, yes, but notice the difference between being a good investor and being a good manager of a hedge fund. To get into Carnegie levels of cash involves not just investing well, but piling up very large sums of other people’s money to play with.

Israel “Izzy” Englander at Millennium is a case in point. A manager of men, rather than money, he hires traders and portfolio managers to do the investing, but Institutional Investor’s Alpha put his so-called earnings (an alchemic mix of pre-tax and pre-cost fees with personal unrealised investment gains) at $850m last year.

Still, the classic route is to put up a big investment performance early on that draws attention and capital, then don’t do anything too stupid. (In the mutual fund world that means hug the index; for hedge funds it means not losing money while projecting a sense of intelligence, process and structure.)

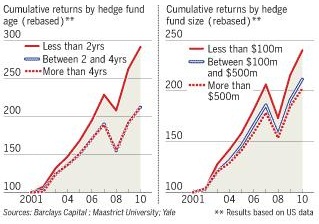

Small and young hedge funds are nimble, their managers are focused, and they can concentrate their capital in a small number of good ideas without moving prices or attracting attention. One study by Barclays found that funds under two year’s old, and managing less than $100m typically make better investment returns than their larger older peers.

Small funds are also more likely to blow up, and it is hard (impossible?) to spot good funds consistently in advance, so money follows the performance — which explains why investors in hedge funds have historically earned far less than headline indices of performance suggest....MUCH MORE

Fun With Numbers: Matt Levine on Hedge Fund Pay

The Top 25 Highest Earning Hedge Fund Managers

Possibly also of interest:

From Knowledge@Wharton:

Gaming the System: Are Hedge Fund Managers Talented, or Just Good at Fooling Investors?

Eugene Fama: Do Active Managers Earn Their Fees?

Fee reduction and alpha generation: Why fee reduction is the purest form of alpha

From the Fama/French Forum:

Fama/French: "Luck versus Skill in Mutual Fund Performance" (LMVTX)

What Were the Odds That Legg Mason's Bill Miller Would Achieve the Results That He Did?

The Market Pays Luck as Well as Skill

The optimal design of Ponzi schemes in finite economies

Finally, one of the best:

Dogbert is, of course, a sociopath but that's his charm.

That and his little tail wag when he is especially pleased with a scam.

Most managers have only a vestigial tail.