From FT Alphaville a more nuanced look:

The ‘other’ great bond mispricing theory

A lot of people are puzzled over why US yields are falling when nothing has changed on the Fed communication side, and QE is supposed to be slowing.

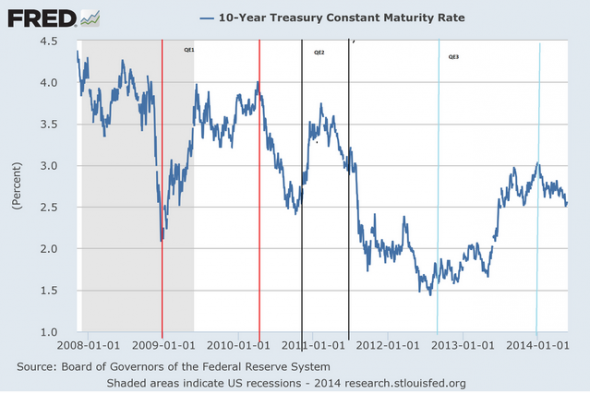

Frances Coppola notes an even stranger phenomenon. When you look at the very big picture you realise that if there is a correlation between QE and rates, it’s actually a very counterintuitive one:

Every time QE is announced, yields rise: when it ends, they fall. And no, this doesn’t just affect the 10-year yield. The same basic shape can be observed on just about any maturity over 1 year (short-term rates are propped up by the positive IOER policy).It’s counterintuitive because people tend to believe that QE suppresses rates by creating a bid where there otherwise wouldn’t be one.

The standing theory, consequently, is that a QE exit should encourage rising yields....MUCH MORE