From Investing.com:

Busting Small Cap Market Risk Myths

- We have all heard that weakness in small caps foreshadows a breakdown in the general stock market.

- The implication is that small caps are a leading indicator, and S&P 500 weakness is coming soon.

- Historical evidence does not support either claim.

- Small caps are important and they can help us manage risk in 2014 if we know what to look for.

Legitimate Concerns About The Message Of Small Caps

Many, including CCM on May 16, have voiced concerns about the economic message being sent by small cap stocks in 2014. Comments similar to those shown below have been common and warranted in recent weeks. From NASDAQ.com:

The tug of war between earnings, economic data, and interest rates has helped to put a modest floor under larger, cash-rich companies. However, the same can’t be said for small cap stocks, which have been under more selling pressure recently…On the surface, this may seem like a somewhat benign decline of 9% from the 2014 highs in IWM. However, there is some legitimate concern mounting that small-cap stocks may become be a leading indicator of weakness that will spill over into the rest of the market. It would not be surprising to see this index lead a correction lower after being one of the strongest segments during this bull market.Small Cap Cracks Always Mean Trouble, Right?

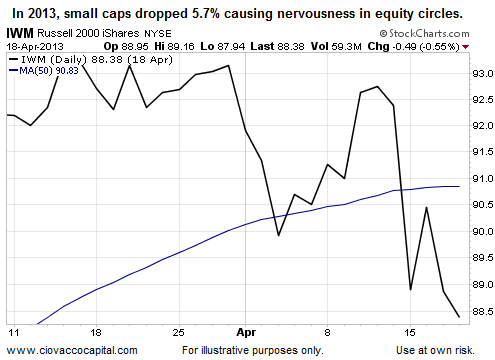

A common investment mistake we all have made is to decide in advance what the future looks like. For example, if we saw small caps begin to fall hard in early 2013, we may have decided that a correction in the S&P 500 was coming soon. The chart below shows a 5.7% drop in small caps that occurred in Q1-Q2 2013. For the answer to “what happened next?”, continue reading.

Small Cap Cracks Don’t Necessarily Have To Widen

Did small caps and the S&P 500 follow the bearish script as many expected in 2013? No. In fact small caps found their footing near point A below, and the S&P 500 rallied near point B. After point B, the S&P 500 rewarded flexible investors with an 8% pop.

The subsequent 2013 rallies (shown above) in small caps and the S&P 500 tell us two things:...MORE

- It is not safe to assume that 2014 cracks in small caps can only widen.

- Small caps could rally in 2014 as they did in 2013.

*The joke is not original to me. When Nixon was trying to wind down the war in Vietnam he met with Israel's Golda Meir and said she could have any three U.S. generals if he could have the guy who beat Egypt, Jordan and Syria in the Six-day War, General Moshe Dayan.

She was reported to have said “I’ll take General Motors, General Electric and General Dynamics.”