Predicting the Next Financial Collapse

J. Kyle Bass, a Dallas-based investor, forecasted the mortgage bubble and the European collapse. But what happens if his third prediction comes true?That is an incorrect assessment of the sequence of events.Paying back the debet is not the issue.

J. Kyle Bass has a knack for forecasting economic trouble. Back in 2006 the Dallas-based investor observed that there was a seemingly unstoppable market for sub-prime mortgages. But research convinced him the market was wildly overvalued, that it was a quasi-pyramid scheme built on low interest rates, inflated home prices and bundles of shaky loans made to people who couldn’t really afford the payments. Wouldn’t many of these people eventually default on their debt and cause the entire market to crash? Conventional wisdom and triple-A ratings on the bundled mortgages said otherwise, but Bass, a contrarian, remained convinced the market would implode. He bought an enormous amount of credit default swaps, an investment that would pay if the mortgages went under. And when they did, he became a very wealthy man.

Then in 2008, Bass turned his attention to the global bond market, and concluded that the bonds of a number of Euro-nations, particularly Greece, were set to fall. He again bought credit default swaps, this time against Greek bonds. When Greece restructured its debt and prompted payout to these swaps, Bass’ investments reportedly stood to pay him 650 times his original buy-in.

Now Bass, who runs his own hedge fund, Hayman Capital Management, is predicting that Japan’s economy—the third largest in the world—will experience a financial collapse. The country’s government debt is at about 240 percent of GDP, the highest in the world. Even more critical, according to Bass, is the fact that Japan’s government debt dwarfs its annual central government revenue, which is how interest on the debt gets paid. Japan’s aging and shrinking population is also part of the problem, since fewer and fewer workers mean less and less tax revenue for the government, even as debt grows.

What Japan desperately needs is economic growth, and Prime Minister Shinzo Abe has undertaken a plan to kick-start growth with government stimulus, which means even more debt and possibly inflation. The plan has been called “Abenomics,” and it has gotten off to a strong start, with Japanese stock markets moving sharply upward. But Bass believes it will be in vain.

“There is nothing Japan can do to avoid what is going to happen,” he told me.

Bass is not the only one who believes Japan’s debt may lead to financial calamity. Martin Feldstein, a well known economist at Harvard, also takes a dim view of Abe’s policy, writing that if it increases interest rates on Japan’s borrowing, the government could find itself in an even more precarious situation than it is in now.

At the heart of the matter is the question of whether the country’s debt can be repaid. Taking on debt is like traveling in a time machine to your own future, where you can slice off a piece of the wealth you expect you will have and take it back with you. The problem occurs when people (or countries) are too optimistic about their future wealth, and take on debt they cannot later repay. When this happens on an economy-wide basis, an even bigger problem occurs—a financial bubble. At some point in a bubble, people realize the over-optimism. Confidence falters and the market passes through a financial black hole.

In the case of Japan, the black hole will appear if the people and institutions that buy Japanese government bonds lose confidence in the government’s ability to repay those bonds. They will either stop buying them or demand a higher interest rate. Either way, the Japanese government could find itself in the same predicament as Greece and now Cyprus, unable to pay its bills without outside help....MORE

As everyone and his mother has figured out, if a country is issuing debt in its own currency it can inflate away the principal. The problem is the interest rate. At some point the debt buyers get wise to the inflation game and any newly issued debt has to carry higher and higher rates of interest to compensate for the principal destruction.

As the event horizon of the black hole is passed the debt buyers will go on strike and it is game over as the government can only finance itself Zimbabwe style.

By the time Japan crosses the event horizon it won't really matter because war with China will have broken out and all bets are off.

See also:

Kyle Bass' Hayman Capital's Doomsday Scenario: Japan

Another Look at the Kyle Bass Nickel Trade

Is Hayman Capital Management's Kyle Bass About to Get Crushed in Physical Commodities?

Nah.Kyle Bass' Hayman Capital Management Letter to Investors (Nov. 2012)

However, his plan for world domination may be delayed a bit. Here's the story....

Kyle Bass: "We believe that war is an inevitable consequence of the current global economic situation."

Finally, as I mentioned in "So a Sicilian mafioso walks into HSBC…":

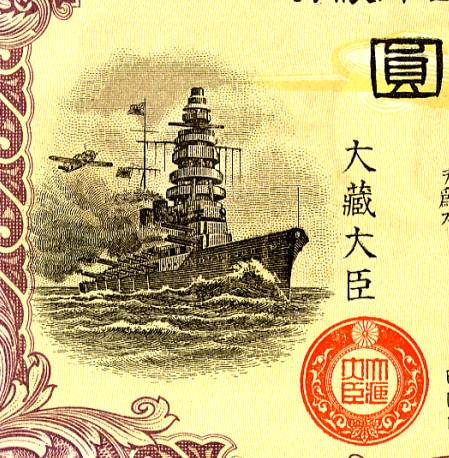

In a less sophisticated move, I once had a slightly deranged money guy insist that his $1 Billion of Japanese government bonds were good collateral. Here's one of the issues he proffered, image via Scripophily.com:

Here's a close-up of the engraving:

Certificate Vignette

For the longest time Carl Marks & Co. (or was it Herzog?) made markets in defaulted bonds, for some reason I remember the Kingdom of Serbs, Croats and Slovenes 8's of 1922.

It may have been a different S,C&S issue, I can't find any record of the paper. Off to Zagreb?

[try 'off too, Zagreb' -ed.]

Here's a quick story about this odd corner of the market, from Time Magazine, Aug 8, 1983...