Cracking story on Bloomberg, straight out of the annals of couldn’t make it up if you tried, and involving the Sicilian Mafia, Venezuelan bonds and a host of global banks (emphasis ours):

May 22 (Bloomberg) — Italian prosecutors today broke up an international ring led by the Sicilian Mafia that tried to use fake Venezuelan bonds to obtain credit lines totaling $2.2 billion from HSBC Holdings Plc, Bank of America Corp. and unidentified British banks, according to an arrest warrant.“This was a colossal operation,” Marcello Viola, one of the lead prosecutors, said in a telephone interview from Palermo, Sicily. Some of the Mafia-linked people involved “were experts in finance who traveled the world,” he said....

...False Venezuelan bonds were authenticated by corrupt officials within the South American nation’s central bank, prosecutors said. The bonds were used to ask for credit lines of $500 million each from HSBC in London and Bank of America in Baltimore in 2003 and 2004. U.K. authorities and the U.S. Secret Service broke up both the deals before either bank provided financing, Viola said....MORE

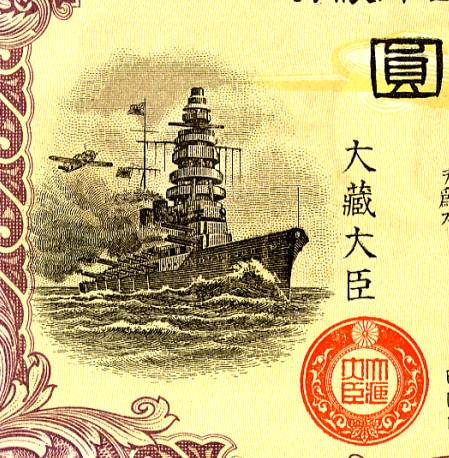

In a less sophisticated move, I once had a slightly deranged money guy insist that his $1 Billion of Japanese government bonds were good collateral. Here's one of the issues he proffered, image via Scripophily.com:

|

Here's a close-up of the engraving:

Certificate Vignette

For the longest time Carl Marks & Co. (or was it Herzog?) made markets in defaulted bonds, for some reason I remember the Kingdom of Serbs, Croats and Slovenes 8's of 1922.

It may have been a different S,C&S issue, I can't find any record of the paper. Off to Zagreb?

[try 'off too, Zagreb' -ed.]

Here's a quick story about this odd corner of the market, from Time Magazine, Aug 8, 1983:

...Foreign bonds are riskier because it is difficult to force payment or arrange settlements. The Wall Street firm Carl Marks & Co. is still fighting a class-action suit against the People's Republic of China to recover losses from Hukuang Railroad bonds issued by the imperial Chinese government in 1911. Last year a U.S. district court in Alabama ordered China to cough up to U.S. bondholders the unpaid principal plus the interest that has been mounting at 5% annually, a total of $41.3 million. Marks also has two suits against the Soviet Union involving $75 million in dollar-denominated bonds issued by the imperial Russian government. The bonds, held by U.S. investors, were repudiated by Moscow after the 1917 revolution. Daniel Collier, a Marks vice president, is not holding his breath. In his firm's offices, one of the Russian bonds is mounted, with a small hammer beside it, along with the words: IN CASE OF SETTLEMENT, BREAK GLASS.

Even if the court actions fail, some of the paper still has value. A Hukuang Railroad bond for 20 gold pounds ($96) that is in good condition is worth from $50 to $100 as a collector's item....