From the Market Monetarist:

Never reason from a price change – the case of commodity prices

The big story in the financial markets this week is the continued decline in commodity prices – particularly the drop in gold prices is getting a lot of attention.

The drop in commodity prices have led some people to speculate that this is an indication that the global economy is slowing. That may or may not be the case. However, as Scott Sumner like to remind us – we should never reason from a price change.

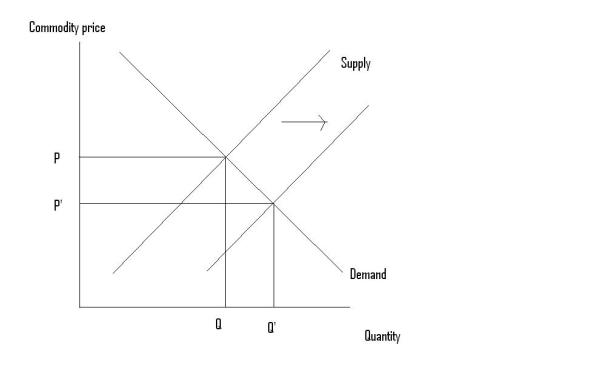

We have to remember that the price of commodities can drop for two reasons – either demand for commodities declined (that would be an indication that the global economy is slowing) or because of a positive supply shock (that on the other hand would be good news for the global economy).

The good news graph…

And the bad news graph…MORE