Production, not usage, is the key number right now and it is not easy to get an accurate (to within .2Bcf/day) read on where production is at. Remember, even the EIA uses Bentek's guesstimates in the weekly report.

From RBN Energy:

It’s the first week of March 2013 – the final month of the natural gas winter season. This winter has been colder than last so far reducing the record storage surplus that we started the season with. Natural gas prices have traded in a range between $3.25 and $3.50/MMBtu so far this year. Production continues at or near to record levels however and higher prices will likely reduce gas fired power generation. That means summer demand could be lower than last year and the storage surplus would rebound again. Today we review the current natural gas supply and demand situation.Here's the recent action via FinViz:

How Cold is Colder?

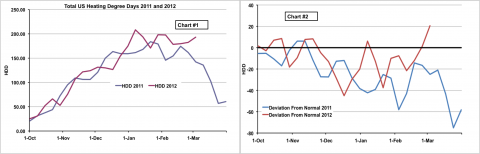

The winter of 2012/2013 has definitely been colder than the non-winter of 2011/2012. We can get a good idea of how cold the winter has been against prior years and against a 30 year normal by looking at population weighted Heating Degree Day (HDD) data from the National Oceanic and Atmospheric Administration (NOAA). We have previously discussed HDD data and gone through an example of the calculation for Cooling Degree Days (see Under the Weather – Cooling Degree Days). Recall that each HDD represents one degree Fahrenheit below 65. Chart #1 below on the left shows US HDD data for 2011 (blue line) and 2012 (red line).

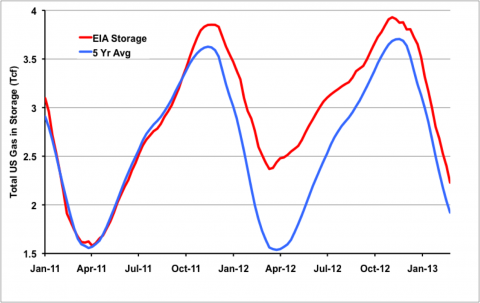

Source: NOAA Data from Morningstar (Click to Enlarge)The 2012 winter HDD (red line) tracked 2011 winter HDD (blue line) levels from October through December and then in January the 2012 HDD level increased above 2011 and has pretty much stayed higher since then. This is not entirely unexpected given that the winter of 2011/2012 was famously mild. Chart #2 on the right shows the HDD deviation from 30-year normal levels for this winter and last. You can see clearly that the 2011 winter (blue line) is consistently lower (indicating warmer) than normal (the black zero line is normal). The 2012 winter was relatively warm compared to the normal before the end of December but a cold spell in the second half of February has meant that this winter is likely to finish colder than usual. The colder weather has increased the demand for natural gas used in home heating – helping to reduce the storage surplus.That storage surplus started the year at record levels with a surplus 0.75 Trillion cubic feet (Tcf) above the 5 year average in March 2012 according to the Energy Information Administration (EIA). The storage surplus last year was caused by a combination of rapidly increasing shale gas production and limited demand during the non-winter of 2011/2012. The chart below shows EIA total US storage levels since January 2011. The actual storage level (red line) followed the 5 year average (blue line) through October 2011. Then the combination of a mild winter and increasing production led to a large storage surplus by the end of winter 2012. The surplus led to a natural gas price collapse to lower than $2/MMBtu values in April 2012. The storage surplus hung over the market for the remainder of 2012 and has only begun to recede since the start of this year. The current storage surplus over the 5 year average is 0.3 Tcf. Because last March was so warm just normal temperatures this month will see the surplus reduce because demand will be higher than 2011.

Source: EIA Data from Morningstar (Click to Enlarge)The recovery to something like a normal surplus and a few reassuring cold spells during January and February this year appear to have supported higher prices during the 2012/2013 winter. Since October 2012 prices have traded in a range between $3.25/MMBtu and $3.50/MMBtu except for a brief rally to $3.90/MMBtu in November. NYMEX Henry Hub natural gas futures settled at $3.529/MMBtu yesterday (Monday March 4, 2013). With the storage surplus looking set to reduce further by the end of March prices are unlikely to fall this April to the levels that we saw last year.Whatever happens to the weather this month the fate of natural gas prices this summer will have a lot to do with the levels of production. According to Bentek’s Cell Model production numbers, natural gas production reached a 2013 record on Feb 4th at 64.3 Bcf/d and has since fallen off to 64.1 Bcf/d....MORE