From an April '08 post, "Buy Tin":

That was the cryptic message from a reformed metals trader this afternoon. No rationale, no investment thesis, just "buy tin".The episode aired in January 1980 so at $.8580, zinc didn't do so hot (but actually better than gold, which hit $850 that same month). The reformed metals trader worked for one of the discrete, some might say secretive Swiss-based physical commodities traders.

I couldn't help thinking of the Barney Miller episode "Child Stealers".

Time traveler "Adam Boyer" comes back from 2057 and is hounded by Harris for stock tips:

[Harris, acting on a tip from a "twinkie" claiming to be a Sociology Professor from Columbia University who's traveled back in time from the year 2057 (played by the great character actor Richard Libertini), calls his broker to transfer his assets from gold bullion to the financial standard of the future--Zinc!!]:

"...no, no blue chips, either...I was thinking about Zinc! (pause) Yeah, Zinc! What's it goin for these days? (writing the figure on a notepad)...Thirty seven and a half cents---a POUND?? (The "Professor" gives Harris an encouraging nod)...Yeah, well, I might be willin' to spring for a coupla TONS!"...

He had up to $50 mil. discretion to buy Russian copper cathodes or aluminum or whatever, figure out the logistics, rail, shipping, bribe the right port authorities etc. Pretty much end-to-end, turnkey, whatever you wanted to call it.

So when he called, I listened. And started laughing. I couldn't get that damned Barney Miller scene out of my head....

From Kitco, the 1-year chart:

| 1 Year Zinc | ||

|

From Mineweb:

Platinum and Zinc imbalances and how to profit from it - Matthew O'Keefe

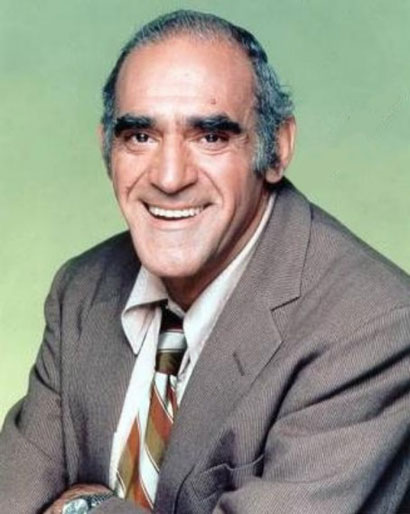

Market fundamentals are about to pop up some serious game changers in both the platinum and zinc space, making now the time to take a hard look at the state of supply. An interview with the Gold ReportFrom time to time we check in with "Abe Vigoda Watch":

The Gold Report -

The Gold Report: What is the current state of demand in the international zinc market?

Matthew O'Keefe: As a base metal, demand for zinc mirrors economic growth. When industrial growth is slow, demand for zinc is slow. The zinc supply is currently about 13.2 million tons (Mt) per year versus demand of about 13 Mt per year. Due to the current gap between supply and demand, inventories are high.

But things are going to change pretty dramatically during the next year or so. In Q1/13, the first of a number of large zinc mines is slated to close down.

TGR: Why?

MO'K: Zinc mines tend to be smaller than gold and copper mines with fewer very large producers. But early next year, the first of several large mines will close with production of about 275,000 tons (275 Kt) a year.

Later in the year, another large mine is scheduled to shut down. Along with a few smaller operations, the market will lose more than 0.5 Mt next year alone, which is a big chunk of production. That will start the trend of depleting zinc inventories. In 2014, more large mines will close. These are structural changes in the industry because there are no large operations to replace them. The global decline in inventory should perk-up the price of zinc.

TGR: Why are these mines scheduled to close?

MO'K: These mines are at the end of their lives. Zinc mines, like all mines, have finite life spans. But they also tend to be fairly discrete deposits compared to the large porphyry deposits that dominate the copper industry that can often be expanded to capture lower grades. But the issue is more one of timing as the closure of several large zinc properties is occurring close to the same time. Usually, closures are offset by the development of new mines, but there is only one new large producer starting up with about 90 Kt per year. That's less than half of what the larger mines are producing, highlighting the looming supply-demand imbalance.

TGR: With gold mines, as technology improves and the price of gold goes up, you can access tailings and basically re-mine the property.....MORE

I have no idea why this is in the bookmarks or why someone has a single page website devoted to Mr. Vigoda's mortal state. From Abe Vigoda.com:

Abe Vigoda is alive