From Investing Answers:

Be First to Invest in This High-Demand Commodity

Investors clamoring for an opportunity to invest in sand are in luck....MORE

With its recent IPO, U.S. Silica (NYSE: SLCA) became the first publicly traded pure play industrial sand producer....

...As a result, sand demand is increasing because it's a key component in the fracking process. Frac sand demand has increased at a rate of 28% a year since 2004 and it's expected to increase 15% a year over the next three years.

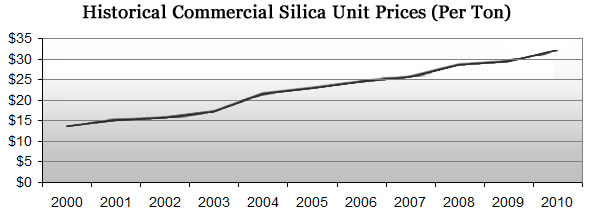

Sand's newly discovered role in energy exploration is creating a supply squeeze. This explains the rising price of silica sand over the past several years.

Soaring prices are prompting some degree of vertical integration in the energy sector. EOG Resources (NYSE: EOG) bit the bullet and bought a frac sand company. Pioneer Natural Resources (NYSE: PXD) did the same; shelling out nearly $300 million for Carmeuse Industrial Sands....

The stock, at $21.16 is up a nickel today and 24.47% from the IPO and after the company reported record Q4 and yearly earnings (that's a 111-year record) Dahlman Rose raised their price target from $25 to $27.

Jeffries initiated with a Buy and BAC/Merrill initiated with a Buy and $25 PT on Mar. 23.

Oh yeah, Morgan Stanley raised their earnings estimate and have an overweight on the stock with a $28.00 target.

(MS; JEF and BAC were joint bookrunners on the offering, Dahlman was below the bulge)

What the frack?

Sand trades at a premium?

We have four fracking IPO's on our watch list and were going to patiently wait for the 180 days to pass, thinking that, what with the slowdown in gas drilling that we'd get a chance to swoop-n-scoop.

So much for that idea, it looks like the sand is going to the oil drillers instead.