Abstract:We've had a few posts* on Keynes at the market and came to the conclusion that Keynes traded on the knowledge of Great Britain's abandonment of the Gold Standard in September 1931.

Keynes made a major contribution to the development of professional asset management. Combining archival research with modern investment analysis, we evaluate John Maynard Keynes’s investment philosophy, strategies, and trading record, principally in the context of the King’s College, Cambridge endowment. His portfolios were idiosyncratic and his approach unconventional. He was a leader among institutional investors in making a substantial allocation to the new asset class, equities. Furthermore, we decipher a radical change in Keynes’s approach to investment which was to the considerable benefit of subsequent performance. Overall, Keynes’s experiences in managing the endowment remain of great relevance to investors today.

In his Weekend WSJ column, "Keynes: One Mean Money Manager" and this morning's blog post "Keys to Thinking About Keynes" the Journal's Jason Zweig isn't buying it. Here's the WSJ's Total Return blog putting it bluntly:

My column this past weekend about the remarkable investing record of John Maynard Keynes provoked an outpouring of comments...

...Thus, several commenters ridiculed the notion that Keynes could have had access to inside information on interest rates and currency values without trading on it. Others insisted that he was front-running his own economic policies, buying gold before he debauched the value of the British pound.

But, to paraphrase Keynes’s friend Bertrand Russell, it’s important to distinguish what you wish were true from what you believe is true.Here's Dimson/Chambers on the question, page 29 of the paper:

You may wish that Keynes traded on privileged information, but that doesn’t make it true. There is zero evidence that he ever traded on inside information; furthermore, as my column pointed out, Keynes’s investing performance improved when he stopped relying on his own macroeconomic forecasts....

...Was Keynes an insider? One difficulty in answering this question is that the investment community then did not have the same view of insider trading that we have today. Other than directors who owed fiduciary duties to their company not to trade on price-sensitive information, insider trading by investors in general was not subject to regulation until 1980 in the UK (Cheffins, 2008: 39–40).*Previously:

It is certain that Keynes was in receipt of what today would be deemed price-sensitive information – he was, for example, aware of a change in the UK bank rate before it occurred in 1925 (Mini, 1995). However, it is impossible to discover how frequently and the extent to which he exploited such information in his trading. What we can say is that he would most certainly have regarded the exploitation of inside information as substantiating the view of stock trading as a “low pursuit” rather than a “game of skill” (CWK XII, 109)....

March 2009

Keynes The Money Manager

August 2009

John Maynard Keynes: Money Manager (Couldn't Trade Lard to Save His Life)

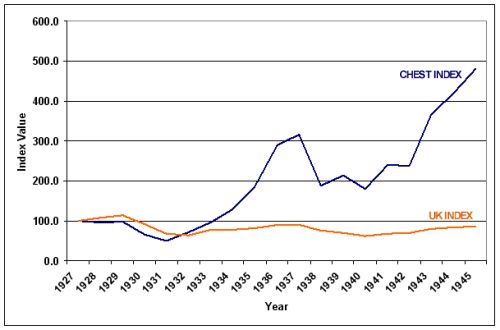

...In a 1983 paper "J.M. Keynes' Investment Performance: A Note" the authors are dubious of his performance, without casting the aspersion that I do in my comment. They on the other hand have a great tidbit:Chest Fund Performance 1927 to 1946

...Investments in commodities were more substantial. The highest annual gain was for ₤17,000 from September 1936 to August 1937 and the highest annual loss, mainly in lard, for ₤12,600 in the following twelve months...We too have commented on the lard market, in the March '08 post "Volatility Getting You Down, Bunky?":

Maybe it's time you looked into the tallow market.

The tallow/grease/lard complex has been traded for five thousand years:...