From Six Figure Investing:

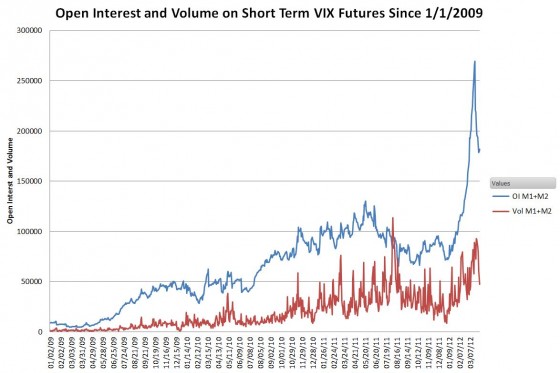

The VIX Futures market has been on a bit of a tear—driven by inflows into volatility ETFs like Barclays’ VXX, VelocityShares’ XIV and TVIX, and ProShares’ UVXY. The chart below shows the resultant growth in the short term futures open interest and volume.

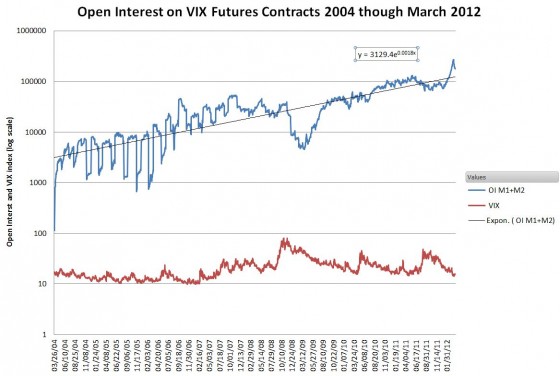

The data doesn’t look as dramatic if we change the vertical axis to a logarithmic scale—a scale that makes it easier to see if the rate of growth is changing. The chart below shows the short term VIX futures growth in open interest from the beginning of trading in 2004 compared to the VIX index.

The open interest has doubled pretty consistently every year and a half since inception, and doesn’t show any signs of slowing down. In the early years institutions drove growth, but the current growth in VIX futures is dominated by the volatility ETFs. The largest, Barclays’ VXX with $1.8 billion in assets under management, only needs to grow another 15% to become one of the top 100 biggest ETFs.

What will happen as the demand for volatility increases?

When demand for a physical commodity like gold increases the price goes up. The increased price helps satisfy that demand in two ways: current owners sell their holding to take their profits, and producers are motivated to obtain/make more of it. If the price increases enough previously uneconomic sources (e.g., lower grade ores) might become profitable. On the other hand, increased production might strain the ability of suppliers to provide required materials and create supply disruptions and price increases in other areas.

Even though volatility can’t be eaten, alloyed, burned, or worn the same thing happens when demand goes up. The price increases, some holders sell, and producers (futures market makers in this case) make more of it. In some cases historic price relationships might start changing....MORE