See also his post: "The difference between 2009-2010 & 2002-2003":Whether or not the Federal Reserve has the ability or willingness to plug in deleveraging-induced black holes in the financial sector’s balance sheets with printed money is a foregone conclusion at this point. But the real question is whether or not this is priced in. Or rather, whether or not current asset marks are a reflection of that perception of permanent backstopping.

As we enter 2010, the 30yr Tsy bond yields more than 4.5%, the 2s30s curve is at 367bps (up 55% YoY and at thirty-year wides), the United States public debt has surpassed 94% of GDP, and 13% of tax revenues are for servicing debt interest alone. Roll risk is clearly a significant issue at the Treasury, as diminishing tax receipts and weakened foreign reserves drastically damage potential capital inflows, exacerbating decades of fiscal imbalances.

The basis to the structural global imbalances is the American consumer. With freely available credit (thanks to the Federal Reserve) and inflating asset values producing a “wealth effect,” the American consumer levers up household balance sheets by debt-financed consumption. As emerging economies enter international capital and labor markets, American consumption shifts to goods produced for low costs in these emerging economies. This capital flows from the United States to trade surplus nations’ reserves. The emerging economies invest these reserves in dollars and dollar-denominated debt, as the dollar is the most liquid and international reserve currency in the world (with most commodities priced in the currency) and supporting the United States is vital to their exports, their main engine of growth.

However, without the American consumer, these creditor nations are forced to make a secular policy shift and domesticize growth. This implies reserve diversification and lack of net demand for Treasury securities (and possibly a shift to net supply offered). Though the global liquidity & reserve status of the dollar and political & economic leverage held by the United States prevent an all-out creditor nation hyperinflationary exodus from the USD and spiking Tsy yields, a disappearing American consumer prevents creditor nations from continuing the status quo of sovereign consumption financed by foreign capital inflows. Especially when deficit spending is skyrocketing, monetary supply and debts are surging, and both foreign inflows and domestic tax receipts are dwindling.

And the American consumer has hit the debt wall and can no longer lever up to capacitate further foreign capital inflows into Tsys, after experiencing two asset crashes within a decade. The most recent consumer credit figure, a $17.5 decline reported for November 2009, is the largest recorded and represents an 18.5% annualized dropoff in revolving consumer credit. Household deleveraging has come and is here to stay, especially with the spiking unemployment rate.

With the foundation to the creditor nation-financed suppression of bond yields suddenly gone, the Treasury has to look elsewhere for demand, especially down the curve. Thus far it has found a suitable substitute in the Federal Reserve, but monetization causes a bearish reflexive response in the Tsy market, as investors offer supply because of inflationary concerns. Indeed, since Bernanke announced the QE program back in March 2009, the 30yr yield has risen 753bps, or 20%, dramatically increasing funding costs.

Because of the roll risk and the ever-shortening average duration of marketable Tsys, Bernanke’s Fed cannot print money and inject liquidity into perpetuity, ceteris paribus....MORE

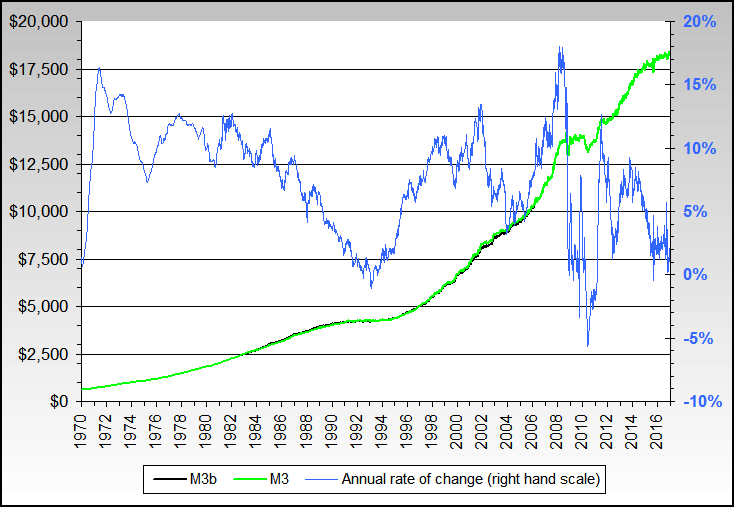

Two charts, both courtesy of Now and Futures, sufficiently explain why today’s deflationary deleveraging gorilla (tomorrow’s inflationary sovereign debt crisis) is of a different nature and magnitude than the post-dotcom crash environment, which was easily reflated by Greenspan for a 5-year bull.

Without money velocity (which is suppressed by the Fed’s incentivized sequestering of bailout/stimulus liquidity as “excess reserves”), injected liquidity does not reach the lending & spending level, and valuations signify future cash flow that never manifests. Notice the lack of any stabilization at all in the M3 aggregate, even since March 2009 lows in equities....MORE