A second repost, this and the piece that follows it may be important.

We posted this piece

a month ago and today's events make it seem more prescient than the day we first linked.

Although we don't agree with all of the interpretations, especially

those in the introduction, the observations are pretty sharp and give us

a guide to what we should watch out for.

A couple notes on

nomenclature: 1) the fact the U.S. Federal Reserve Bank will soon begin

'tapering' does not mean that their purchases of treasuries and agency

debt have stopped. It is only decreasing. QE lives!

2) On the

fiscal side of things, every dollar spent in excess of tax revenue is

stimulus. It doesn't have to be called stimulus, you can call it, as we did in 2012 when referring to 2010's Recovery Summer: "Sweet, Sweet Biden Love." Remember that? President Obama put Joe in charge. Call it Democracy's Flaw, or whatever you want, every dollar of deficit spending is still stimulus. And it is working less and less well.

Just making sure we are all on the same page with the words because, as noted in the seminal work "De Do Do Do, De Da Da Da":

Poets, priests and politicians

Have words to thank for their positions

Words that scream for your submission

And no one's jamming their transmission

'Cos when their eloquence escapes you

Their logic ties you up and rapes you

De do do do, de da da da....

From The Philosophical Salon, October 18:

Sheep spend their entire lives being afraid of the wolf, but end up eaten by the shepherd.

(Popular proverb)

By now it should be clear that COVID-19 is, essentially, a symptom of

financial capital running amok. More broadly, it is a symptom of a

world that is no longer able to reproduce itself by profiting from human

labour, thus relying on a compensatory logic of perpetual monetary doping.

While the structural shrinking of the work-based economy inflates the

financial sector, the latter’s volatility can only be contained through

global emergencies, mass propaganda, and tyranny by biosecurity. How can

we break out of this vicious cycle?

Since the third industrial revolution (microelectronics in the

1980s), automated capitalism has been engaged in abolishing wage labour

as its own substance. We have now passed the point of no return. Due to

escalating technological advance, capital is increasingly impotent

vis-a-vis its mission of squeezing surplus-value out of labour-power.

With the unleashing of artificial intelligence this truly becomes

mission impossible – game over.

This means that the foundations of our world no longer reside in the

socially necessary labour contained in commodities such as cars,

telephones, or toothpaste. Rather, they reside in highly flammable

debt-leveraged speculations on financial assets like stocks, bonds,

futures, and especially derivatives, whose value is securitised

indefinitely. Only the religious belief that the mass of these assets

produces value prevents us from seeing the yawning abyss beneath our

feet. And when our faith dwindles, divine providence intervenes by

sending us into collective hypnosis through apocalyptic tales of

contagion and attendant narratives of salvation....

....Pandexit In the Land of Unicorns

How close are we to Pandexit? The following excerpt from a recent Bloomberg

piece has the most likely answer: “For anyone hoping to see light at

the end of the Covid-19 tunnel over the next three to six months,

scientists have some bad news: brace for more of what we’ve already been

through.” To unpack this statement, let us surmise that our future is

characterised by the following events: 1. Central banks will continue to

create inordinate amounts of money, mostly destined to inflate

financial markets; 2. The contagion narrative (or similar) will continue

to hypnotise entire populations, at least until Digital Health

Passports are fully rolled out; 3. Liberal democracies will be

dismantled, and eventually replaced by regimes based on a digitised

panopticon, a Metaverse of control technologies legitimised by deafening

emergency noise.

Too dark? Not if we consider how the health crisis rollercoaster

(lockdowns followed by partial openings alternating with new closures

caused by mini-waves) looks increasingly like a global role-play, where

actors pass the buck to make sure the emergency ghost continues to

circulate, albeit in a weakened capacity. The reason for this depressive

scenario is simple: without Virus justifying monetary stimulus, the

debt-leveraged financial sector would collapse overnight. At the same

time, however, rising inflation coupled with supply-chain bottlenecks

(especially microchips) threatens a devastating recession.

This catch-22 appears impossible to overcome, which is why the elites

cannot let go of the emergency narrative. From their perspective, the

only way out would seem to imply the controlled demolition of

the real economy and its liberal infrastructure, while financial assets

continue to be artificially inflated. The latter comprises cynical

tricks of financial greenwashing such as investment in ESG securities,

an environmentally disguised loophole to legitimise further debt

expansion. With all due respect to the Greta Thunbergs in our midst,

this has nothing to do with saving the planet.

Rather, we are witnessing the accelerating dissolution of liberal

capitalism, which is now obsolete. The outlook is objectively

depressing. Global financial and geopolitical interests will be secured

by mass data harvesting, blockchain ledgers, and slavery by digital app

peddled as empowering innovation. At the heart of our predicament lies

the ruthless evolutionary logic of a socioeconomic system that, to

survive, is ready to sacrifice its democratic framework and embrace a

monetary regime supported by corporate-owned science & technology,

media propaganda, and disaster narratives accompanied by nauseating

pseudo-humanitarian philanthro-capitalism.

By appealing to our personal sense of guilt for ‘destroying the

planet’, the coming climate lockdowns are the ideal continuation of

Covid restrictions. If Virus was the scary appetiser, a generous portion

of carbon-footprint-mixed-with-energy-scarcity ideology is already

being served as main meal. One by one we are being persuaded that our

negative impact on the planet deserves to be punished. First terrified

and regimented by Virus and now shamed for harming Mother Earth, we have

already internalised the environmental command: our natural right to

live must be earned through compliance with ecological diktats imposed

by the International Monetary Fund or the World Bank, and ratified by

technocratic governments with their police. This is capitalist realism

at its most cynical.

The introduction of Digital Health Passports (only a year ago

ridiculed as conspiracy theory!) represents a critical juncture. The

tagging of the masses is crucial if the elites are to gain our trust in

an increasingly centralised power structure sold as an opportunity for

emancipation. After crossing the digital-ID Rubicon, the crackdown is

likely to continue smoothly and gradually, as in Noam Chomsky’s famous

anecdote: if we throw a frog into a pot of boiling water, it will

immediately come out with a prodigious leap; if, on the other hand, we

immerse it in lukewarm water and slowly raise the temperature, the frog

will not notice anything, even enjoying it; until, weakened and unable

to react, it will end up boiled to death.

The above prediction, however, needs to be contextualised within a

conflictual and deeply uncertain scenario. Firstly, there is now

evidence (however heavily censored) of genuine popular resistance to the

pandemic psy-op and the Great Reset more widely. Secondly, the elites

appear deadlocked and therefore confused as to how to proceed, as

demonstrated by several countries opting to de-escalate the health

emergency. It is worth reiterating that the conundrum is, fundamentally,

of economic nature: how to manage extreme financial volatility while

holding on to capitals and privileges. The global financial system is a

huge Ponzi scheme. If those who run it were to lose control of liquidity

creation, the ensuing explosion would nuke the entire socio-economic

fabric below. Simultaneously, a recession would deprive politicians of

any credibility. This is why the elites’ only viable plan would seem to

lie in synchronizing the controlled demolition of the economy (collapse

of global supply-chain resulting in an ‘everything shortage’), with the rolling out of a global digital infrastructure for technocratic takeover. Timing is of the essence.

Emergency addiction

With regard to a potential recession, financial analyst Mauro Bottarelli

summarised the communicating-vessels logic of the pand-economy as

follows: “a state of semi-permanent health emergency is preferable to a

vertical market crash that would turn the memory of 2008 into a walk in

the park.” As I tried to reconstruct in a recent article, the ‘pandemic’ was a lifeboat launched to a drowning economy. Strictly speaking, it is a monetary event

aimed at prolonging the lifespan of our finance-driven and terminally

ill mode of production. With the help of Virus, capitalism attempts to

reproduce itself by simulating conditions that are no longer available.

Here is a summary of Covid’s economic rationale. The September 2019

bailout of the financial sector – which, after eleven blissful years of

Quantitative Easing, was again on the verge of a nervous breakdown –

involved an unprecedented expansion of monetary stimulus: the

creation of trillions of dollars with the magic wand of the Federal

Reserve. The injection of this inordinate amount of money into Wall

Street was only possible by turning the engine of Main Street off.

From the point of view of the short-sighted capitalist mole, there was

no alternative. Computer money created as digital bytes cannot be

allowed to cascade onto economic cycles on the ground, as this would

cause an inflationary tsunami à la Weimar 1920s (which ushered in the

Third Reich), only much more catastrophic for a stagnant and globally interconnected economy.

Inevitably, the (cautious) reopening of credit-based transactions in

the real economy has caused inflation to rise, hence further

impoverishment on the ground. The purchasing power of salaries has been

dented, along with revenues and savings. It is worth recalling that

commercial banks are positioned at the interface between the magical

world of Central Banks digital money, and the emergency-swept wasteland

inhabited by most mortals. Thus, any wild expansion of Central Bank

reserves (money created out of thin air) triggers price inflation as

soon as commercial banks leak cash (i.e. debt) into society.

The purpose of the ‘pandemic’ was to accelerate the pre-existing

macrotrend of monetary expansion, while postponing inflationary damage.

Following the Federal Reserve, the world’s central bankers have created

oceans of liquidity, thus devaluing their currencies to the detriment of

populations. While this continues, the transnational turbo-capital of

the elites keeps expanding in the financial orbit, absorbing those small

and medium size businesses it has depressed and destroyed. In other

words, there is no such thing as a free lunch (for us). The Central

Bank’s money-printer works only for the 0.0001% – with the help of

Virus, or a global threat of equal traction.

At present, it looks as if central bankers are indulging in the noble

art of procrastination. The Fed’s board will convene again in early

November 2021, with taper (reduction of monetary stimulus) announced to

start in December. However, with the Covid bubble deflating, how will

the elites deal with zero interest rates and direct deficit financing?

In more explicit terms: what new ‘contingent event’ or ‘divine

intervention’ will get them out of trouble? Will it be aliens? A

cyber-terrorist attack on the banking system? A tsunami in the Atlantic?

War games in Southeast Asia? A new War on Terror? The shopping list is

long.

In the meantime, ordinary people are caught in a suffocating double

bind. If credit needs to be made available to businesses, Central Banks

must keep a lid on inflation, which they can do only… by draining

credit! Runaway inflation can be avoided only by containing the

disruptive effects of excessive money creation; that is, by bringing work-based societies to their knees.

Most of us end up squashed between price inflation of essential goods,

and deflationary liquidity drainage via loss of income and erosion of

savings. And in a stagnant economy with inflation off the chart, each

suppressed business transaction is channeled into financial assets.

A tool preventing liquidity from reaching the real economy is the

Federal Reserve’s Overnight Reverse Repo facility (RRP). While

continuing to flood financial markets with freshly printed money, thanks

to reverse repos the Fed mops up any excess of that very cash it pumps

into Wall Street. Effectively, a zero-sum game of give and take: at

night, financial operators deposit their excess liquidity with the

Federal Reserve, which delivers as collateral the same Treasuries and

Mortgage-Backed Securities it drains from the market during the day as

part of its QE purchases. In August 2021, the Fed’s usage of RRP topped $1 trillion, which led the Federal Open Market Committee (FOMC) to double the RRP limit to $160 billion, starting from 23 September 2021.

Here, then, is the elephant in the room: how will the Fed’s taper

square with reverse repos of this astronomical magnitude? Is the

much-anticipated reduction of monetary stimulus even possible

with a global financial bubble fuelled by zero-interest-rate leveraging

and structural borrowing? But, at the same time, how can central bankers

continue to expand their balance sheet, when the double whammy of

stagnation and rising inflation (stagflation) is just around the corner?....

....MUCH MORE

A topic near and dear to our jaded hearts.

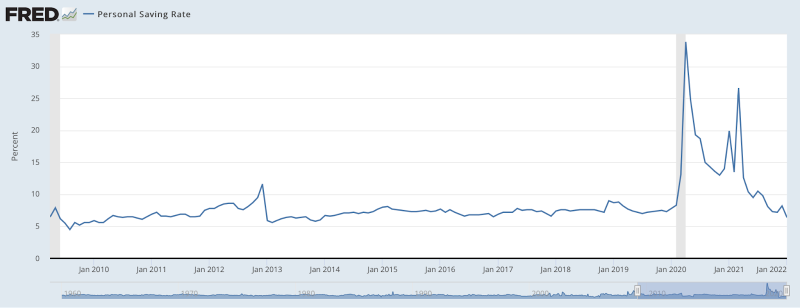

This is a real

problem, whether you call it "Marginal Productivity of Debt" or "Debt

Saturation" or "Bang-for-the-Buck", we are running faster and faster

just to stay in place. This is not a new phenomena, the piddly 6.5% GDP

growth we just saw, despite the trillions and trillions in new debt is

just the latest example.....

Previously from The Philosophical Salon:

Money, Money, Money: "A Self-Fulfilling Prophecy: Systemic Collapse and Pandemic Simulation"