Possible band name? Contact the writer for licensing info.

From Michael Green (you may know him as https://x.com/profplum99) at his Yes I give a fig substack, January 18:

Why Wall Street is Long the Wrong Singularity

My apologies for the one week gap. Occasionally, the attic receives an inflow of new information that requires additional reorganizing. And this is why I love writing on Substack. In response to my scarcity posts, I received a research package from Hudson Bay Capital that perfectly crystallizes the “Optimism” narrative currently sweeping Wall Street. The papers, titled “Tech Trumps Tariffs” (Nouriel Roubini) and “No, Stocks Aren’t in a Valuation Bubble” (Jason Cuttler), are sophisticated, compelling, and arguably the most dangerous documents I have read this year. Please read them.

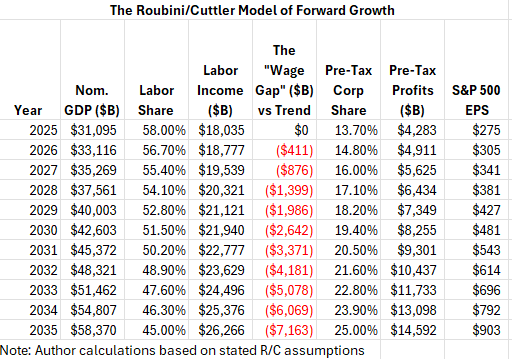

Their argument is the highest-conviction version of the “Soft Landing” consensus. They posit that we are on the precipice of a “positive supply shock” driven by AI that will raise US potential GDP growth to 4%, crush inflation, and justify an S&P 500 target of 9,000. Their thesis is elegant: Technology (AI) enables us to dematerialize growth, rendering physical constraints such as labor shortages and tariffs irrelevant.

It is a beautiful theory. Unfortunately, it violates the laws of physics — specifically, the physics of our infrastructure networks. And, as the latest research from Jones and Tonetti identifies, it violates the “laws” of economics. Using their projections, it also assumes a catastrophic path for wages vs capital that will not be tolerated:

Fortunately, it will not come to pass. The Hudson Bay thesis rests on a fatal accounting error. It assumes that Machine Labor is infrastructurally equivalent to Human Labor. It assumes that replacing a worker with an AI agent is a 1:1 swap in the economic ledger.

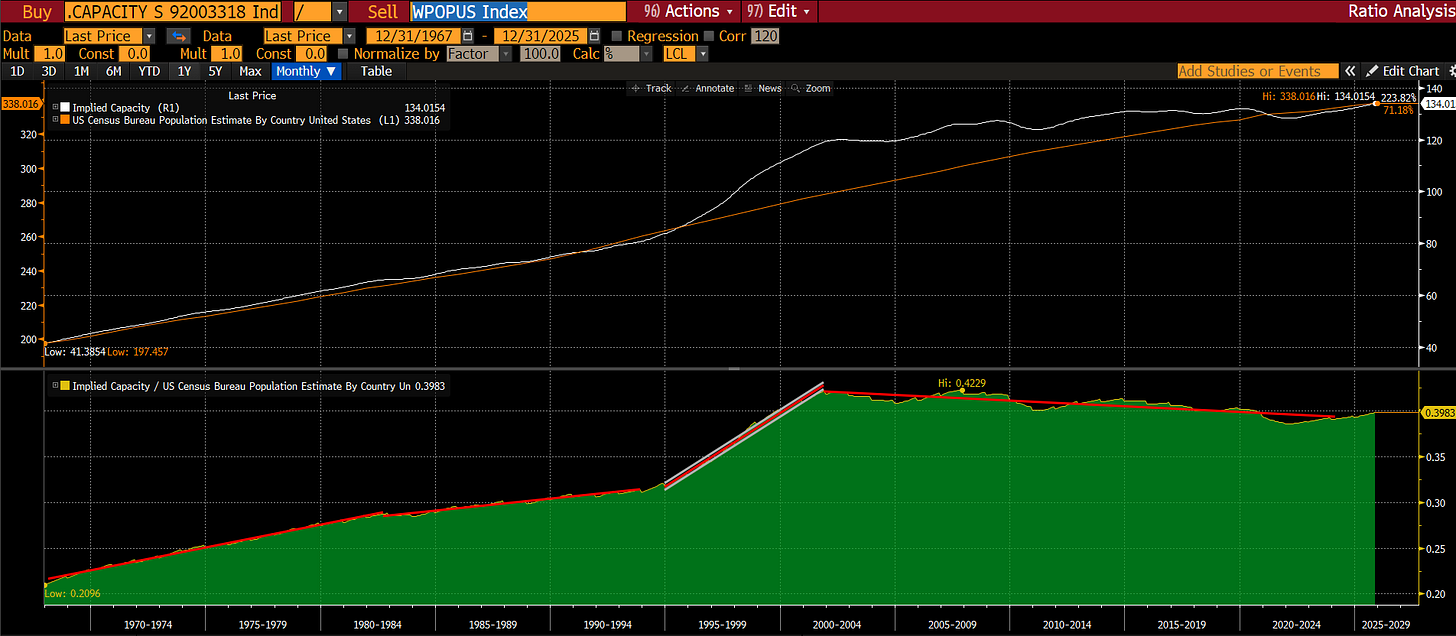

It is not. Per-capita productivity equals throughput divided by population only if capital scales at least proportionally with the population. Wall Street assumes the numerator (throughput) scales infinitely, while ignoring that the denominator (capital stock) is physically capped. This isn’t a Malthusian tale of inevitable collapse—I’m not predicting an endpoint where growth hits zero forever. It’s about the path: the short-run thermodynamic penalties and ergodicity errors that Wall Street’s linear models miss, turning a ‘productivity boom’ into a margin call unless we adapt.

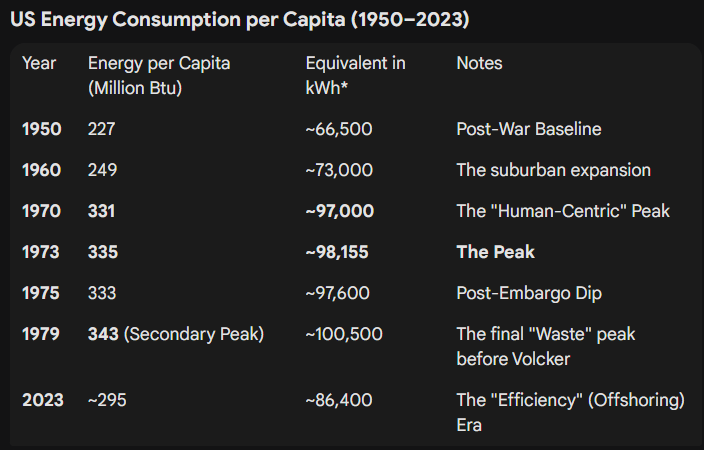

I spent the last week auditing the energy books, and the results are stark. We are not facing a “Productivity Boom”; we are facing a “Thermodynamic Margin Call”. The transition from a human-led economy to a machine-led economy carries a specific topology penalty that Wall Street’s linear models are missing.

This is the Growth Wedge. And it implies that the “Cost of Capital” isn’t going back to zero—it’s going to track the cost of rebuilding the entire US energy grid from scratch.

The Optimist’s Delusion

To understand why the consensus is wrong, we must first steelman their argument. Hudson Bay posits that US exceptionalism is strengthening. They argue that the productivity gains from AI (estimated at 0.5–1.5% annually) will outweigh the stagflationary drag of protectionism.

In their model, AI acts as a deflationary force. By substituting capital (software/compute) for labor, we lower unit costs and expand margins. This justifies a “Sentiment Spread”—a premium valuation multiple—similar to the 1985-2001 period.

The mistake in the AI-optimist model is treating machine substitution as “Hicks-neutral” (a technological change that doesn’t alter the ratio of capital to labor). In reality, this transition is energy-biased and capital-deepening.

The Ergodicity Error

More fundamentally, the AI-optimist model commits an ergodicity error: it confuses the ensemble average with the time average.

Wall Street implicitly assumes that because capital can flow and equilibrate in the long run, it will do so smoothly over the short run. But we do not live in an ensemble of possible economies. We live in a single, path-dependent timeline.

If the copper wires, transformers, and gas turbines cannot be built fast enough to support the AI load in 2027, the system breaks long before it ever reaches the hypothetical 2035 equilibrium.

They see “The Cloud” as a place where value scales infinitely with near-zero friction. But “The Cloud” is not a place. It is a physical infrastructure of aluminum, copper, and megawatts. And unlike the software boom of the 1990s, which ran on the “stranded capacity” of office buildings and efficiency gains from the death of the incandescent bulb, this new boom requires Net New Industrial Capacity (a replay of the DotCom fiber buildout).

Revisionist History: The Decoupling of Throughput

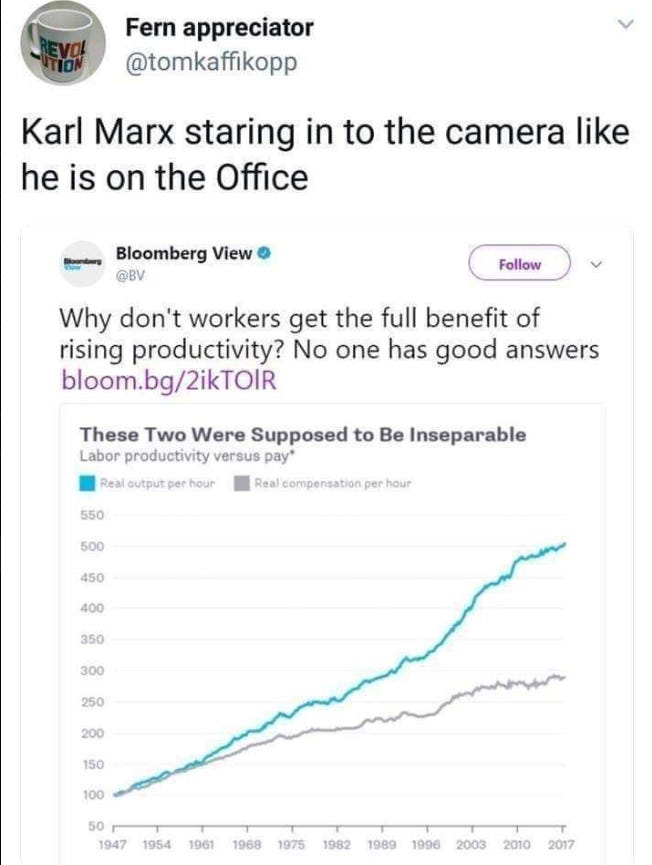

To understand the trap we are in, we have to rewrite the history of the last 50 years. Standard economics holds that the divergence between Productivity and Wages that began in 1973 was a policy failure or the result of corporate greed, the loss of unions, etc.

Institutions and policy certainly shaped how this divergence manifested, but it became unavoidable once throughput migrated from human bodies to owned infrastructure.

Some economists argue that this divergence is a statistical illusion—that if you adjust for inflation correctly (using output prices instead of consumer prices) and include non-wage benefits, pay actually kept up with productivity.

They are missing the point (unsurprisingly). The divergence isn’t a measurement error; it is a Topology Shift.

As the chart above illustrates, Labor and Productivity marched in lockstep for the first half of the 20th century. Why? Because the economy ran on Liquid Fuels and Human Labor. To burn more oil, you needed more men to drive the trucks, man the rigs, and work the assembly lines. Labor controlled the throughput and hence negotiated its proportionate share. In the areas of the economy where this remained true, as the linked paper demonstrates, wages largely tracked productivity:

In 1973, we hit the Thermodynamic Wall. We couldn’t just add more men to burn more oil. We switched to the “Cheat Code” (Offshoring) and began the slow transition to the “Electro-Capital” grid....

....MUCH MORE