"The world's" may be a bit of hyperbole but combined with what China will have to do to achieve the 5% growth figure that was reaffirmed yesterday, we are looking at potentially maybe $2 trillion in deficit spending over the next six years between the two economies and though not enough to offset the shrinkage of the U.S. deficit—which shrinkage must happen to delay slow-motion but inevitable worldwide disaster—it looks like the global party could continue until sunrise and/or 2030.

The fact much of the German deficit spending will go toward armaments is all the better—it is the most inflationary bang-for-the-buck, so to speak, spending a government can do; you make stuff, you blow it up, you make more stuff. It may not add to a country's real national wealth but boy-oh-boy does it boost nominal GDP growth.

This is a really big deal. If you don't believe me, believe the German bond market.

From ZeroHedge, March 5:

Bond Vigilantes Blow Up German Bond Market After "Whatever It Takes" Fiscal Package

As we detailed earlier, last night saw Germany announce plans for one of its largest fiscal regime shifts in post-war history.

The leaders of CDU/CSU and SPD this evening announced an agreement on an even more significant fiscal expansion than what anyone had expected at the beginning of the week. The plan is to make three material changes to the debt brake in the very near term, convening the outgoing parliament in which the centrist parties still hold a constitutional majority:

A EUR 500bn (11.6% of GDP in 2024) special purpose off-budget vehicle for infrastructure investment, that is planned to be disbursed over the next 10 years, and which amounts to roughly 1% of GDP in annual infrastructure spending (of which EUR 100bn will be allocated to the federal states).

A reform of the debt brake to exempt any defense spending in the main budget’s "Einzelplan 14", the budget of the Ministry of Defence, over and above 1% of GDP, effectively permitting open-ended borrowing for defense. Currently the Einzelplan 14 amounts to EUR 53.25bn (1.25% of nominal GDP in 2024). The current off-budget fund adds another EUR 25bn of defence funding but this would not be relevant for this part of the proposal. Thus apart from removing any constitutional limit on additional defence spending, 0.25% of GDP (EUR 11bn) of spending in Einzelplan 14 that surpasses the 1% threshold is freed up to fund other measures, for example tax reductions.

An increase in the structural deficit allowed for the states (Länder) from the current level of 0.0% of GDP to 0.35%, the same proportion as the federal level. Furthermore the proposal includes the formation of an expert commission tasked with creating a long-term reform proposal to structurally reform the debt brake by the end of 2025. This would have to be passed by the newly elected 21st Bundestag. It remains unclear if this reform proposal would supersede the announced measures to be passed in the 20th Bundestag or would add to them.

All elements require a two-thirds constitutional supermajority. The parties want to pass the agreed measures with the old 20th Bundestag parliament, before the newly elected 21st Bundestag (where the AfD has a potential blocking minority) is convened on March 25.

In keeping with recycled European aphorisms, party leaders, especially the Conservatives, explicitly referred to this decision as a "whatever it takes" moment and a determination to "rearm completely". According to DB's reading, tonight's robust rhetoric implies that the open-ended borrowing room for defense will be used at a pace that could bring German defence spending to at least 3% perhaps as early as next year (although the exact target may only be defined after the NATO summit in June).

Assuming it goes through, Deutsche Bank's Jim Reid warns that everything you thought you knew about Germany's economic prospects 3 months ago, or even 3 weeks ago, should be ripped up and you should start your analysis from fresh.

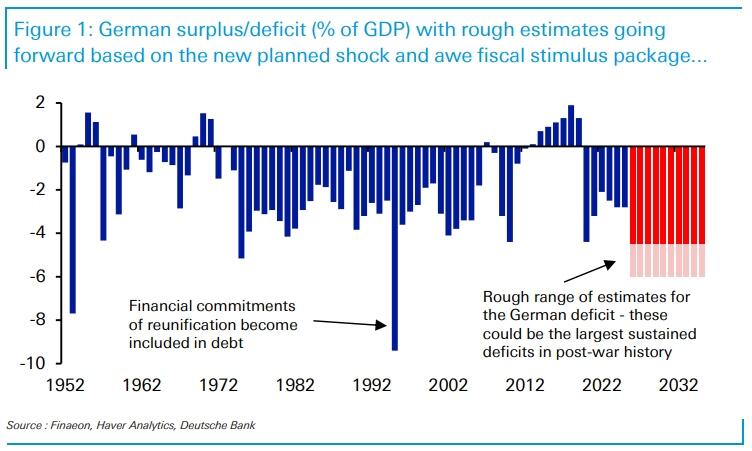

Today’s CoTD simply looks at Germany’s fiscal deficit through time and assumes an extra 3% deficit phased in over the next decade from current levels.

This is incredibly back of the envelope, but puts the planned move in some historical perspective.

Of course, if growth rebounds then this may reduce the deficit so there are a lot of moving parts. However, this could easily be a sustained fiscal stimulus unparalleled in Germany’s history. Germany will still likely have the lowest debt/GDP in the G7 as far as the eye can see.

We estimated that Germany could spend around $1.6tn before its debt/GDP equalled the second lowest (the US) in the G7.

This package has the potential to be in the magnitude of around $1tn over time and the US won’t stand still in terms of its debt over this period.

If you want a bit of fun, Germany could spend $8.5tn before its debt/GDP equalled Japan’s!

So don’t underestimate how important this news is. Your portfolio over time will thank you for it.

Indeed it will, if you were long bunds as zee bond vigilantes just sent Bund yields higher by over 24bps...

...the biggest yield jump in history for the German bond market...

....MUCH MORE

Also at ZH this morning:Futures Rise On Hope For Trade War Relief, Europe Soars, Bunds Crash On "Whatever It Takes" StimulusIn equities, Germany's DAX index is up 3 1/2% today.