Or maybe you will want to miss it, your call.

From Energy Bad Boys, March 15:

We read it so you don't have to

On March 4th, JP Morgan Chase released its 15th Annual Energy Paper. The report, written by Michael Cembalest, is a 55-page analysis with hundreds of graphs and charts on the state of the energy industry.

It spans most aspects of the energy industry, discussing costs for wind and solar, conventional fuels, electrification and heat pump adoption, a status update on the deindustrialization of Europe, and the use of green hydrogen.

Here are the nine takeaways we found most interesting from the study, hereafter referred to as the JPMC report.

1. Wind and Solar Prices Continue to Rise

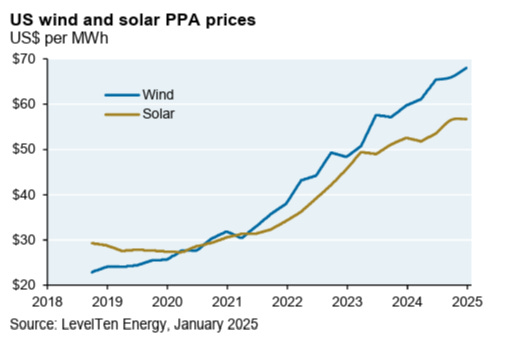

Remember when we were told that wind and solar would always get cheaper? Well, that hasn’t been the case since 2018 for wind or 2020 for solar. According to the JP Morgan Chase Report, power purchase agreement (PPAs) prices for wind have more than doubled since 2019, and solar PPAs are near $60 per megawatt hour.

Prices are rising due to US tariffs on Chinese solar panels, a tripling of insurance premiums in MISO, ERCOT, and SPP due to weather events, supply/demand gaps due to permitting delays, higher interest rates, and increased corporate demand for green power. Keep in mind that PPAs almost always show the subsidized cost of an energy source, so in reality, the cost of these resources is even higher.

As we have written about before, these rising price trends are a key reason why we believe the use of the National Renewable Energy Laboratory’s (NREL) Annual Technology Baseline in energy modeling amounts to utilities and “renewable” special interest groups fudging their numbers to justify massive capital spends on wind, solar, and battery storage technologies.

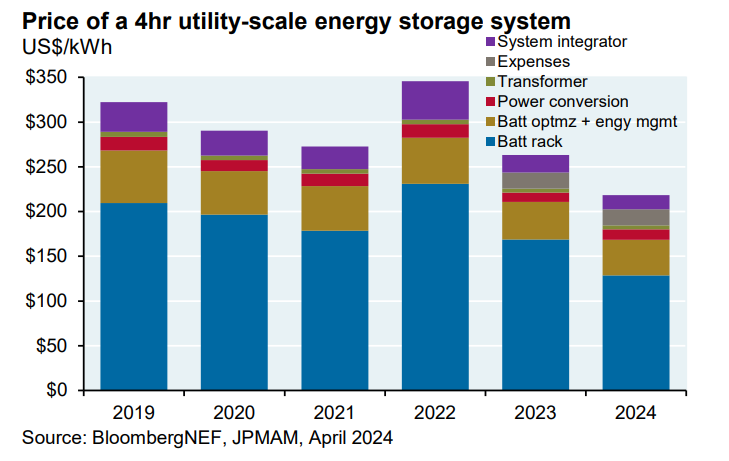

2. Battery Costs Are Coming Back Down

Battery storage prices are falling again after a price spike in 2022. According to Energy Storage News, the main drivers of the fall are cell manufacturing overcapacity, economies of scale, low metal and component prices, a slowdown in the EV market, and increased adoption of lithium iron phosphate (LFP) batteries, which are cheaper than nickel manganese cobalt (NMC) batteries.

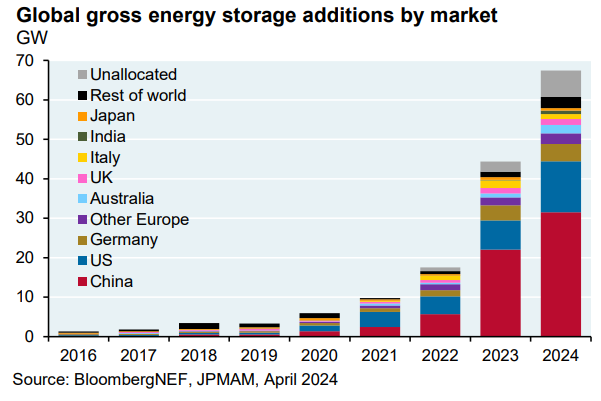

In other battery news, global storage capacity is growing quickly, with the vast majority of batteries being installed in China, the United States, and Germany.

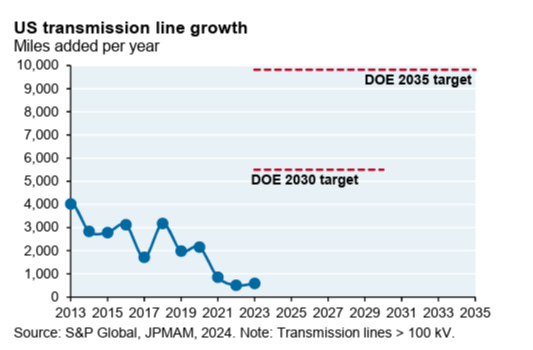

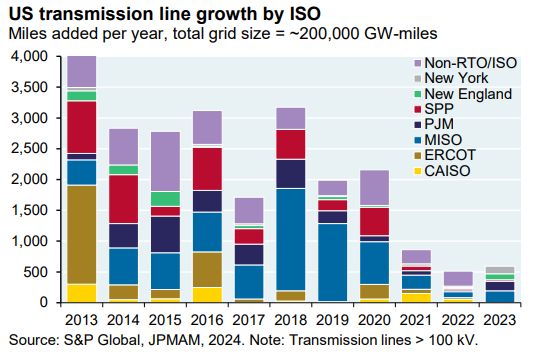

3. U.S. Transmission Line Growth is Far Below DOE Targets

As our friend Robert Bryce frequently notes, the “energy transition” depends on massive expansions of our high-voltage transmission grid, but capacity additions are falling, and per-mile costs and utility product costs are soaring.

The JPMC report notes that annual additions of transmission lines are far, far below the levels envisioned by the Biden Administration’s Department of Energy, as you can see in the graph below.

Rather than increasing, transmission line growth has fallen as projects in the Electric Reliability Council of Texas (ERCOT), Southwest Power Pool (SPP), and the Midcontinent Independent System Operator (MISO) regions were completed. More interregional transmission lines have been approved by MISO and PJM, but given the delays inherent with building new transmission lines, when or if those projects come online is an open question.

In our view, the idea that we need a massive buildout in interregional transmission infrastructure is incorrect. It is necessary to add more wind and solar generators, but that doesn’t mean that it is imperative that we build it when other sources of electricity, like new natural gas plants, would require far less new transmission and deliver more reliable, affordable electricity—if you can get a turbine....

....MUCH MORE