Following on this morning's "CPI Rises 0.5% In January; 3.0% Year-over-Year".

From/via ZeroHedge, February 12:

"These Numbers Are Uncomfortable For The Fed": Wall Street Reacts To Today's Red Hot CPI

Ahead of today's shockingly hot CPI report we warned that today's CPI report would be, well, shockingly hot...

***

... and not just because the trends in most of the components hinted it... not just because this was the Biden admin's farewell report, one in which the previous administration would kitchen sink all the "real" data to make up for years of fabricating numbers, just as Trump correctly responded...

***

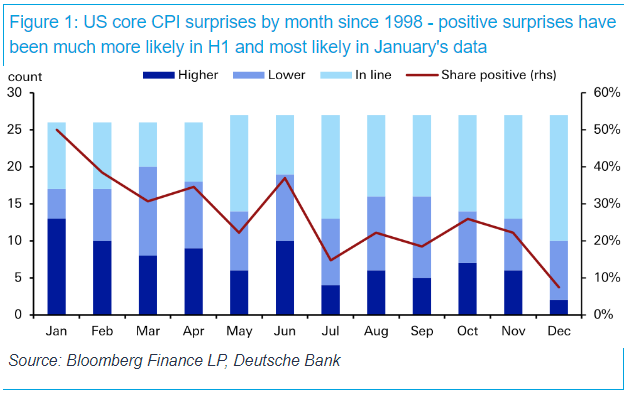

... and certainly not just because of the well-known seasonal bias - which we noted in our preview last night - to make first half inflation numbers in general, and January in particular especially hot, as shown by Jim Reid. As the DB strategist notes, surprises to CPI over the last 25-plus years have been more likely to be biased to the upside in H1 than in H2. January’s release has seen the largest number of beats (50%) and the lowest number of downside misses (15%).

No, all of the above were certainly arguments behind our correct conclusion that today's CPI would come in red hot, but the clearest reason why inflation surprised to the upside is the Fed's now openly political bias, which culminated with a 50bps jumbo rate cut in September only to make the Kamala Harris/Biden campaign easier. We all know what happened next, and in case we don't, here it is again.

And while very few others were accurate in their preview of today's CPI number, all of them had an opinion about it after the fact (of course). So, as we do every month, below please find several excerpts of what Wall Street strategists and analysts think of today's CPI print (and why it is so different from what they thought about it before). .

David Kelly, chief global strategist at JPMorgan Asset Management:

There is nothing in this report that suggests the Fed should lower interest rates.

Steven Ricchiuto, chief economist of Mizuho Securities USA

The rise in consumer prices was broad-based with both goods and services leading the way higher. Headline and core CPI both came in hot confirming that the disinflation the Fed has been counting on has stalled, suggesting the Fed has probably lost its opportunity to cut rates further.

Ryan Sweet, chief US economist at Oxford Economics

We don’t want to chalk all the upside surprise to residual seasonality, but shifting through the details, it seems eerily similar to early 2024 when inflation came in hotter than expected. Keep in mind that the additional tariffs on China along with the slew of tariffs threatened on other countries have yet to make their way into the inflation data.

Seema Shah, chief global strategist at Principal Asset Management

These numbers are uncomfortable for the Fed. Seasonality and one-off factors may have played some role in the upside surprise, but the combination of average earnings growth surprising to the upside last week, the supercore services inflation number moving sharply higher today, and the government’s policy agenda threatening to raise inflation expectations, is almost too convincing to dismiss. If this persists into the next few months, inflation risks may become too heavily weighted to the upside to permit the Fed to cut rates at all this year.

Scott Helfstein, Global X’s head of investment strategy,

A tough inflation report to get while the White House is looking at further tariffs with consumer inflation expectations jumping higher.

Omair Sharif, founder of Inflation Insights

The price of used cars spiked due to a large adjustment to the seasonal factor, which leans against a price breakout in this sector....

....MUCH MORE