Yes.*

Absolutely first rate reporting from The Guardian, October 10:

From football clubs to water companies, music catalogues to care homes, private equity has infiltrated almost every facet of modern life in its endless search to maximise profits

Whenever I ponder the enormity of the multitrillion-dollar industry known as private equity, I picture the lavish parties thrown by Stephen Schwarzman – and then I think of the root canals. Schwarzman is the billionaire impresario of Blackstone, the world’s most colossal private equity firm. In August, he hosted a 200-person housewarming party at his $27m (£21m) French neoclassical mansion in Newport, Rhode Island. It was a modest affair compared to the grand soiree he threw himself at his Palm Beach, Florida, estate for his 70th birthday, in 2017. That black-tie bash was itself a sequel to his multimillion-dollar 60th, in 2007, which became a symbol of the sort of Wall Street excess that led to the global financial crisis. The Palm Beach party, which some reports say cost more than $10m, featured Venetian gondolas, Arabian camels, Mongolian acrobats and a giant cake in the shape of a Chinese temple. “Brilliantly stimulating” was the billionaire industrialist David Koch’s review. Gwen Stefani serenaded Schwarzman as Jared Kushner, Ivanka Trump and several members of her father’s cabinet looked on. It was a world in miniature, ruled over by a modern Croesus – the perfect symbol for a form of money-making that has infiltrated almost every facet of modern life.

Preschools and funeral homes, car washes and copper mines, dermatologists and datacentres – private equity is anywhere and everywhere that money changes hands. If it can in any way be marketed or monetised, private equity firms have bought it – from municipal water supplies to European football clubs to the music catalogue of the rock group Queen. By some estimates, these firms now control more than $13tn invested in more than 50,000 companies worldwide. “We cannot overestimate the reach of private equity across the global economy,” Sachin Khajuria, a former partner at Apollo Global Management, which manages half a trillion dollars in assets, wrote in 2022.

It’s not just that hundreds of millions of us interact with at least one private equity-owned business every day. More and more people, especially the relatively poor, may live almost their entire lives in systems owned by one or another private equity firm: financiers are their landlords, their electricity providers, their ride to work, their employers, their doctors, their debt collectors. Private equity firms and related asset managers “increasingly own the physical as well as financial world around us,” the scholar Brett Christophers writes. “All of our lives are now part of their investment portfolios.” This is true not only in the US, where private equity has been on a spree since the late 1970s, but increasingly in the rest of the world, too. In recent years, private equity firms have spent hundreds of billions of dollars snaffling up businesses from Canada to Cambodia, Australia to the UK.

As private equity has spread, so have dire warnings about its effects. The vultures and vampires of the industry have been decried almost everywhere in the media that isn’t already owned by private equity. In the span of a single week last year, two major and almost identically titled books were published in the US – Plunder: Private Equity’s Plan to Pillage America and These Are the Plunderers: How Private Equity Runs – and Wrecks – America. Private equity is “greed wrapped in the American flag of efficiency, looting justified by solid investment returns”, the authors of Plunderers write. “The marauders answer to almost no one.”

This is where the baby root canals come in, as a grotesque epitome of the industry’s modus operandi. According to multiple media investigations and a US Senate inquiry, in order to drive up profits, private equity-controlled dental chains have induced children to undergo multiple unnecessary root canals. “I have watched them drilling perfectly healthy teeth multiple times a day every day,” a dental assistant in a private equity-owned practice told reporters. One child even died as a result. To its many critics, private equity is a shining example of “asshole capitalism”, but baby root canals make one feel even that label is a touch too kind.

Unsurprisingly, practitioners of private equity see their industry differently. Yes, they admit, there have been a few bad actors, and yes, a handful of bad deals, but by and large private equity firms are not full of profiteering sociopaths merrily making the world a crappier place. Rather, they’re the necessary fertilisers of growth and innovation, using their superior talents to rid companies of bad management, rejuvenate sluggish businesses and grow the economic pie so we can all continue to enjoy the relative prosperity of our developed societies. It’s just capitalism doing what capitalism does best. They call it “value creation”.

What’s more, they say they’re providing amazing returns to their investors, who might well include you, dear reader, if you happen to have a pension. “Hopefully we can get the news out there that, actually, private equity’s been a great thing for America,” Stephen Pagliuca, the billionaire co-chairman of Bain Capital, said at Davos in 2020. David Rubenstein, the billionaire founder of the Carlyle Group, another of the world’s largest private equity firms, goes further. “Private equity,” he likes to say, “is the highest calling of mankind.”

Whatever good or ill there is in private equity is not just about greedy sinners or enterprising saints. Whether acquiring a bakery that makes chocolate chip cookies or the nursing home where your grandmother is living out her days, private equity relies on the same basic business model: the leveraged buyout. These transactions – which account for roughly three out of every four dollars of all private equity deals – are frequently compared to house flipping: you buy a business using a ton of debt, or leverage, the way you buy a house with a mortgage; then you try to sell it for a tidy profit after you replace the carpets (or, better still, the market goes up). Unlike buying a house, however, the debt isn’t the responsibility of the buyer; it sits on the balance sheet of the acquired company. As strange as it sounds, it’s sort of like the company is forced to take out a loan to buy itself....

Following on yesterday's "The Guy Who Wrote “An Inconvenient Fact: Private Equity Returns & the Billionaire Factory” Does Not Genuflect At The Alter Of Bain, Carlyle and Blackstone"

Sometimes it's hard to tell the difference between a bankruptcy bust-out/bleed-out fraud and private equity.

Also between private equity with its internal rate of return, IRR, and piracy with its eerily similar Arrgh, but that's a whole 'nother post.

Or: Former CIA director Petraeus joins KKR backed security firm"

There aren't any assets to strip, or leverage before a bankruptcy bust-out.....

And: Private Equity: "having your industry compared to a Ponzi scheme is less than ideal"

.... My question going forward is: "Should times get really tough will we see a return to the asset stripping/bankruptcy bust-out model?"

Wait. Did I say that out loud? I meant "will we see a semi-permanent step-change to lower valuations that trap capital?"

Yeah that's it, that's what I meant.

And related:

From June 2019's The Hidden Risks In Shorting Dogs:

One of the scariest concerns when shorting non-frauds in a bull market is that the very things that make a company a laggard and seemingly offer a tempting short—or the short leg of a pair trade—are things that attract the private equity vultures. This is why, for 2 1/2 years when talking about the mess that American packaged foods had become, we would obliquely, and sometimes not so obliquely warn:

March 7, 2017

M&A In European Food

I'm not sure that consumer packaged goods is the area to be in, at least not in the U.S. and not based on names like Kellogg or General Mills.

For a quarter-century those manufacturers ratcheted prices as though they were tobacco companies but people find it easier to give up their Cheerios than their cigarettes.

The managements milked that approach for pretty much all it was worth so, as operating entities, they aren't all that attractive but someone will decide the only thing left to do is to asset strip or dividend recap the life out of the former cash cows.

Top o'the market to ya....

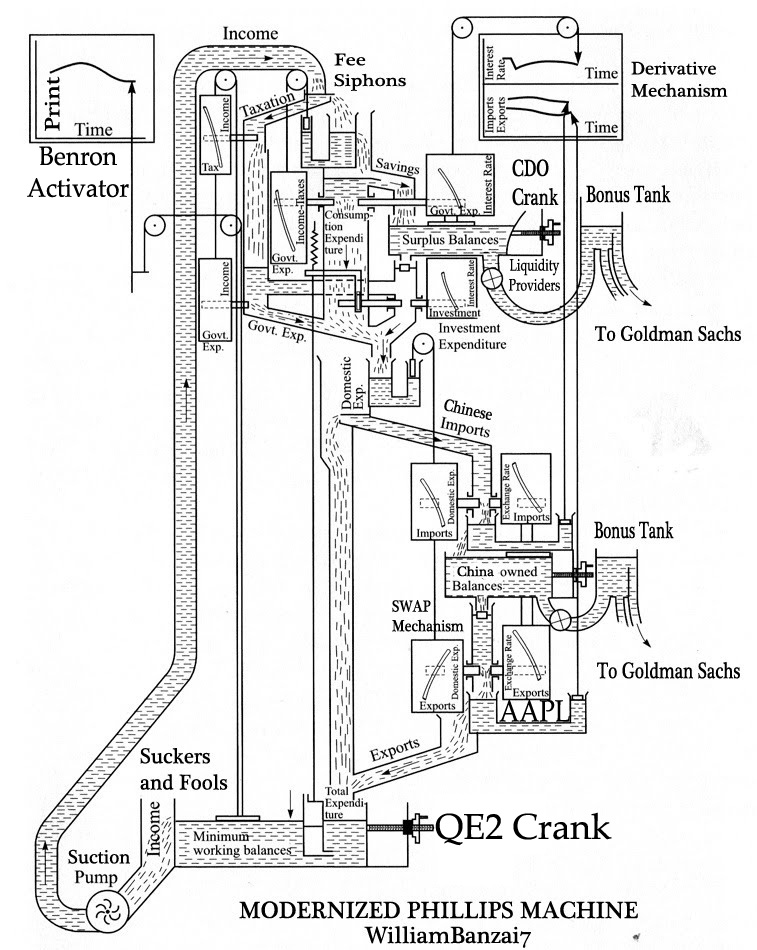

Speaking of the Private Equity model, here is sheer genius from William Banzai, last seen in

"...Since 2006, Private Equity Has Produced Only S&P 500 Returns While Reaping $400+ Billion in Fees"

The discussion of hydraulic models of the economy in this morning's "If The FT's Izabella Kaminska Doesn't Start Posting To Alphaville...." reminded me of William Banzai's take on the Phillips model but with bonus receptacles and fee siphons:

Compare/contrast with the original:

"The computer model that once explained the British economy (and the new one that explains the world)"

From the New York Times:

Two weeks ago, while visiting Cambridge University, I arranged to have lunch with my friend Allan McRobie. He’s a professor of engineering, so it seemed a bit strange that he kept insisting we meet at the department of applied economics. “There’s something there you’ve really got to see,” he said in his Liverpudlian lilt. “It’s utterly fab. Just brilliant. The Phillips machine — it uses water to predict the economy.”...MORE

Schematic diagram of the Phillips machine. (Click to enlarge.)

See also Warren:

Berkshire Hathaway as Idealized Private Equity

We quoted Buffett on P.E. in last month's "How Vulture Capitalists Ate Toys 'R' Us", updated below....

****

The quote was:

And then there's 2011's "The Porn Shop Operators Strike Again: Harry & David files for bankruptcy";

``You can sell it to Berkshire, and we'll put it in the Metropolitan Museum; it'll have a wing all by itself; it'll be there forever,'' he says at the February meeting.

``Or you can sell it to some porn shop operator, and he'll take the painting and he'll make the boobs a little bigger and he'll stick it up in the window, and some other guy will come along in a raincoat, and he'll buy it.''

On why a business may prefer selling to Berkshire Hathaway rather than a private equity firm.

I know Warren is talking down the bidding pressure that PE firms might put on the price he has to pay for privately held businesses but looking at his comments on PE over the years it's more than that:

He actually loathes private equity and its practitioners....

And so many more.