For two years our econ/investment thesis on China has been centered on the observation that any stimulus the Party/government employs, it will not be directed at rekindling residential construction. There is simply too large a black hole of debt-financed over-building sucking up every yuan/renminbi that comes near it to allow anything beyond Cantillon effects i.e. redistribution from those furthest away from thos furthest away from the financial injection sites (the people) to those closest (the nomenklatura and other connecteds).

From ZeroHedge, August 15:

Some economists warn that central banks, including the Federal Reserve, have pushed their interest rate hiking cycle too far. Meanwhile, Chinese investors are wary of the growth prospects for the world's second-largest economy. The troubling trends in the world's two biggest economies have sparked concerns that the global economic landing might be far more turbulent than initially anticipated.

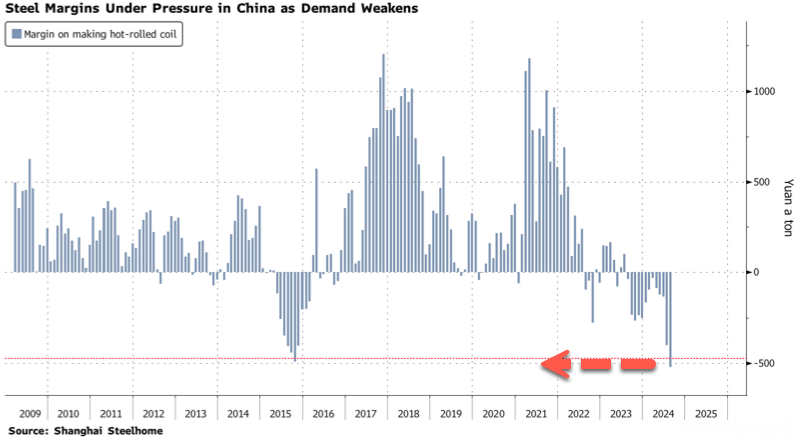

For instance, this morning, the world's biggest steel producer in China, China Baowu Steel Group, warned that the steel industry is plunging into a prolonged "harsh winter."

This downturn will be "longer, colder, and more difficult to endure than expected," Baowu Steel Chairman Hu Wangming said at the company's most recent half-year earnings result meeting.

"Financial departments at all levels should pay more attention to the security of the company's funding," Wangming said. He noted a need to strengthen controls over overdue payments and detect fake trades.

He said, "In the process of crossing the long and harsh winter, cash is more important than profit."

Hou Angui, general manager and deputy party secretary at Baowu Steel warned at the meeting, "The current situation in the steel industry is more severe than the downturns of 2008 and 2015."

For commodities, including steel and copper, the dire warning from Baowu Steel comes as the property market downturn in China continues to worsen. Factory activity in the world's second-largest economy remains under pressure, and investors are extremely cautious about China's growth outlook.

Goldman's Lisheng Wang recently met with onshore clients in Beijing and Shanghai. These clients include mutual funds, private equity funds, and asset managers in banks/insurance companies.

Wang said, "Compared with two months ago, local investors viewed signals from the Third Plenum and July Politburo meeting as neutral, remained cautious on China's growth outlook and policy implementation, and showed increased concerns on the US recession risk, election uncertainty, and potential impact on China."

In markets, Goldman's James Busby said iron ore prices moved lower in Singapore, down nearly 3% with "Macro fund selling." He noted to clients about Baowu Steel's warning and pointed out that iron ore prices slid to May 2023 lows.

BMO analyst Colin Hamilton said, "The entire Chinese steel industry is positioning for a consolidation."

As Chinese iron ore inventories swell, steel mills face mounting supply pressures, likely forcing them to cut production. Additionally, these mills are exporting deflation, with steel exports expected to exceed 100 million tons this year—the highest level since 2016....

....MORE

Australia's MacroBusiness has been on top of the Chinese iron and steel situation for quite a while. In the last couple months he's had a particular focus on construction dependent rebar (our headlines, his legwork):

- Construction Commodities: Chinese Rebar Rolls Over

- Indicators: Chinese Steel Reinforcing Bar Prices Continue Descent

- China: Despite The Recent Food Price Inflation There Is Serious Industrial Commodity DEflation

Some of our 2022 - 2024 posts on the Chinese economy:

....Or, as noted a half-dozen times over the last few years, in various forms and degrees of coherent expression (this from September 2023):

"Chinese Property Stocks Soar After Latest Beijing Support, Country Garden Debt Deal"

Once again we cautiously caution be cautious, that support for the group does not mean new construction (and the GDP growth it brings) is about to return to the glory days.

That time has passed, never to return and at best Beijing will keep the world from descending into a depression caused by the Chinese property market....

Also the outro from June 29, 2024's "China's Credit Impulse Loses Its Mojo":

Or:One of the oddest failures of analysis of the past two years is the apparent belief that Chinese central bank and government stimulus would do anything for future construction and thus demand for the inputs that go into construction.

They have their hands full just trying to mitigate a multi-trillion USD black hole of real estate that sucks up any money that comes near it....

December 14, 2022

China's $3 Trillion Shadow Banking Industry Pivots Away From Property Developers

This is one of the effects of the fact that the huge (eventually multi-trillion yuan) Chinese government effort to stabilize the property sector will not stimulate new construction. With all the implication for commodities that understanding entails....

Probably not related, September 2021:

"Attention: The Black Swan In The Center Of Beijing's Tiananmen Square Meant Nothing, Please Go About Your Business".

And more broadly, the 2023 posts

July 10: "China May Face A Dreaded 'Balance Sheet Recession'":

Of course it is, this is the classic central bank "pushing on a string" scenario....

Which was re-iterating June 18's "Goldman Sachs cuts China GDP forecast for 2023":

That 'the country’s ongoing stimulus was incapable of generating a strong “growth impulse,"' line is what we were trying to communicate last week. From June 14's "What's that Got To Do With The Price Of Pork In China?"....

Here's "What's that Got To Do With The Price Of Pork In China?":

Pork prices are one of the most basic indicators of the health of the Chinese economy.

Our proxies are hog futures on the Dalian Commodities Exchange. For folks paying attention, the months-long sideways move, here using the September futures as the example, the sideways move from mid-January to mid-April put the lie to the hubbub about the Great Reopening. The move up from December 2022 was all anticipatory emotion rather than actual demand:

The reason we are pointing this out today is the possible double bottom and the mini-rally over the last couple days. Again, like the December rally, traders may just be optimistic about recent events, in this case the loosening implied by the rate cut by the People's Bank of China but the directional change is definitely worth noting.

The negative spin on the rate cut would be the one we used on Tuesday, that it's classic "pushing on a string" i.e. the problem isn't the cost of money but rather the lack of demand for money.

In this sort of situation, if the money isn't going into domestic demand in will go into financial assets. In the West the Central Bankers say about that reality "We meant to do that, it's the Wealth Effect' whereas it's actually the Cantillon Effect where the people who get the money first get to take advantage of prices that haven't yet moved and are thus lower for them than for those who follow them in.

Unfortunately for us, this time it is tougher to distinguish between a real demand driven move and a speculative "close-your-eyes-and -bet-on-higher" than it was in January, for another very basic reason: We had the Chinese lunar New Year on January 22 to tip us off.

As repeated in May 15's ""China Data Dump Total Disaster; Youth Unemployment Hits Record High"":

....the point of the intro to and outro from January 31's "What If China Had A Reopening And Nobody Cared?":

China isn't reopening, it has reopened. This is it. And despite the record savings the population has accumulated over the last three years we are not seeing a wave of demand in the domestic economy. Using one of the most basic proxies for what is actually going on, the price of pork, the grand reopening, is, to say the least, muted. This is especially true considering the country just celebrated the largest, most festive holiday on the calendar....