Once again we cautiously caution be cautious, that support for the group does not mean new construction (and the GDP growth it brings) is about to return to the glory days.

That time has passed, never to return and at best Beijing will keep the world from descending into a depression caused by the Chinese property market.

From ZeroHedge, September 4:

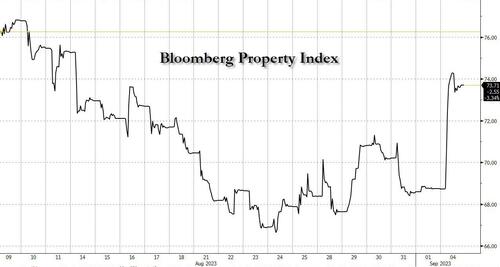

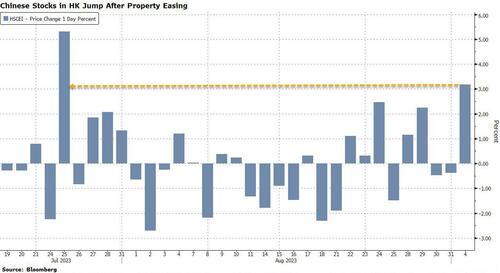

With US markets closed for the day, let's take a quick look at the biggest overnight action which today was in Asia, and specifically China, where the drip-drop of piecemeal stimulus continued and finally triggered some threshold of optimism (at least until Xi fires the big "whatever it takes" bazooka), and on Monday, the Bloomberg Intelligence gauge of Chinese developer shares surged more than 7%, after Beijing and Shanghai lowered mortgage requirements and data over the weekend showed sales jumped, following Friday’s typhoon induced market closure.

The property rebound helped China's CSI 300 Index - which had been left for dead by most hedge funds following the longest selling stretch on record - gain as much as 1.7%, and Asian stocks headed for their best day in a week, boosted by a rally in Hong Kong-listed Chinese shares.

The MSCI Asia Pacific Index rose as much as 1.1%, advancing for a sixth session, aided by gains in Tencent and Alibaba. The Hang Seng China Enterprises Index was the best performing gauge in early trade, lifted by property shares.

In Japan, equities already at the highest level since 1990 continued to gain, boosted by Toyota after Mizuho raised its price target of the world’s No. 1 carmaker, sending its price to a record high.

There were two big reasons for China's property optimism. first, key Chinese metro-areas, including Beijing and Shanghai, eased mortgage requirements for some home buyers late last week, with other cities following suit over the weekend.

First, following the slew of easing announcements in the week prior, policymakers released another batch of easing measures last week. On property policy, the central government lowered the floor for downpayment requirements and mortgage rates. All four tier-1 cities, including Beijing and Shanghai, loosened the definition of "first-time homebuyer" to ease mortgage credit for qualified individuals. Existing mortgage borrowers can refinance into somewhat lower mortgage rates. On fiscal policy, individual income taxpayers are allowed to deduct additional expenses from childcare, children's education and elderly care. On monetary policy, large state-owned banks are reported to start lowering deposit rates. At the same time, the PBOC cut the RRR for onshore FX deposits to help support the RMB. Individually, these easing measures are not large. According to Goldman, the measures "collectively sent a clear signal that policymakers want to stabilize the property market, boost growth and lift sentiment." The bank suspects more piecemeal measures will continue to be introduced until policymakers are satisfied with the result.

As Bloomberg further reports, home sales in Beijing and Shanghai soared in the past two days following mortgage relaxations, an early sign that government efforts to cushion a record housing slowdown are helping. Existing-home sales in the two megapolises doubled over the weekend from the previous one, according to CGS-CIMB Securities. “We were surprised by the strong pick up in Beijing and Shanghai, despite the challenging economy,” said Raymond Cheng, head of China property at CIMB.

The Chinese mega cities — each with a population of more than 20 million — benefited the most from Thursday’s announcement which lowered down-payment thresholds across the nation. Beijing and Shanghai also will no longer disqualify people who’ve previously had a mortgage — even if fully repaid — from being considered a first-time homebuyer, as long as they don’t own a property, according to separate statements from the city governments.

Second, Country Garden, one of China’s most troubled property developers, agreed with creditors to restructure an impending bond repayment. Hong Kong-listed shares of Country Garden - which is facing default and whose collapse would have more adverse consequences than the bankruptcy of Evergrande - soared 14.6% higher after having jumped as much as 19% to their highest level since Aug. 10. Other Chinese property developers also jumped, with Hong Kong-listed Longfor Group climbing over 8% and Seazen Group rising more than 18%.

The worsening financial woes of Country Garden have further highlighted the fragile state of the country's real estate industry, which accounts for roughly a quarter of the economy and whose debt situation has been dire since 2021. Considered financially sound compared to peers, Country Garden, China's top private developer, had not missed a debt payment obligation, onshore or offshore, until it failed to make coupon payments on dollar bonds last month after slowing home demand hurt its cash flow. Despite today's rebound, Country Garden now has just days to avoid default on Dollar Bonds where a grace period ends Sept 5 on $22.5 million in interest. There was some good news: In the deal reached late on Friday, a day before the developer had been due to repay its onshore debt worth $536 million, the company will pay its obligations in instalments over three years.

China’s steps are the latest in a long-running campaign to shore up its real-estate sector. Beijing’s newest measures appeared to be building a critical mass behind the efforts, said Altaf Kassam, head of investment strategy and research for Europe, the Middle East and Africa at State Street Global Advisors.....

....MUCH MORE

If interested see also September 1's: "China's Measures Begin to Find Traction, US Employment Report on Tap"