Over the course of the last month or two there have been a lot of articles/stories/posts comparing Cisco 2000 to Nvidia 2024. Some even have charts to hammer home the point - which I think can be summed up as "analogue is prologue." If that's not the reason, then I don't understand why people are taking the time to point out the obvious. Here's one of the clearest analogue charts, from ZeroHedge:

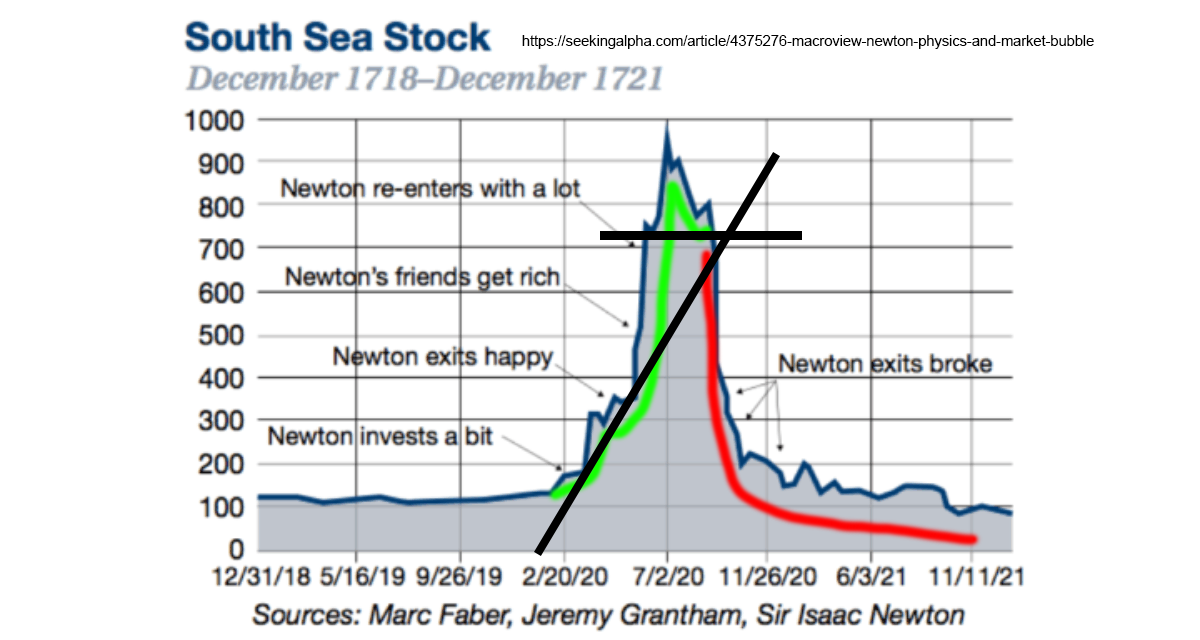

What I think is actually going on is a passive-aggressive attempt at generating some street cred while leaving an out should the implication fail to materialize: "You misunderstood what I was saying, I was just showing the similarities not making a forecast", and should Nvidia collapse (by the way, that is the classic bubble pattern, see South Sea stock* among others) we'll get some variation of "Stocks--I'm a genius! Housing--I'm a genius! Commercial real estate--yes, well, I suppose the evidence is overwhelming...".

If you ask them, passive-aggressive manipulators are the most misunderstood people on the planet.

It's all just rhetorical manipulation that will slide very easily into straight up gaslighting where the intent is to portray the victim of the attack as crazy/delusional/a bad person, whatevs.

Anyhoo, on to Dr. Ed and one of the more thoughtful of the CSCO/NVDA comparisons.

From MarketWatch, First Published: Jan. 29, 2024 at 7:15 a.m. ET:

Is it possible that the meltup phase of the bull market (which started on Oct. 12, 2022) has begun already — having started following the correction low on Oct. 27, 2023? Yes, it is possible.

Since that recent low, investors have become much less concerned about such adverse macro issues as a recession, higher interest rates, persistent inflation, and the federal government’s deficit. Instead, they are excited about the likelihood that the U.S. Federal Reserve will cut interest rates this year as inflation continues to subside. They are also exuberant about the potential impact of artificial intelligence (AI) on the earnings of technology companies.

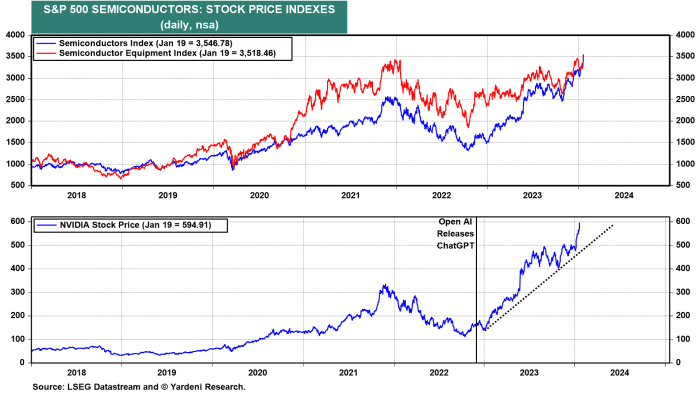

Their exuberance for AI started when OpenAI introduced ChatGPT on Nov. 30, 2022. Since then, Nvidia’s NVDA, -3.24% stock is up more than 250% because it is the leading semiconductor manufacturer of AI chips. It has led the S&P 500 Semiconductor stock price index to a gain of 108% since then.

Nvidia’s share price performance is starting to remind us of the parabolic ascent of Cisco Systems CSCO, -0.64% stock during the tech bubble of the late 1990s. The company manufactured key equipment necessary to expand the internet, and its share price increased eightfold from the end of 1997 through March 2000. The stock then crashed, even though the internet continued to proliferate rapidly.

Is Nvidia today’s Cisco? It’s possible. If so, then it has a lot more upside before it crashes — if it crashes.

Fed Chair Jerome Powell has studied the history of Fed chairs, especially Paul Volcker. Unlike Volcker, Powell might succeed in bringing inflation down without a recession. The financial markets are expecting him to lower interest rates this year now that his inflation mission is nearly accomplished. Indeed, he and other Fed officials have opined that they might have to lower the federal funds rate to keep the inflation-adjusted federal funds rate from rising as inflation falls further.

When bubbles inflate to a certain point, it doesn’t take much to pop them....