That sort of headline is a bit scary. What you want to see, to get the most from these major turning points is gloom, doom, despair and most importantly, disbelief.

But that cat's out of the bag. From TradingView, our bogey, the Shanghai-Shenzhen CSI 300 Index:

From Bloomberg via Yahoo Finance, March 12:

A rally in Chinese stocks has sent a number of benchmarks surging 20% from lows, a sign that the battered market may be headed for a more sustainable uptrend after multiple false dawns over the past year.

The Hang Seng Tech Index became the latest gauge to enter a technical bull market during Tuesday trading, joining the ChiNext gauge of China’s growth shares and other sectoral indexes on materials and renewables to hit the milestone.

The current sentiment marks a sharp improvement from just months ago, when Chinese shares were among the world’s worst performers and some big-name investors were cutting exposure. Beijing’s determination to end a rout, signs the economy and earnings are picking up, and a return of foreign inflows have given investors from abrdn plc to M&G Investment Management reasons to believe that the market is bottoming out.

“It’s rare to see China’s markets sustain a rally for weeks since the second half of last year,” said Fanwei Zeng, investment analyst at GAM Investment Management. “Most Chinese tech and renewables companies have been focusing on cost cutting and improving efficiency; we’ve seen improvements in margins and decent topline growth.”

The upswing shows investors are coming to terms with China’s attempts to restructure its economy, with some betting that President Xi Jinping’s attempt to drive high-tech growth and end a property crisis will start to bear fruit. A steady stream of policy support — from a cut to the mortgage reference rate to more liquidity and crackdown on quants — is stacking up, even though some investors decry the lack of a big-bang stimulus.

The CSI 300 Index of mainland shares has gained about 13% since a five-year low reached Feb. 2. The Hang Seng Tech gauge advanced more than 4% on Tuesday, with Xiaomi Corp. contributing the most to the gains after the automaker announced it will start selling its long-awaited electric vehicles this month.

Beijing’s resolve to deliver 5% economic growth this year suggests incremental stimulus will continue to flow in, analysts said. Data show the economy is on the mend, with inflation back in positive territory for the first time since August and manufacturing and services no longer in deep slump.

“We expect high single digit or low-teen earnings growth overall this year,” said Nicholas Yeo, head of China equities at abrdn plc. “We expect deflationary pressure to reduce this year which would provide companies with more pricing power. We are around the range of the bottoming.”....

....MUCH MORE

We should adopt a new tagline: "Before it's on the terminal it's on Climateer Investing." In reverse chroplogical order:

"Nervous about the U.S. market at all-time highs? Buy China stocks"

That's their headline not ours. We don't get nervous, preferring instead to go directly to sheer terror.

"Michael Burry's 'Big Short' Logic On China Tech Stocks"

At the moment we are more interested in the broader Chinese market, proxied by the CSI 300 index, rather than individual names but here's a guy who was right once and may be again.

And ourselves? On December 27, 2023 we posted "A Bottom In Chinese Equities".

We were early. The Shanghai-Shenzhen CSI300 Index continued lower for another month.

Finally on February 1, the rat-bastard turned up with some conviction.

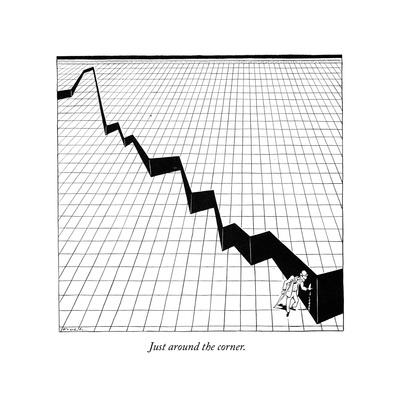

The hazards of bottom-calling were pretty much nailed by a cartoon we used as our guide and warning for readers, repeated some twenty-odd times in the six month crash during the 2008 -2009 unpleasantness: Alfred Frueh's January 16, 1932 New Yorker cartoon, "Just around the corner," playing off President Hoover's "Prosperity is just around the corner" exhortation:

"Everything China’s Doing to Rescue Its Battered Stock Market"The market finally bottomed on July 8, 1932, six months after the cartoon was published and 33 months after that all-time-high up on the upper left of the cartoon.

Bottom calling is hard.

And dangerous.

Holy Hannah it's a long list....

Analysts React: "China markets leap on prospect of policy boost"

"Hedge Fund Stars Who Got China Wrong Are Paying a Big Price"