ZeroHedge with the early overview:

Ahead of today's jobs report, Goldman shared the following market matrix on how to interpret the data: "The best case scenario for stocks is a small headline miss...call it 175k – 200k range. Stocks don’t want a surprising print in either direction (big beat investors will stress over inflation and continued rate hikes / big miss investors will stress the hard landing)." To be sure, now that the BLS has finally stopped defending the "strong labor market" myth, the risk was to the downside, with Newedge warning that “based on a linear regression of jobless claims, ISM employment, NFIB hiring, ADP, JOLTs, conference board, and Indeed/ZipRecruiter surveys that predict a negative 49K.”

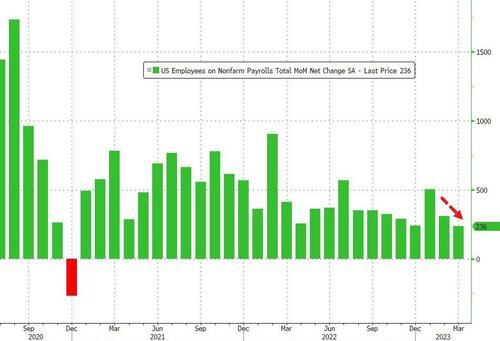

In the end, however, the BLS decided not to ruffle any feathers on a day when markets are closed and the March payrolls print came at 236K, just above the 230K expected, and below last month's upward revised 326K (up from 311K). Despite the aggressive recent revisions, this was the lowest monthly increase in 27 months: the last time we had a lower monthly print was December 2020 when they tumbled 268K.