From Allison Barr Allen's Life on the Trail substack, April 7:

185 companies & counting. $8B in funding. 2 IPOs. What's next?

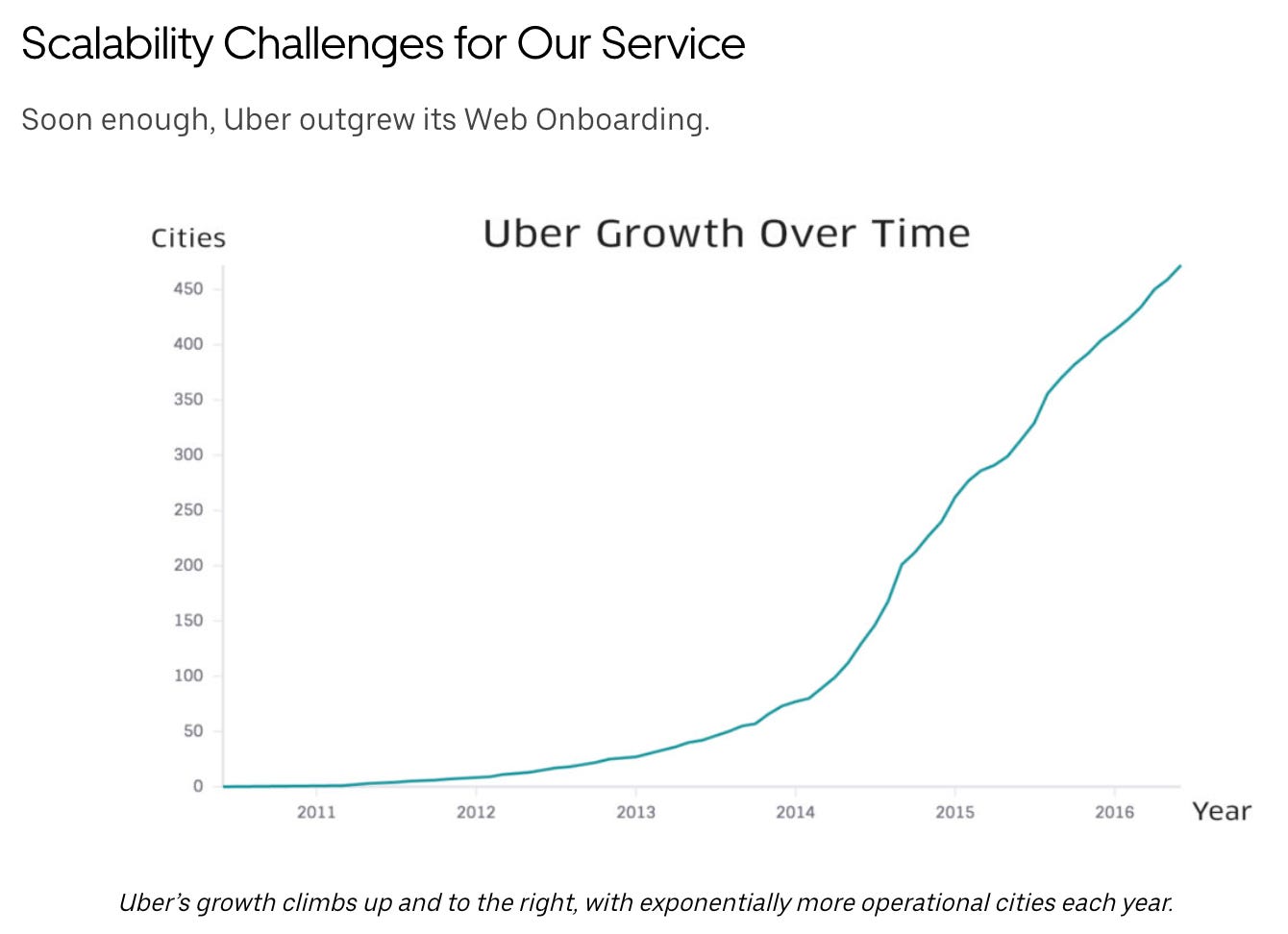

Uber was a wild place in the early days. I can think of no other company that scaled globally so quickly. Uber completed 6 billion trips just 6 years after trips began! This was not a pure software startup where a team in San Francisco can click a few buttons to onboard users across the world. It was scaling a complex logistics marketplace in hundreds of unique cities with their own distinct cultures, technology capabilities, and policies. Over the years, Uber expanded both in breadth and depth - eventually building teams focused on Health, Food, Mass Transit, Self-driving, Trucking, Aviation, Micromobility, and more. Uber succeeded by hiring Really Smart People all over the world who were not afraid to tackle big challenges and who wanted to win.

Not only did Uber need smart on-the-ground Operations teams to succeed, it required best-in-class Engineers building platforms to a scale that had never existed before. Our 1455 Market Street headquarters buzzed until late into the evening. We built tech primarily in-house because either: 1) startups or known companies couldn’t handle our volume, or 2) data privacy reasons. Uber created a custom customer support system, payments platform, CMS, and dozens-upon-dozens of internal tools. Very sophisticated data science and engineering teams managed the marketplace side of the businesses - which included pricing, rider-driver matching technology, and surge.

What happens to the people who leave one of the fastest growing startups ever? It turns out a lot of them start hyper-growth companies themselves.

I’ve spent months scouring the web to compile the results. Thus far, 185 companies have been founded by ex-Uber employees, and have raised $8B in disclosed capital, with a median funding amount of $16.4M.

I believe the Uber alumni network is the most influential since the PayPal Mafia. And they're just getting started....

....MUCH MORE

Looking past the somewhat breathless opening paragraph, what is presented here is astounding and the result of a lot of digging. A lot.

We linked to The Telegraph in 2014's ""The PayPal Mafia: Who are they and where are Silicon Valley's richest group of men now?" (EBAY; TSLA; LNKD; FB)" which was pre-Tele paywall. If you click through and can't access the site, Business Insider also had it.

You'll note the lack of Elon in the group photo but even if he was in it, he might be unrecognizable in a pic of his pre-hairplug visiage.

In 2018 we had:The Stanford Bitcoin Mafia

Not exactly The PayPal Mafia but aspiring.

And in 2019 it was:

The Skype Mafia: Who Are They And Where Are They Now?

In 2020:

"Yakuza: Japan’s armed venture capitalists"

And, along the way, the Mafia Mafia, including the post-Kyoto era when they were flexing their ESG cred:

Police in Italy Seize Mafia-linked assets worth $1.9 billion "Mob was Going Green"