From Michael Roberts, our new favorite Marxist economist, September 14:

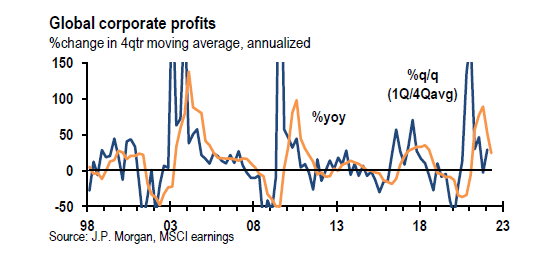

Global corporate profits growth is heading south, according to analysis by JP Morgan economists. JP Morgan estimates that, after surging a humungous 89% (4q moving ave) in 2021, global corporate profits moderated to a still-solid 24% in the year ending in 2Q22. And they reckon that “on net, the level of profits is 17% above its pre-pandemic trend, but still making up for lost earnings through the pandemic.” However, JP Morgan expects “slowing in profit growth in the coming quarters as inflation cools while labor markets remain tight. Additional pressure is coming from rising corporate borrowing rates as central banks press on with the steepest tightening cycle in decades.” The scissors of a future slump (falling profits and rising interest rates) are beginning to close.

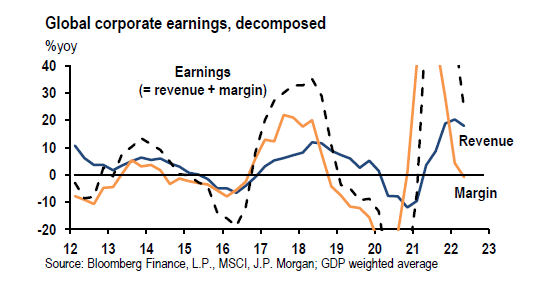

During the post-pandemic recovery, corporate profit margins (that’s the difference between revenues and costs per unit of production) reached multi-decade highs as the surge in inflation boosted corporate pricing power while wages languished.

But things are changing in 2022. Profit margins are sliding down as costs of production rise and revenue growth slows

When broken down by sector, JP Morgan finds that each of the 10 sectors comprising the total economy show a slowing in earnings growth from multi-decade highs posted in 2021, although only four have experienced outright contraction since the beginning of the year. Although the profits boom in 2021 was broad-based in all sectors, it is clear from the data that the bulk of profit gains were in energy and raw materials including food. And that’s where the biggest falls are coming....

....MUCH MORE

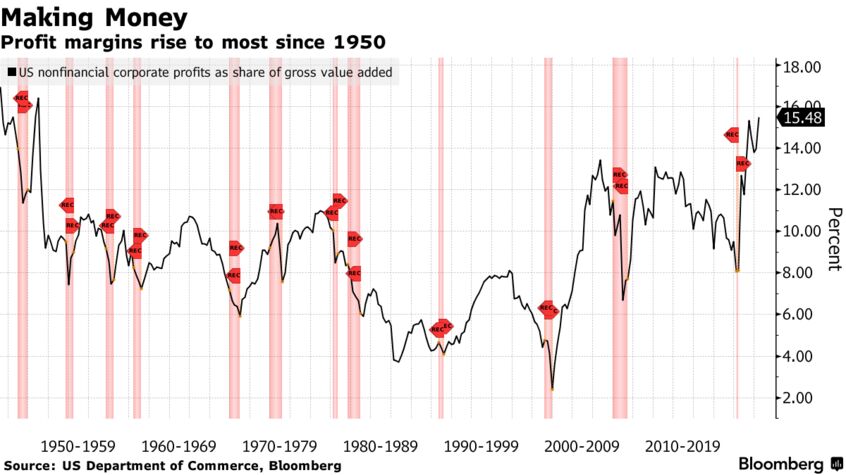

If Mr.Roberts is correct, and I believe he is, this headline at Bloomberg, August 25 marked the peak in profit margins:

US Corporate Profits Soar With Margins at Widest Since 1950

A measure of US profit margins has reached its widest since 1950, suggesting that the prices charged by businesses are outpacing their increased costs for production and labor.

After-tax profits as a share of gross value added for non-financial corporations, a measure of aggregate profit margins, improved in the second quarter to 15.5% -- the most since 1950 -- from 14% in the first quarter, according to Commerce Department figures published Thursday....

....MUCH MORE

During the Great Depression the scissors worked in reverse for one company, I'll retell that story next week.

Right now, a flashback to the outro from a Google earnings miss last April: