Some points of similarity in this piece and November 13's "Updates on China's Digital Yuan".

From Seeking Alpha, November 11:

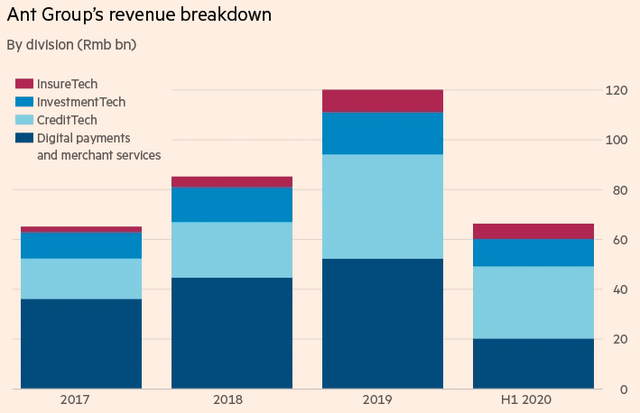

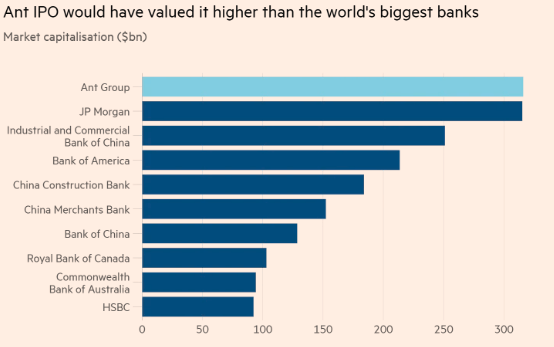

Ant Financial, a third owned by Alibaba (BABA) under the control of Jack Ma, is China's flagship FinTech behemoth offering a bundle of financial services. Started off as a digital payments provider, it has in recent years branched out into several other lucrative areas (e.g. consumer credits and investments) previously dominated by state-owned banks. On November 5, Ant Financial was scheduled to IPO at a record-setting $300 billion valuation in both Shanghai and Hong Kong. However, just two days before, in a surprising turn of events, Beijing moved to halt the listings as new draft rules that imposes more online lending restrictions were released.

Source: Financial Times

Different from a few authors previously writing on the topic, I hold a bearish view on this developing situation and would caution investors rushing to buy the recent Alibaba (BABA) selloff. Wall Street analysts forecast that the increased funding requirements would slash its IPO valuation by as much as half. Whether that will become true or not, the outlook of the business have changed permanently for the worse.

There were already worrying signs before the incident. Linking to China's ongoing experiment with a retail central bank digital currency (CDBC), I argue that the pattern of events reflect regulator's increasing concerns to preserve the competitiveness of existing banking system. China's FinTech regulation for the next 5 years can look fundamentally different than the past 10, and we shall witness more proactive, precautionary interventions under a more conservative regulatory philosophy. This is a bearish development for leading FinTech players like Ant Financial and Tencent (OTCPK:TCEHY).

The Suspended IPO

The sudden suspension of what could have been the world's largest IPO could not have been made lightly. What worries me is that, current discussion surrounding it has overly analyzed the role of Jack Ma's blunt remarks in days prior and lacks adequate concerns for the deeper implications of the regulatory action. Though the narrative of a totalitarian vengeance against the country's richest oligarch makes another juicy free speech headline in the democratic world, it misses the point.

The simultaneously released new FinTech rules, which include mandating 30% capital contribution in joint loans with banks, were simply not drafted overnight. What really led to the regulatory reactions were not Jack Ma's speech but what was written in the prospectus. Before its filing, regulators had very little insights into the true size and systemic importance of Ant Financial. The filing functioned to confirm the regulator's longstanding suspicions and provided the necessary details to complete the regulatory picture.

The Digital Yuan Pilot

A month ago, on a separate timeline of events, China's central bank issued 10 million ($1.5m) Digital Yuan to 50,000 residents in Shenzhen as part of the trial testing for its central bank digital currency (OTC:CBDC) named Digital Currency Electronic Payments (DCEP). China is one of the leading countries in launching a digital currency. Though seemingly unrelated, both DCEP and the IPO suspension reflect the regulator's increasing concerns for the competitiveness of the existing banking system. What this means for FinTech players going forward is a potentially more adversarial environment marked by proactive, precautionary interventions....

....MUCH MORE