We've been pitching the realpolitik answer to China's empty threats for a few years and now it looks like the running dog capitalists at ZeroHedge get it and lay out the endgame, better, backward and in heels.*

From ZH:

Beijing May Dump US Treasuries In Response To US Hostility, Start Its Own QE: Chinese Media

In response to recent media speculation that as the blame game over the origins of the coronavirus pandemic escalates the US may cancel some of its $1.1 trillion debt owed to China, the South China Morning Post reported today that China may "move to reduce its vast holdings of US Treasury securities in the coming months" in response to a resurgence in trade tensions and a war of words between the world’s two largest economies.

While analysts have also said that the US was highly unlikely to take the “nuclear option” of cancelling Chinese-held debt, with Larry Kudlow himself refuting this suggestion on several occasions last week, the "mere fact that the idea has been discussed could well prompt Beijing to seek to insulate itself from the risk by reducing its US government debt holdings", the SCMP writes.

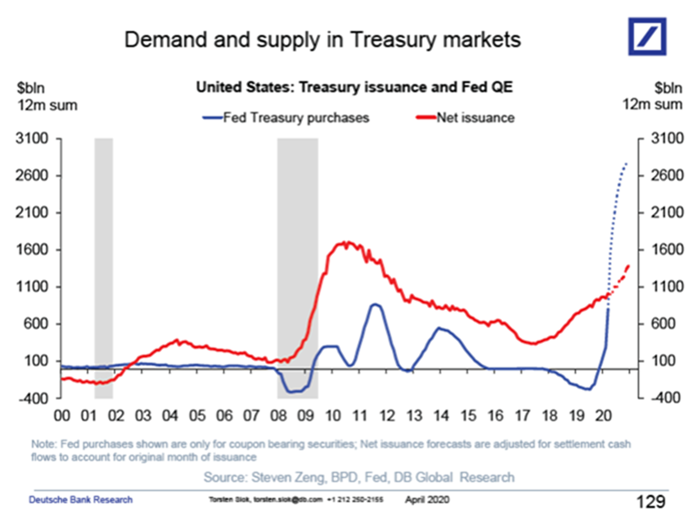

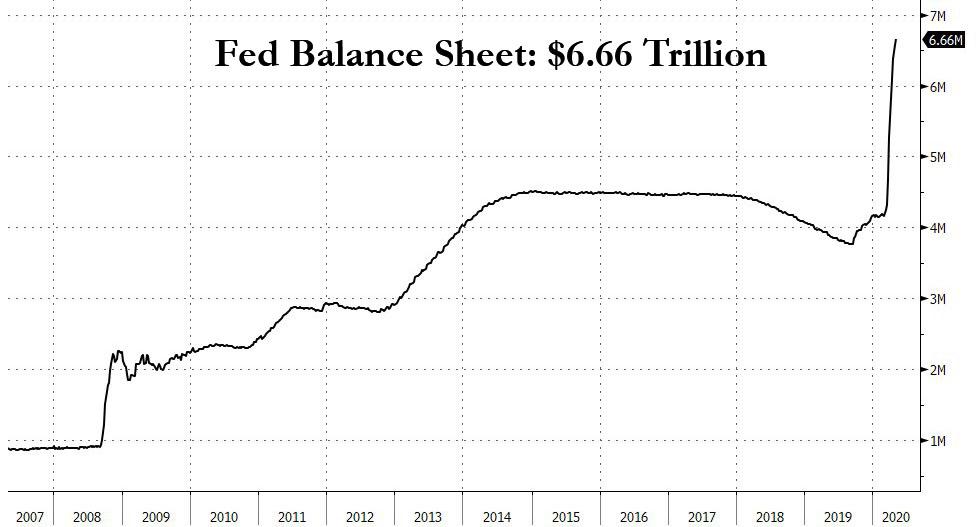

And while the SCMP then suggests that this "could spell trouble for the US government bond market at a time when Washington is significantly ramping up new issuance to pay for a series of programs to combat the pandemic and the economic damage it is causing", nothing could be further from the truth: yes, the US Treasury will issue over $4 trillion in new debt this calendar year, but now that the US officially lives under central planning, courtesy of helicopter money, the Fed will monetize not just every dollar the Treasury issues, but will monetize double the net issuance.

Which means that not only does the US not need China to buy its debt ever again, the US in fact does not need anyone outside the Fed, now that open debt and deficit monetization is the endgame, with the only unknown is when this will lead to currency collapse.

Surprisingly, the Chinese still don't get that any tactical advantage they may have had is now gone:

any move to cancel the debt owed to China – effectively defaulting on it – would be counterproductive to US interests because it would likely destroy investors’ faith in the trustworthiness of the US government to pay its bills, analysts warned.Again: no. Maybe this idea had some validity when the Fed was pretending it wouldn't do unlimited QE, but now that the Fed is purchasing hundreds of billions in US paper every month, what China may or may not do with its holdings of US debt is completely irrelevant.

This would send US interest rates soaring, making borrowing more costly for the government, as well US companies and consumers, and in turn strike a sharp blow to America’s already very weak economy.

“It's such a crazy idea that anyone who has made it should really have their fitness for office reconsidered,” said Cliff Tan, East Asian head of global markets research at MUFG Bank. “We view this as largely a political ploy for [Donald Trump’s] re-election and a cynical one because it would destroy the financing of the US federal budget deficit.”

Uhm, Cliff, yes it is insane, but not because China has any leverage left: in case you missed it, the Fed purchased $2.5 trillion in debt in the past 6 weeks.

That's more than double what China owns. So yes, if Beijing wants to dump its Treasuries, bring it on: it will cause yields to spike for an hour or two, at which point everyone will frontrun the Fed which will activate the turbo POMO and purchase every last penny that China had to sell........MUCH MORE, it gets pretty brutal and, as that guy from Avon said in 1592 (also Scorpions 2010)

Previously on understanding the relative power of the playas:...“Petruchio: Come, come, you wasp; i' faith, you are too angry.

Katherine: If I be waspish, best beware my sting.

Petruchio: My remedy is then, to pluck it out.

Katherine: Ay, if the fool could find where it lies.

Petruchio: Who knows not where a wasp does wear his sting? In his tail.

Katherine: In his tongue.

Petruchio: Whose tongue?

Katherine: Yours, if you talk of tails: and so farewell.

Petruchio: What, with my tongue in your tail? Nay, come again, Good Kate; I am a gentleman.”

—The Taming of the Shrew via No Fear Shakespeare

May 2019

Alhambra: On China's Empty Treasury 'Nuke' Threats

September 2018

New York Fed: "Do You Know How Your Treasury Trades Are Cleared and Settled?"

And a couple others including most recently, May Day's "Rabobank: This Is How We Get To The "Unthinkable" 10-Handle In The Yuan"

*The "better, backward and in heels" was not in reference to ZHs's sex, gender and/or preferred personal pronoun but rather to the quote often mis-attributed to Ginger Rogers herself. The actual source was a Frank and Ernest cartoon:

I'm trying to picture the Tyler Durdens (for they are multiple) at ZeroHedge wobbling around on six inch spike heels.