More on our Albert headlines after the jump.

From ZeroHedge:

Albert Edwards On How It All Ends: "In The Next Recession, The S&P Will Drop Below 666"

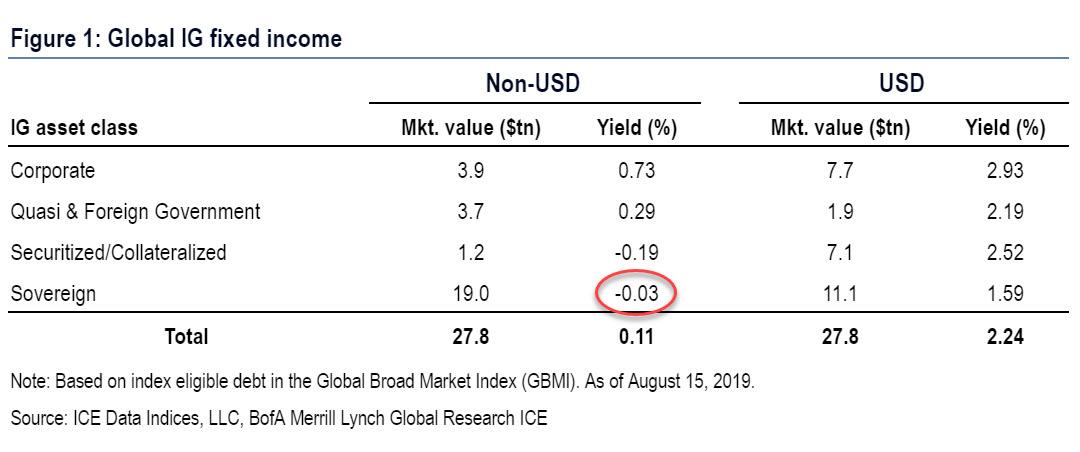

Back in August, we wrote that after decades of waiting, for Albert Edwards vindication was finally here - if only outside the US for now - because as per BofA calculations, average non-USD sovereign yields on $19 trillion in global debt had, as of Monday, turned negative for the first time ever at -3bps.

So now that virtually every rates strategist is rushing to out-"Ice Age" the SocGen strategist (who called the current move in rates years if not decades ago) by forecasting even lower yields (forgetting conveniently that just a year ago consensus called for the 10Y to rise well above 3% by... well, some time now), we reported what man who correctly called the unprecedented move in global yields - which has sent $17 trillion in sovereign debt negative - thinks happens next (for those who missed it, the summary was "There is a lot more to come.")

Of course, it ain't easy being a permabear - even when your global "Japanification" thesis, 30 years in the making, has been validated - for the simple reason that there are haters always and everywhere, and for some odd reason Edwards decided that responding to them in his latest letter is a prudent use of his time. In this particular case, Edwards takes umbrage at the criticism of a fellow "financial advisor" who inexplicably, spends more time on CNBC and on twitter than, well, providing financial advice, but that's Albert's prerogative (our advice: ignore them).

So instead of diluting Edward's message with trivial tangents, we focus on several key points, the first of which is why if Edwards got the bond bull market so spectacularly right at a time when virtually everyone remains short bonds...

... has he been wrong on stocks, with his calls to short the equity market, which is also explains the genesis of his "permabear" moniker (alternatively, Edwards is the biggest bond permabull in existence). This is what Edwards said:

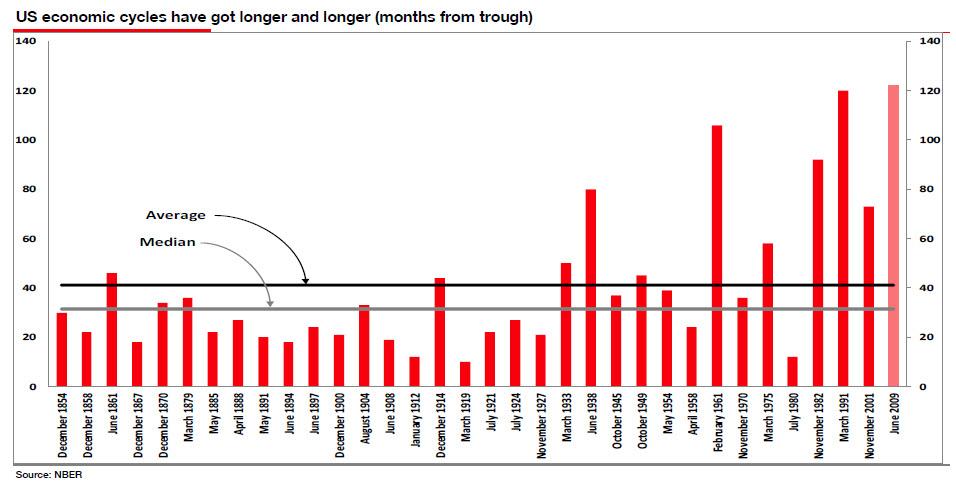

... my biggest Ice Age mistake was to assume that the US would be like Japan and that subsequent to the 2008 GFC, US policymakers would find it much harder to manipulate the economic and credit cycles. I thought we would return to ‘normal’ economic cycles with lengths nearer to 40 months.

And if I was right, perceptions of increased EPS volatility would cause the equity or cyclical risk premium to rise – ie the increased volatility of the economic cycle would cause PEs to decline for any given level of bond yield.

However a funny thing happened on the way to normalcy: central banks decided that they need to unleash more central planning that the USSR, and effectively kill the business cycle, so rather than seeing shorter cycles of around 40 months, the US is still enjoying the longest economic cycle in its history of 122 months and counting!....MORE

"How wrong can one be?" Edwards asks rhetorically, adding "Yes, I know it is also one of the weakest in history, but that’s not the point."

For I had pencilled in the next US recession as the time when we see the next intensification of the Ice Age (as occurred in Japan), where equity prices and PEs would fall to new lower lows and where new and unprecedented monetary measures would need to be taken in the face of outright deflation. That is why I have been so wrong for so long – and that also goes for my bearish view on bonds, articulated in 2011 (see reference to blog criticism, page 3). I had by now expected the helicopters to have already dropped hundreds of trillions of confetti dollars onto the US economy and CPI inflation to have already begun to twitch into life like Frankenstein’s monster.Don't worry Albert: one look at the campaigns of potential socialist US presidents, and it becomes abundantly clear that helicopter money, i.e. MMT, is coming. And once said socialists promise enough free shit, it is only a matter of time before they are elected. After all, everyone likes free shit.

Which brings us to the logical next question: having discussed what next happens to bond yields two weeks ago, Edwards now tackles the question of "what might happen in the next recession?"

Will equity yields continue to grind lower (PEs higher) in line with US bond yields falling into negative territory, and as the printing presses are started up again and running at such a frenzied pace you will be able to hear them from Mars? Or will, as I suspect, a slide into recession again be accompanied by the bursting of credit and asset bubbles and the ensuing recession be as surprisingly deep as the 2008 GFC?The answer coming from the equity permabear deflationista will hardly be a surprise: he maintains his view that the US equity market will fall to a new low in the next recession as investors witness yet another credit-induced, economic implosion. "And, at the same time as the economy implodes, expect President Trump to explode with rage. Indeed, even before his election I felt it very unlikely that the Fed would be able to maintain its independence if it is the midwife for yet another credit-induced deep recession."

Oh sure, the Fed will try to fight it, and it will, culminating with the endgame for every central bank - the release of helicopter money in hopes of terminal currency debasement sparking debt hyperinflation. But to the SocGen strategist, that won't be enough.

Won’t [helicopter money] fill the swimming pool and cushion the equity market’s descent? Won’t an activist Fed, with President Trump screaming with rage in the background, be able to prevent any potential collapse in the equity market? I believe not. Why will the next recession be any different from the last one, which saw equities collapse despite massive monetary stimulus?As a reminder, yesterday we noted that policy impotence is one of the reasons behind BofA's contention that policy impotence is why the cycle finally ends in 2020. Edwards agrees:

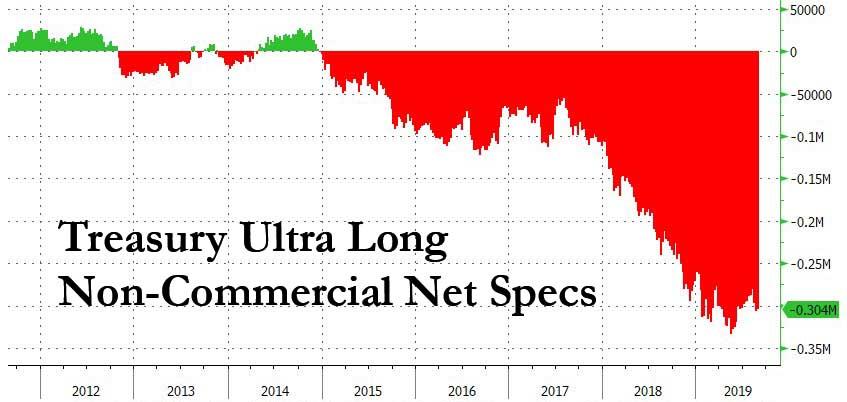

I would expect renewed rounds of QE, and/or helicopter money, as MMT is embraced as a desperate solution to the next slump. But this liquidity is not guaranteed to flow into equities or indeed any risk asset while the economic downturn is in full force. I use the example of commodity prices after the GFC, which initially behaved just like equities, benefitting massively from QE. Then, as you can see in the chart below, industrial commodities de-coupled from rising equity markets, primarily because the fundamental backdrop deteriorated as the Chinese economy slowed. Ample liquidity cannot be guaranteed to flow into any particular risk asset if its fundamentals turn negative. Liquidity will initially flow into whatever momentum trade is still standing at the time, backed by fundamentals, and that will most likely be government bonds.But if everyone buys bonds, won't stocks also be bid? After all, that's the basis of the Fed model, is it not? Well, here too Edwards has something to say....

Hmmmm....I'm not sure what to think regarding that "trivial tangents" shot. So here's our thinking on Albert:

He's not as good at equities as he is on credit.

For 21 years if you asked Mr. Edwards which way on bonds his answer was "Higher".

And so it came to pass:

A trend appears to be emerging

However, as noted in another 2018 post...

Société Générale's Albert Edwards Says "My Reputation For Calling Stocks Is In Tatters"

But it isn't for the equity calls that Albert gets paid, and they're not why pros still listen to him:

The House Fed has thwarted his House Stark at every turn.

Now he's getting ready to roll but it may be too late for him.

"I fought. I lost. Now I rest. But you, Lord Snow… you'll be fighting their battles forever."

Albert addressing another standing room only investment conference crowd

Last seen in "Société Générale's Albert Edwards: Winter Is Coming".

Albert's twenty-year bullishness on bonds and what declining yields tell us about the underlying economy is why SocGen keeps him around....

...Over the years we've had some fun at Albert's expense. As noted in a 2017 post:

Every time I am asked why we post on Mr. Edwards "when he's been wrong so often" I debate whether to explain or just give a glib answer.

The flippant rationale would be we get to go with headlines such as:

Société Générale's Albert Edwards Descends Into A Nightmare World of Dream Demons and Market Depravity

Société Générale's Albert Edwards: "Many Think I am Mad..."

Société Générale's Albert Edwards Sees Blue Skies, Sunshine, the Lame Shall Walk Again

Of course it's possible I have misinterpreted the meaning of

"the US economy is on crutches, and they are about to be kicked away"

Société Générale's Albert Edwards Has Some Troubling News He Reluctantly Shares

Société Générale's Albert Edwards Not His Usual Jolly Self (II)

Société Générale's Albert Edwards: "I Have Been Wrong – I’ve Been Too Bullish"

It May Be Time To Put Société Générale's Albert Edwards On Suicide Watch

Société Générale's Albert Edwards: Cry Havoc and Let Slip the...Ah Screw it

And many, many more.

The straight-up answer is: I can't think of anyone else who nailed the deflationary bias in credit markets as well as he has for as long as he has, pretty much the last 15-20 years.

And as far as equities go, absent the extraordinary measures of the world's central banks the landscape would look very, very different.

The biggest criticism you can lay on the guy is he didn't realize what he was up against re: the powers that be.

Plus that whole Albert-in-the-bathtub period was just stupid.

You do have to be careful you don't personally get into a David Koresh/Jim Jones-Drink-the-Kool-Aid frame of mind when gazing upon the dark side, whether Albert or Ambrose Evans-Pritchard or Jim Chanos. I mean it's okay to play around with melancholy:

Music For Albert Edwards. On A Cold Day. In February

In F flat minor.*

And it's raining.

Season's Greetings From Société Générale's Albert Edwards (Nov. 14, 2012)

Expect the New Year to bring nothing but disappointment....

But be attuned to when to take Mr. Edwards with utmost seriousness.

From:

UPDATED *****Alert***** Société Générale's Albert Edwards Bearish *****Alert***** (Sept. 6, 2011)

We passed a three year anniversary yesterday.

On September 5, 2008 we posted "Meltdown"-Société Générale" which linked to Albert's research note of a couple days earlier:

***Alert****Economic and equity market meltdown imminent****Alert***

A good call.

On September 7, 2008 Fannie Mae and Freddie Mac were placed into conservatorship.

On September 14, 2008 Merrill Lynch agreed to be acquired by Bank of America to avoid a Reg. T shut-down when markets re-opened.

On September 15 Lehman filed their bankruptcy petition.

On September 16 AIG became a 79.9% subsidiary of the U.S. Treasury.

Within 10 more days the Nation's largest thrift, WaMu was seized and five days later Wachovia gobbled up.

Good times, good times.

So take what you can use and make dumb headlines with the rest