And from ZeroHedge, this might be the smartest thing we've seen on the curve in ages:

Submitted by Eric Peters, CIO of One River Asset Management

Three Worlds

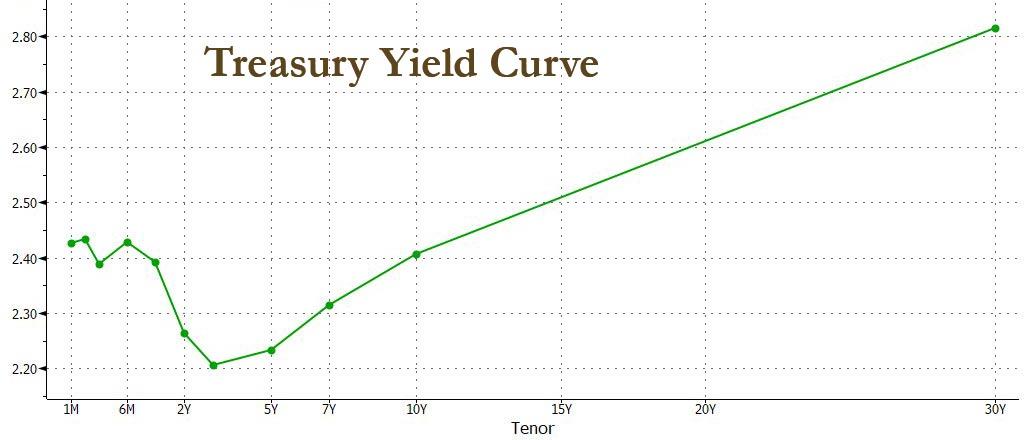

“America’s yield curve inversion can mean one of three things,” said the CIO. “We’re either living in a world of secular stagnation and investors worry that central banks no longer have sufficient policy tools to spur growth and inflation,” he continued. “Or the economy is simply sliding toward recession and the inversion will persist until the Fed panics and spurs a recovery,” he said. “Or we’re living in a world, where the market is moving in ways that defy historical norms because of global QE. And if that’s the case, the curve is sending a false signal.”

“If we’re sliding toward recession, then it seems odd that credit markets are holding up so well,” continued the same CIO. “So keep an eye on those,” he said. “And if the curve is sending a false signal due to German and Japanese government bonds yielding less than zero out to 10yrs, then the recent Fed pivot and these low bond rates in America may very well spur a blow-off rally in stocks like in 1999.” A dovish Fed in 1998 (post-LTCM) and 1999 (pre-Y2K) provided the liquidity without which that parabolic rally could have never happened.

“But if investors believe America is succumbing to the secular stagnation that has gripped Japan and Europe, and if they’re growing scared that global central banks are no longer capable of rescuing markets, then we have a real problem,” said the CIO. “Because a recession is bad for markets, but not catastrophic provided that central banks can step in to spur recovery. But with global rates already so low, if investors lose faith in the ability of central banks to do what they have always done, then we’re vulnerable to a stock market crash.”......MORE

See also the intro to last Thursday's "When Can Yield Curves Fail As Indicators?":

Now.Or

As noted in the intro to Feb. 28's Rhyme Time at the San Francisco Federal Reserve Bank: "Did the Yield Curve Flip? Will the Economy Dip?":

The curve is not yet important. We (possibly delusionally) think we'll be able to tell you when it is.If you think of all the wasted pixels-n-print spent on the curves over the last six months, the attention of millions of readers, time that could just as well been spent watching cat videos, it has to add up to billions of people-hours....

Riding the South Sea Bubble

By PETER TEMIN AND HANS-JOACHIM VOTH

By PETER TEMIN AND HANS-JOACHIM VOTH

This paper presents a case study of a well-informed investor in the South Sea bubble. We argue that Hoare’s Bank, a fledgling West End London bank, knew that a bubble was in progress and nonetheless invested in the stock: it was profitable to “ride the bubble.” Using a unique dataset on daily trades, we show that this sophisticated investor was not constrained by such institutional factors as restrictions on short sales or agency problems....MORE (52 page PDF)