Today, freight brokers’ and carriers’ worst nightmare has come true: Amazon has quietly taken its digital freight brokerage platform live at freight.amazon.com, and it is undercutting market prices from 26 to 33 percent.

Early this morning, in a client note responding to Amazon’s (NASDAQ: AMZN) announcement that it would begin offering free one-day shipping to Prime members, Morgan Stanley equities analyst Brian Nowak made a cryptic prediction.

“We see AMZN’s 1-day Prime shipping raising consumer expectations and increasing the cost to compete in e-commerce. Over the long term, we also see this as a Trojan horse for Amazon to grow its next disruptive business… a third party logistics network,” Nowak wrote.

Amazon already moves an enormous amount of freight through its distribution and sortation centers and has an extensive network of trucking carriers. For many industry observers, it was only a matter of time before Amazon leveraged the implicit network effect — the total number of shippers and carriers who do business with Amazon — and connected both sides of its business....

***

....The entry of Amazon into freight brokerage is the ‘disintermediate to survive’ phase of the flywheel. AMZN is under pressure to re-accelerate its top line revenue, which has slowed from upward of 30 percent annually three years ago to less than 15 percent projected for this year. Amazon cannot allow trucking capacity to constrain its growth and is entering freight brokerage to lock that capacity up.

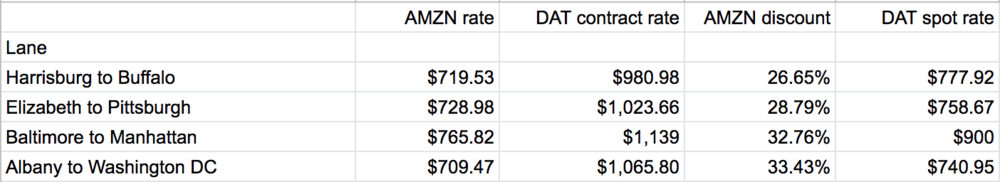

Notice how ‘monetize’ comes after ‘disintermediate’. From a cursory review of four lanes in Amazon Freight’s current offering, it’s clear that Amazon is not trying to realize fat gross margins on its brokerage. Instead, it is massively undercutting market prices. Amazon’s new portal is intended for shippers who want Amazon’s rates for full truckload dry van freight in Connecticut, Maryland, New Jersey, New York, and Pennsylvania.

(Table: FreightWaves)

As this table makes clear, Amazon quotes rates to shippers that are below even DAT’s broker-to-carrier spot rates. In other words, in its current form, Amazon Freight is a free, marginless brokerage.

Monetization will come later, but this is the digital freight brokerage startup model on ‘Georgia overdrive’: massive capital deployed to rapidly scale a network on thin or negative margins and take share. There is no telling how big Amazon wants this business to grow, but at a certain point, prices will creep up as Amazon monetizes the brokerage

service to fund further innovation....MUCH MORE

HT: ZeroHedge

Previously:

April 2019

Logistics: "VCs are fixated on the future of moving people and things"

December 2018

Logistics: "The unsexiest trillion-dollar startup"

April 2018

Shipping: Carriers Fear Becoming the "Uber Drivers of the Sea" (but quants to the rescue?)

April 2018

Shipping: French Giant CMA CGM Looking to Expand Logistics Business with Investment in CEVA Logistics

December 2017

Shipping: Freight Forwarder Flexport: "...Digitizing The Entire International Shipping Process"

August 2017

Shipping: "Amazon vs Maersk: The clash of titans shaking the container industry"

February 2017

Shipping: A Warning To Freight Forwarders, The Good Times Are Over

January 2017

Shipping: "Amazon Enters Trillion Dollar Ocean Freight Business" (AMZN)

January 2017

Shipping: Maersk, Alibaba Team Up To Offer Space On Container Ships.