From Alhambra Investments:

As always, it’s about the whole thing. A

true economic boom spreads out real gains to the vast majority of the

population. There will always be some proportion of people who are left

out. But in the good ones, the true upswings, that share is minimal.

This is the big problem right now, especially as GDP has been positive in a lot of places

for a long time. It is what confuses people into thinking there has to

be a boom. The sad fact is that economic output all over the world, the

US included, hasn’t been near enough to minimize the proportion being

excluded from these small economic gains. There are still too many

people on the wrong side of the economic divide.

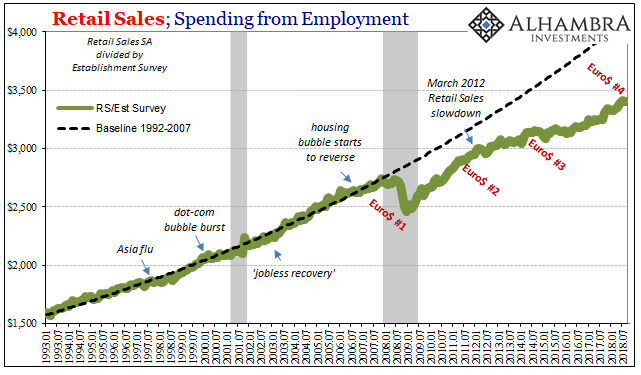

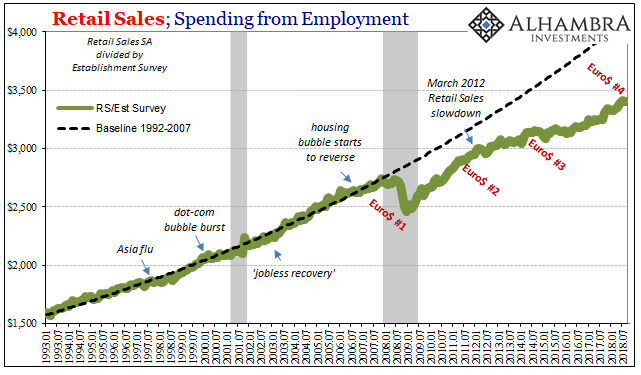

In America, though they go along with the media as to how the economy is described they sure aren’t acting consistent with the rhetoric. Spending remains down across-the-board, and those in the most afflicted of areas are swinging back and forth looking for someone to give them answers.

Two years ago, the Rust Belt

provocatively delivered Donald Trump the White House based in large part

on his observations about the “fake” unemployment rate. Finally,

someone in the right position was willing to say what many actually felt

and still feel. He’s since embraced that particular statistic as has so

many around him. Last night, maybe the President was reminded?

President Donald Trump got a

warning sign on Tuesday from the Midwestern and Rust Belt states that

handed him the presidency, as voters delivered big victories to

Democrats and offered a road map for the crowd of candidates lining up

to challenge him in 2020.

There are a whole bunch of acerbic

political factors rolled up in this midterm ballot and it’s far too easy

and admittedly convenient to distill everything into these broad

economic terms. Regardless of complexity, it’s difficult not to

appreciate the possibility.

The US economy is not booming enough,

therefore it is not booming. And now it faces far more difficult

prospects than the low ceiling.

While everyone is focused on Democrats

versus Republicans, who controls the House and which the Senate, in

those economic terms attention should be directed towards Oklahoma and

Chicago. The oil market is screaming that even if it was a real boom, it

is in its dying days.

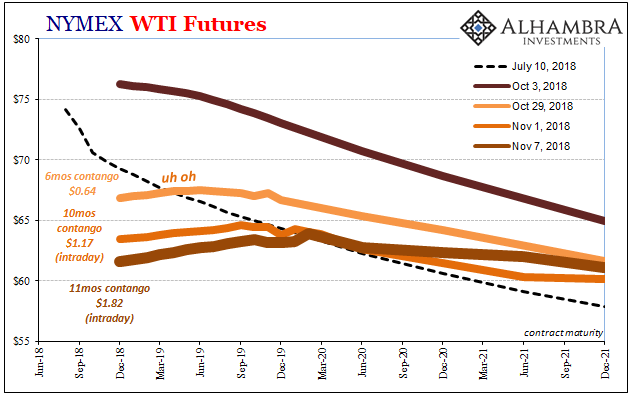

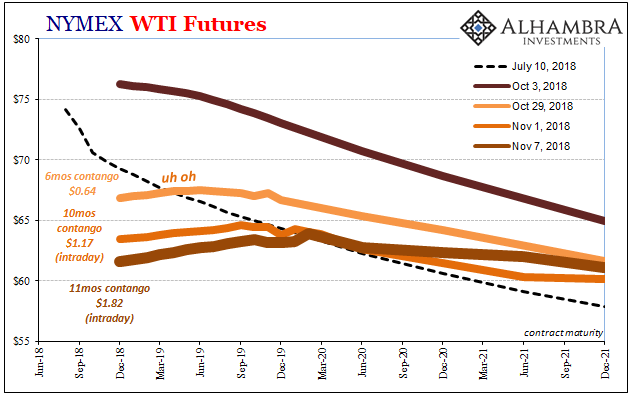

It is now more a matter of morbid

curiosity, to see the oil curve contort and recoil bringing back

memories just four years old. The curve is behaving exactly like it did

in late 2014, another period people have largely forgotten how so many

desperately tried to make that one into a boom, too. It failed because

there wasn’t near enough “good” growth to stave off the building

negative pressures.

Those showed up right on the WTI curve

as well as in any number of places. The warnings were ignored because

that’s what Economists and central bankers do best. Subprime is never

contained because it’s never about subprime.

The fundamentals for the oil market

aren’t good; they really weren’t all that much better last year, either.

The mainstream penchant for making a lot out of a little followed in

Cushing, OK, too. Was economic demand really picking up? Judging by

domestic crude stocks, it didn’t really seem that way.

Instead, a large amount of domestic oil

was diverted overseas. It made the onshore crude inventory seem more

balanced by simple comparison....

...

MUCH MORE