Amazon's recent investment in video channel Tastemade highlights a growing threat to CPG brands' marketing strategies.

Apple CEO Tim Cook railed against tech giants’ tightening grip on our data in a keynote speech yesterday.

Personal data is “carefully assembled, synthesized, traded and sold,” he said, to let “companies know you better than you may know yourself.”

This isn’t just scary for us as individuals. It’s also scary for brands.

Hoarding data

We talked the other week about the dangers of companies outsourcing their e-commerce operations to Amazon.

As Amazon controls more and more points of sale (e-commerce, Whole Foods stores, Alexa-powered gadgets) it won’t just know you better than you know yourself. It will know your brand’s customers better than you do.

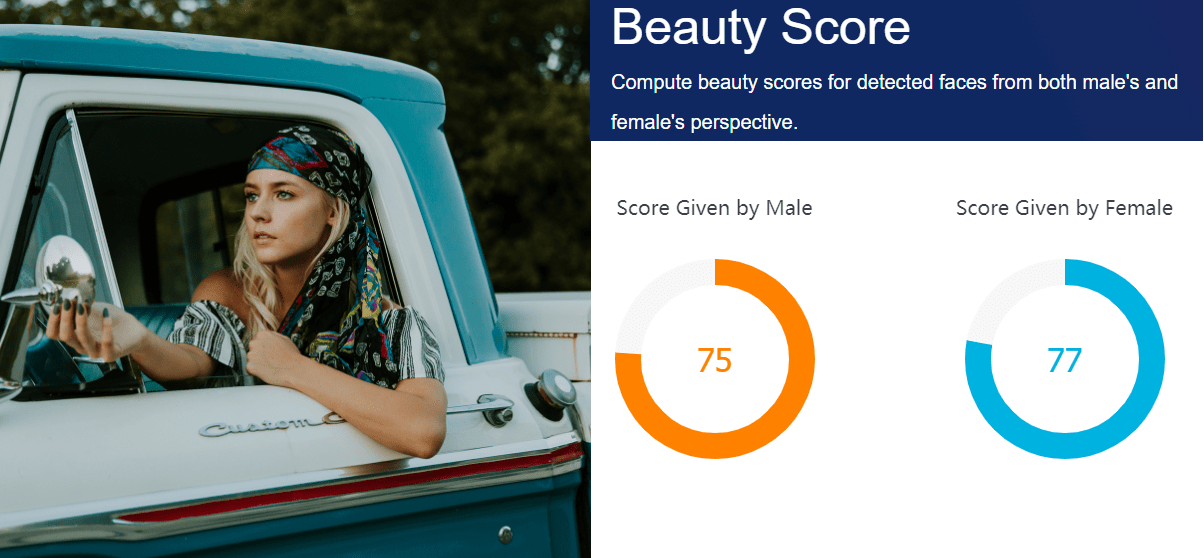

(Though, brands don’t have to worry about faceless algorithms assigning them “beauty scores,” as does Chinese AI platform Face++).

Content will expand tech platforms’ reach.And another threat to the brands by the Bezosians:

From commerce to content

Last week, Amazon invested in Tastemade, an online food and lifestyle video channel.

It’s possible Amazon was inspired by Buzzfeed, whose cooking video channel Tasty turned into a major revenue driver and the basis for a cookware line at Walmart.

But the deal highlights Amazon’s broader push into video content, as well as grocery.

Beyond Amazon Prime’s original videos (about which CEO Jeff Bezos commented, “When we win a Golden Globe, it helps us sell more shoes) the company’s content investments include:

Getting in your head

- Online business TV channel Cheddar, which is now available through Amazon Prime

- Clique Media Group, which owns a number of “shoppable content” and product review sites

- Wikia, a social platform with pop culture and gaming content

Along with more content, comes more data.

If the content’s user generated (like product reviews or Youtube makeup videos), tech platforms can better understand people’s likes and dislikes.

If it’s internally created (like Amazon’s Prime originals), the tech company can monitor users’ interactions. Amazon can also favor its own content over content that helps other brands, as it’s currently promoting positive reviews for its own private labels.

Even if content is created by a publisher and merely distributed through the tech platform, the tech company still captures its data; Netflix, for example, doesn’t share ratings data with TV producers, and Amazon doesn’t share Kindle readership data with the publishing industry.

Meanwhile, Facebook actually shared false data with brands about their video’s viewership for years.

Seeking new channels?

Direct-to-consumer sales can help brands bypass these platforms.

Is there any way for CPG brands to distribute content directly to consumers, though? Without sacrificing data control to Amazon, Facebook and others?

Some are trying.

We see brands and startups building their own content channels, including:...MORE

January 18

In 2018, Amazon will turn to private label goods (AMZN)

October 17

"Secret Amazon brands are quietly taking over Amazon.com" (AMZN)

October 18

"This Is How Amazon Loses" (AMZN)