Good now.

We've looked at the practice of bundling garbage in a bright, shiny wrapper and calling it Christmas many times, usually in the context of CDOs and CLOs and CCOs:

As Carnegie Mellon Financial Engineering prof. Dogbert explains, we are dealing with aggregates here:

This, however, leads to a whole new set of problems that come from physically bundling the cows into the Collateralized Cow Obligation wrapper.

The cows ask questions like "Does this CCO make my butt look big" and seriously, how can you answer that without incriminating yourself?The transformative power of a bright shiny wrapper being used in the leveraged loan business is the latest "product" from the structured product crowd.

For this reason some practitioners prefer to stick with synthetic livestock, not to be confused with....ummm..., where was I?...

From FT Alphaville:

At the most recent meeting of the Federal Open Market Committee in September, Federal Reserve officials debated the usual topics. Is inflation running hot? How tight is the labour market? And of course, what's the future path of interest rates? This time around, however, policy makers raised concerns about something else as well: leveraged loans.

It was not the first set of meeting minutes in which Fed officials have devoted time to talking about leveraged loans, those extended to heavily-indebted companies and individuals at floating rates. In August and June, the Fed mentioned that issuance was picking up. It was the first time, however, that the Fed has flagged leveraged loans as a potential risk to financial stability.

The warning comes at a time when multiple agencies and international organisations have issued their own about the ballooning $1trn-plus leveraged-loan market. This week, the Bank of England (BoE) drew parallels to the growth of sub-prime mortgages in 2006 that triggered the global financial crisis. Earlier this month, the IMF cautioned about the breakneck pace of leveraged lending, which has been largely driven by non-banks, and the sliding standards of many of these loans. And in September, the Bank of International Settlements (BIS) flagged the global boom, and deteriorating credit quality, as potential risks as well.

Let's start with the first concern.

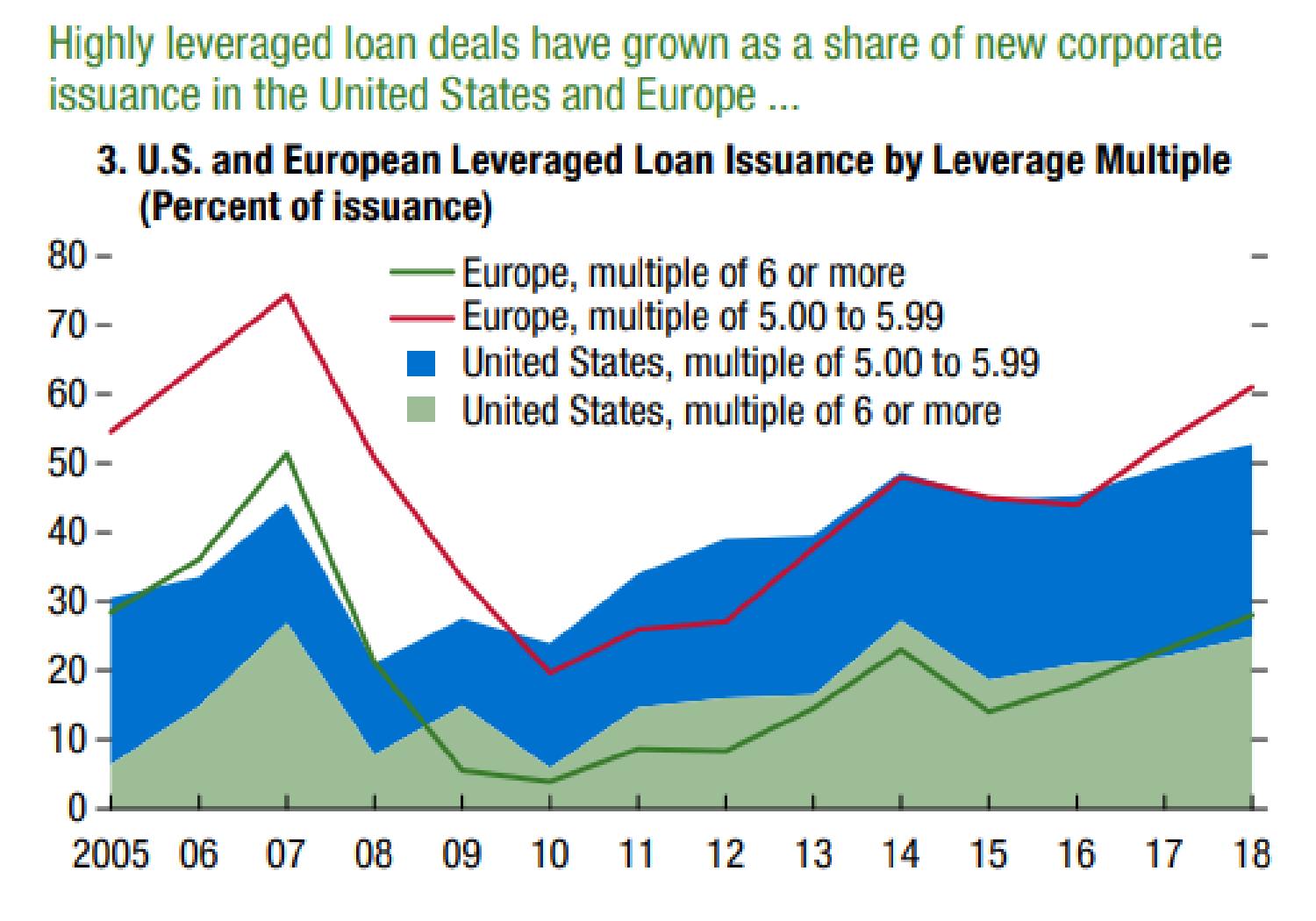

In six short years, the outstanding value of leveraged loans in the US has doubled to $1.1trn, according to S&P Global Market Intelligence's LCD. Europe's share is smaller but it is growing quickly as well. As a share of new corporate issuance in the United States, highly-leveraged loan deals—where debt is at least 5 times ebitda —make up roughly half, surpassing levels seen in the lead-up to the financial crisis. In Europe, the ratio is even higher, at approximately 60 per cent. Here's a chart from the IMF's Financial Stability Report published earlier this month, which shows the growing dominance of leveraged loans:

See also July's "Structured Products Are Back Baby!" wherein Alphaville's Dan McCrum introduces us to the

As noted at the time: "How can anyone look upon this and not weep tears of joy?""Auto-Callable Contingent Coupon Barrier Notes Linked to the Lesser Performing of Four Equity Securities, Due July 1, 2021."